Taps Coogan – August 19th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

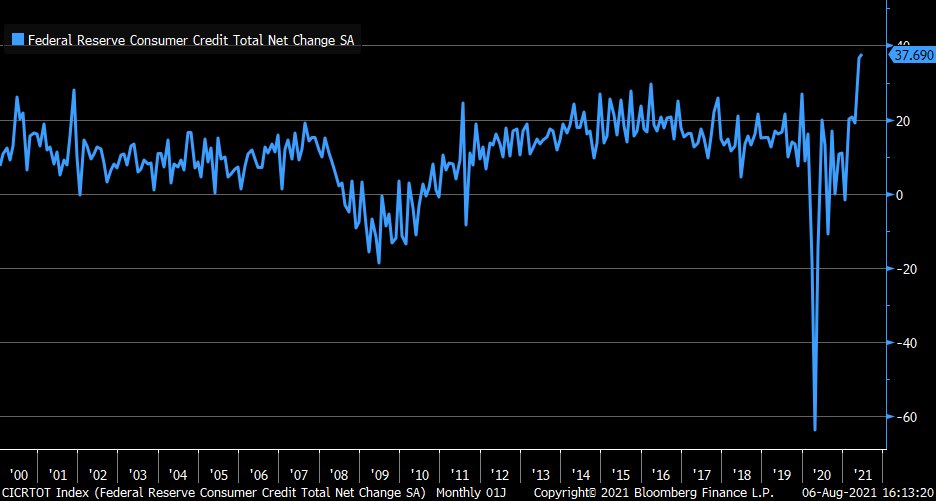

The pace of consumer borrowing has hit its highest level since at least 2000, with consumers taking on $37.7 billion net debt in June and $36.7 billion in May, as the following chart from Bloomberg via Liz Ann Sonders highlights. Annualized Q2 net consumer debt growth clocked in at 7.5%.

The pre-Covid high in consumer debt was $4.217 trillion in February 2020. That number fell to $4.125 by May 2020 but is back to new record high of $4.318 trillion as of June.

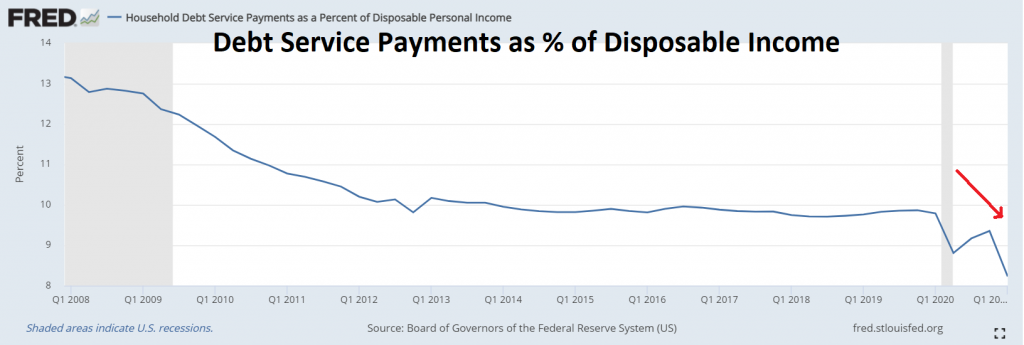

With home and auto prices surging at a breakneck pace this shouldn’t come as too much of a surprise. The ‘silver lining’ is that household debt payments are actually declining as a percent of disposable income. Of course, that’s because of super lower interest rates and multiple rounds of indiscriminate stimulus payments, neither of which seem particularly sustainable.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.