Taps Coogan – June 11th 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Just like old Chance Gardner would say: “Growth has its seasons.” After a terrible 2020, the economy is back and running hot, so hot that CPI inflation has hit a stunning 4.9%. Job openings are at a record high. Stocks are turning in record highs every few days. It’s summer for the economy.

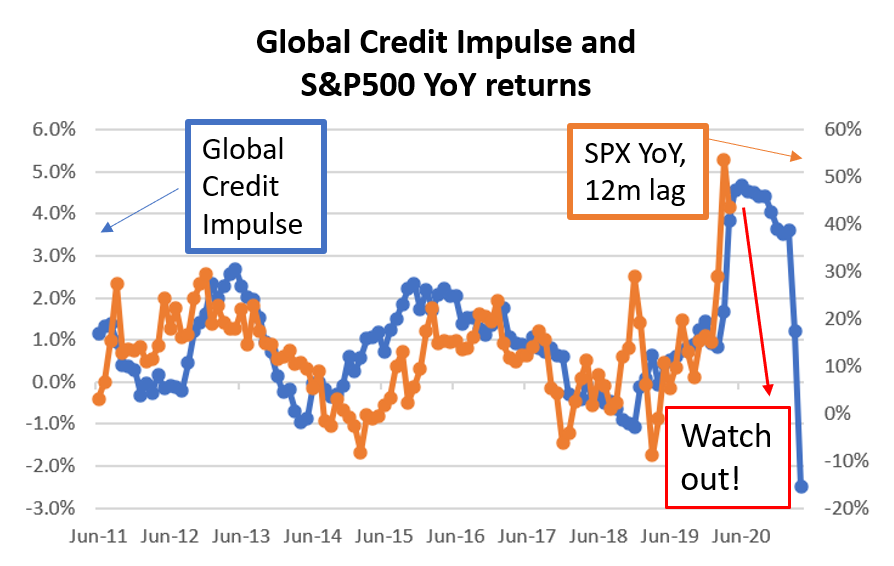

Here to remind us that that won’t last forever is Alfonso Peccatiello of The Macro Compass. His chart below pretty much speaks for itself.

According to the chart, there may still be some time left for the stocks and the economy, perhaps the balance of the year. That anecdotally feels right within the landscape of the credit impulse having peaked, unemployment benefits ending in September, but still some amount of low-hanging recovery left. What comes next? A return to a grossly, grossly, grossly over-indebted ‘normal’ economy, aging populations, rising taxes, tightening regulations, etc…

As Dr. Lacy Hunt is apt to point out, and we’re all reluctant to accept, excessive debt is deflationary. The Fed is pushing a string. They have been pushing that string so fantastically hard that they’ve managed to spike money and credit creation to looney-toons levels despite the pandemic and recession, but ‘peak’ stimulus is already in the books and from the look of the chart above, the hangover is going to be brutal.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.