Taps Coogan – January 30th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

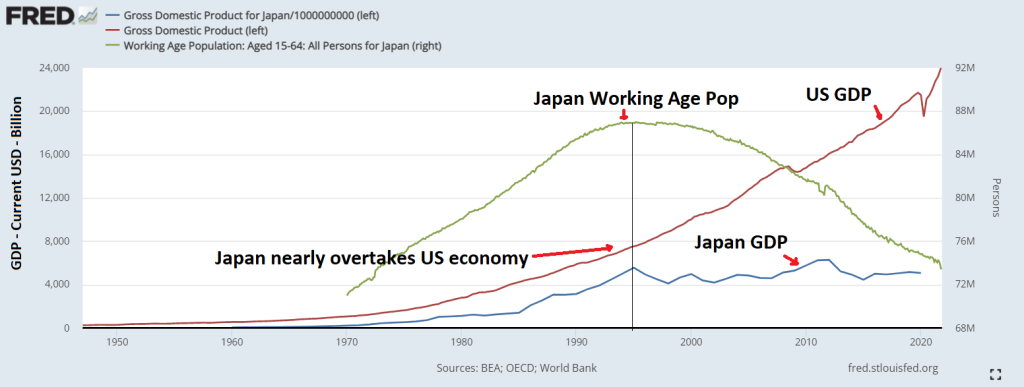

Back in the 1980s and early-to-mid 1990s there was quite a bit of consternation that Japan was going to overtake the US as the world’s largest economy. It had risen from just 20% the size of the US economy in 1970 to 73% by 1995 and its top companies – Toyota, Honda, Sony, etc… – were thrashing their American competitors.

Of course, the overtake never happened. Japan’s working age population peaked in the late 1990s along with its massive real-estate bubble. 25 years later and Japan’s economy has shrunk 10% (in current USD) while US nominal GDP has roughly tripled.

While Japan has maintained a highly advanced economy and high quality of life, its productivity gains have struggled to keep up with the decline in its workforce. As Japan’s population has become more elderly, its dependency ratio has surged (the ratio between workers and non-workers like retirees) and its tax base has shrunk. That has led the nation’s debt to GDP to go from roughly 50% in 1980 to a mind blowing 280% today.

Confounding many predictions, decades of Zero Interest Rate Policy (ZIRP), proportionally much more QE than the US, much more debt, and a declining labor pool, have not led to runaway inflation in Japan. To the contrary, since November 1998, Japan has experienced 1.1% CPI inflation, not per year but over the entire period. Yes, real experienced inflation has almost certainly increased by more than this, but the broader point still holds.

There has proven to be no correlation between 20 years of ZIRP and CPI in Japan. Even right now, with CPI inflation running at 7% in the US, CPI inflation in highly trade dependent Japan is clocking in at just 0.6%. For reasons that we’ve discussed for years here at The Sounding Line, QE and ZIRP don’t cause increases in official inflation measures like CPI (though they do increase real world inflation).

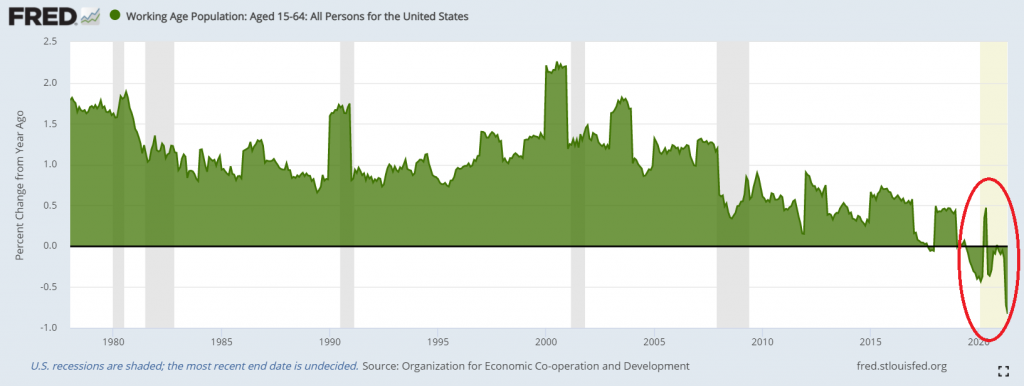

Forecasts for the US working age population have long called for growth for the foreseeable future, largely on the back of immigration. However, those forecasts have consistently underestimated the pace of decline in fertility rates. That decline, combined with the increase in mortality over the last decade due to rapidly rising drug overdoses, suicides, and obesity, plus lower levels of legal and illegal immigration under the prior administration, mean that the US working age population has already started to shrink.

As we’ve been arguing since 2020, the US is now experiencing high inflation because we started to doing helicopter money in response to Covid. While supply chain disruptions have also played a role, if supply chain disruptions were the primary cause of our inflation, how does one explain trade-dependent Japan’s total lack of inflation today?

To the genuine surprise of yours truly, most of the Covid helicopter money programs expired last year: the free money giveaways, paying people more on unemployment than the median working wage, the PPP grants, the Child ‘Tax Credit’ payments, etc… With the backdrop of a rapidly declining working age population – and an even faster decline in working-age Americans that are actually working – and a Fed that waited so long to tighten that it will now be doing so in a slowing economy (as always), the risk from this point forward is not runaway inflation. It’s Japanification. No, that doesn’t mean that Fed should remain ultra-accommodative. It does mean that the endless rate hikes being forecast right now are simply not realistic.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.