Taps Coogan – April 25th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Back in January 2020, right before Covid hit, we published a series or articles here at The Sounding Line making the case that most US shale oil and gas basins were seeing declining well productivity and that production growth was reliant on burning through the inventory of previously drilled but uncompleted wells. We also noted that, while suffering from many of the same problems to a lesser degree, the Permian was the last basin with growth potential.

Fast forward to today, and the following charts, from Bloomberg, highlight the all-important reality that we’ve been warning about ever since: US oil and gas production growth is going to stall out. To understand the gravity of this, recall that US shale production has been responsible for >75% of global production growth since 2010 once declining US conventional oil production is accounted for.

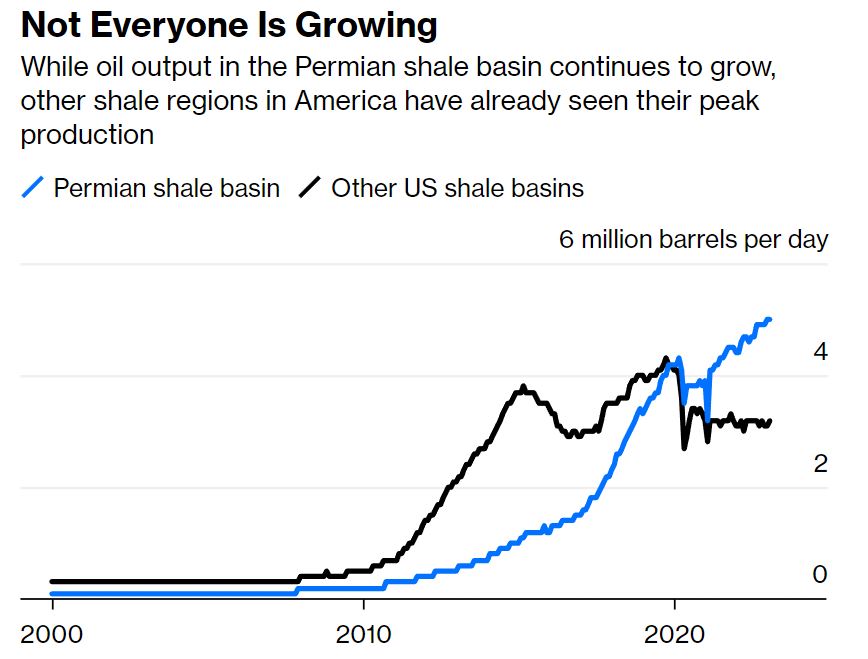

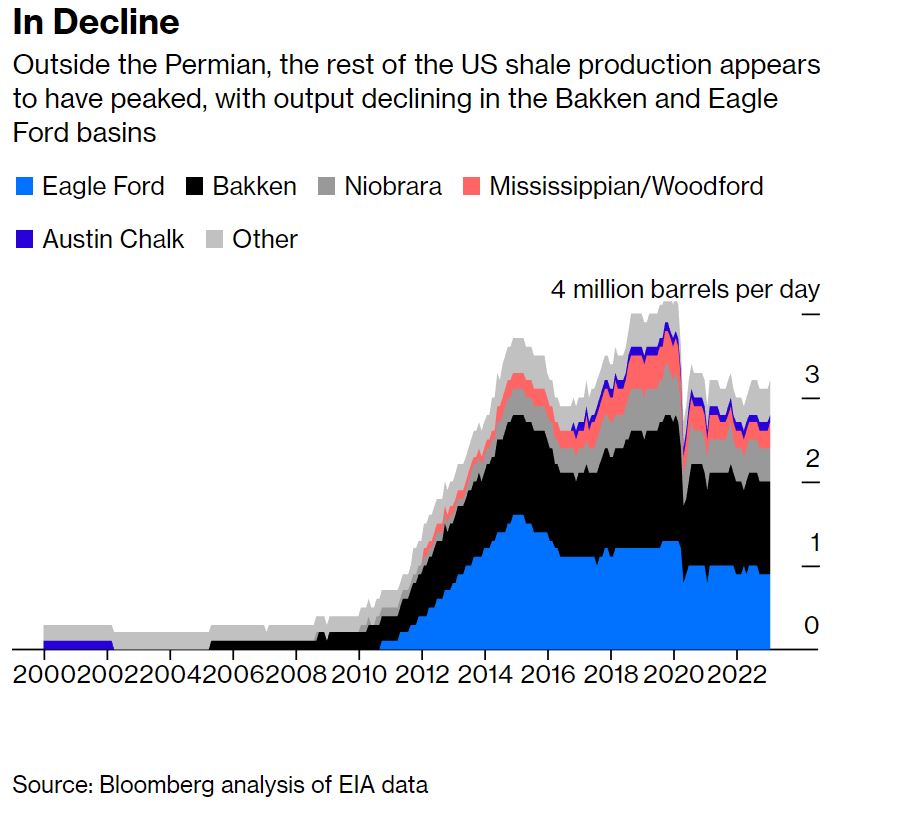

As the two charts below highlights, the Permian is the only shale basin that has grown relative to pre-Covid, with the other basins collectively producing less oil than in 2016:

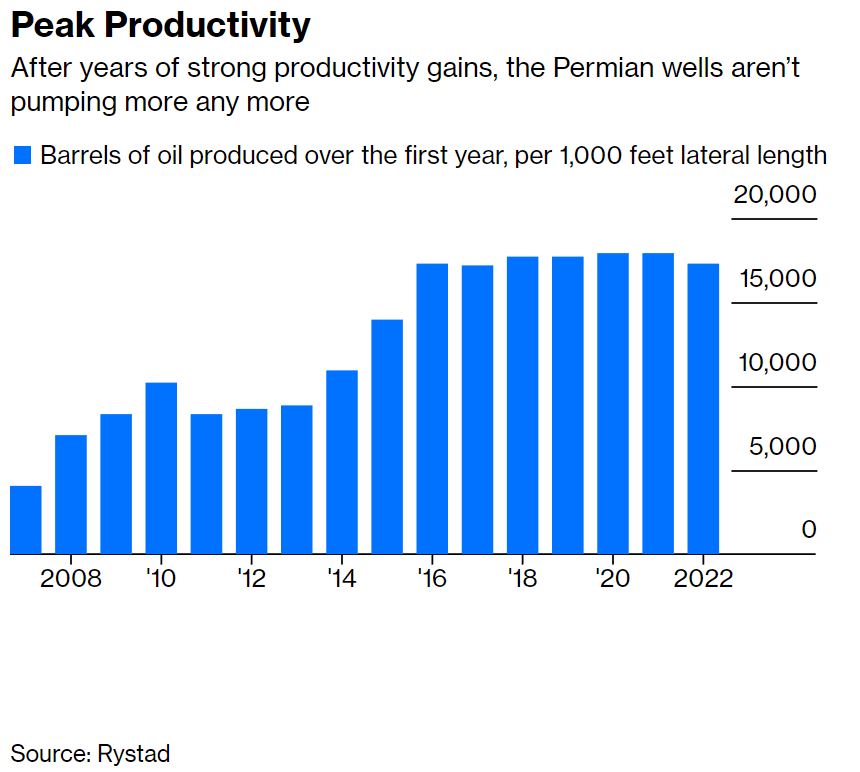

Critically, per-well productivity in the Permian has also peaked. That means that from here on out, production growth in the Permian is only achievable by burning through the finite inventory of previously drilled-but-uncompleted wells and higher drilling activity, which will require sustained high oil prices.

Meanwhile, global oil and gas capex is still down by roughly 50% from a decade ago.

Global oil production growth over the past decade was enabled by three things: the huge capex budgets of 2010-2014 created by $100+ oil, the discovery of the as-of-then untapped US shale resource, and a zero-interest-rate-fueled willingness of investors to sustain massive capital losses to chase production growth.

As the Bloomberg article referenced above notes:

“Over the last decade, the US shale industry had become a byword for capital destruction. Shale investors recovered about 50 cents for each dollar they invested during the 2010-2020 period.

All of those factors are played out, and given cost inflation and the falling productivity of wells around the world, sustaining the oil production levels of 2013, let alone the levels of today, is not going to be sustainable at current capex levels.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

One word … COAL!

Could this be the readon USA is pushing for war with Russia?

Respectfully, I think you’ve lost the plot on Ukraine and Russia