Submitted by Taps Coogan on the 15th of May 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

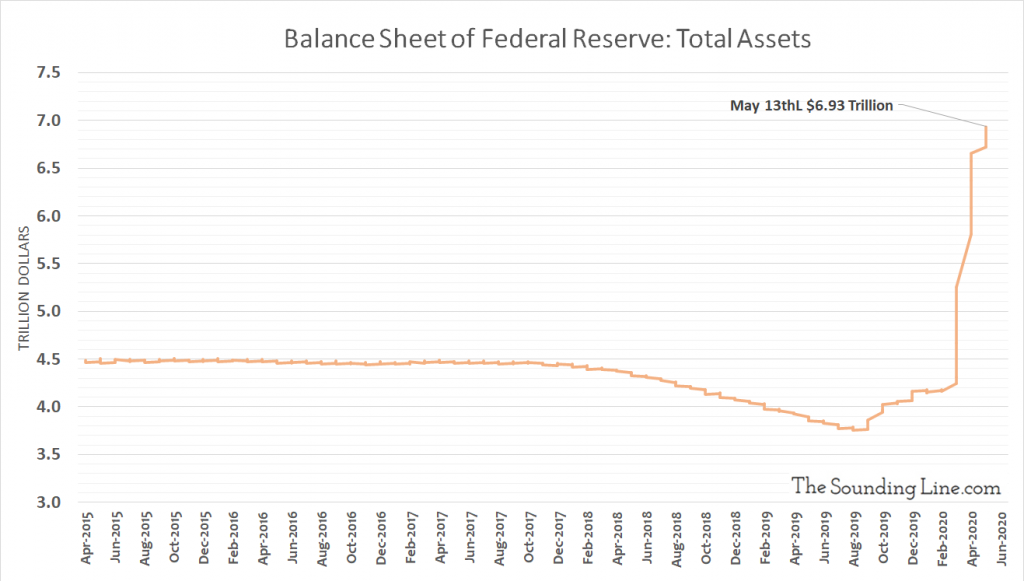

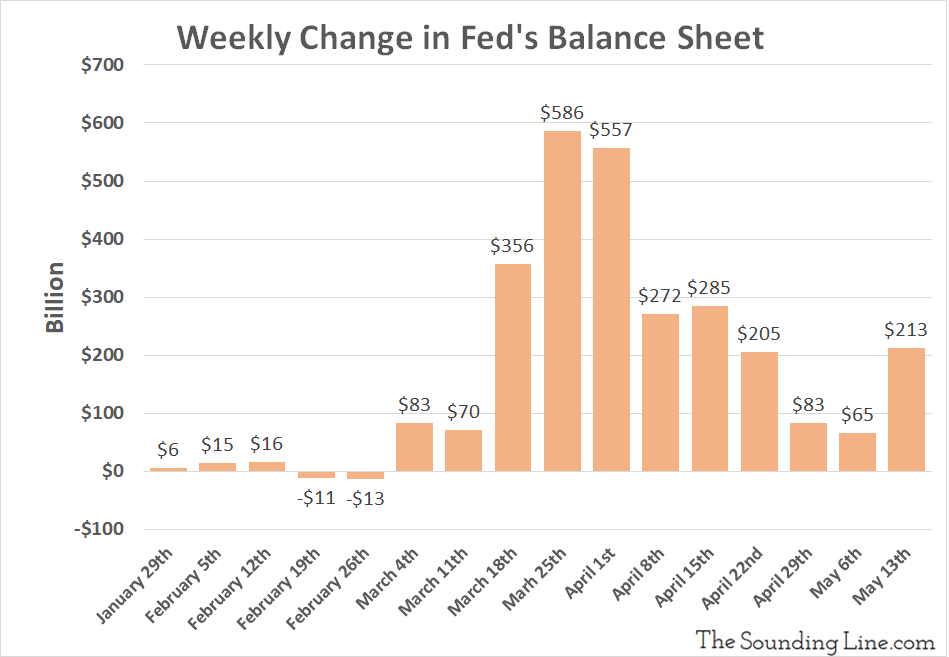

Data released last night (May 14th) reveals that the Federal Reserve’s balance sheet has surged by $213 billion over the past seven days, a significant acceleration compared to prior weeks and a reminder that’s the Fed’s QE-Infinity program isn’t going away anytime soon. The Fed’s balance sheet is now just a hair less than $7 trillion and has increased by over $3.16 trillion since September.

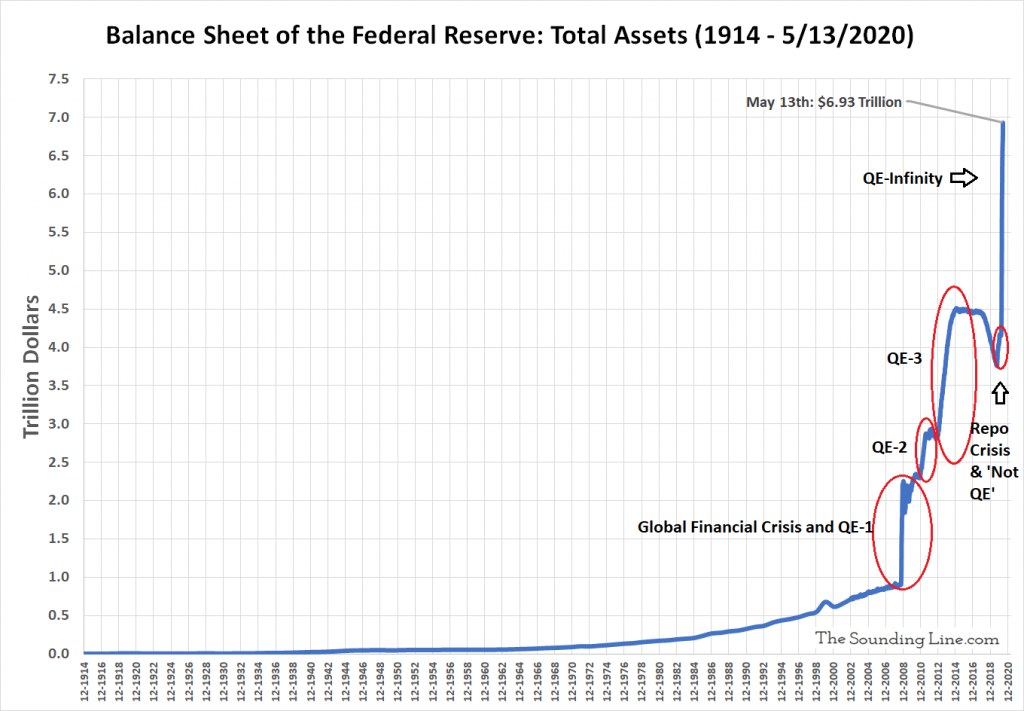

Taking a longer term look at the Fed’s balance sheet shows just how radical its response to the Coronavirus pandemic, and the Repo Crisis that proceeded it, has been. Since September, the Fed has grown its balance sheet by roughly $3.16 trillion, nearly as much as all prior QE programs combined (~$3.5 trillion). Yes, the Fed’s Repo Crisis and Coroanvirus stimulus programs over the past eight months are now nearly as big as QE-1, QE-2, and QE-3 combined, programs that took seven years to deploy. At the current pace of $213 billion of ‘money printing’ per week, we will have surpassed all prior QE programs within another two weeks.

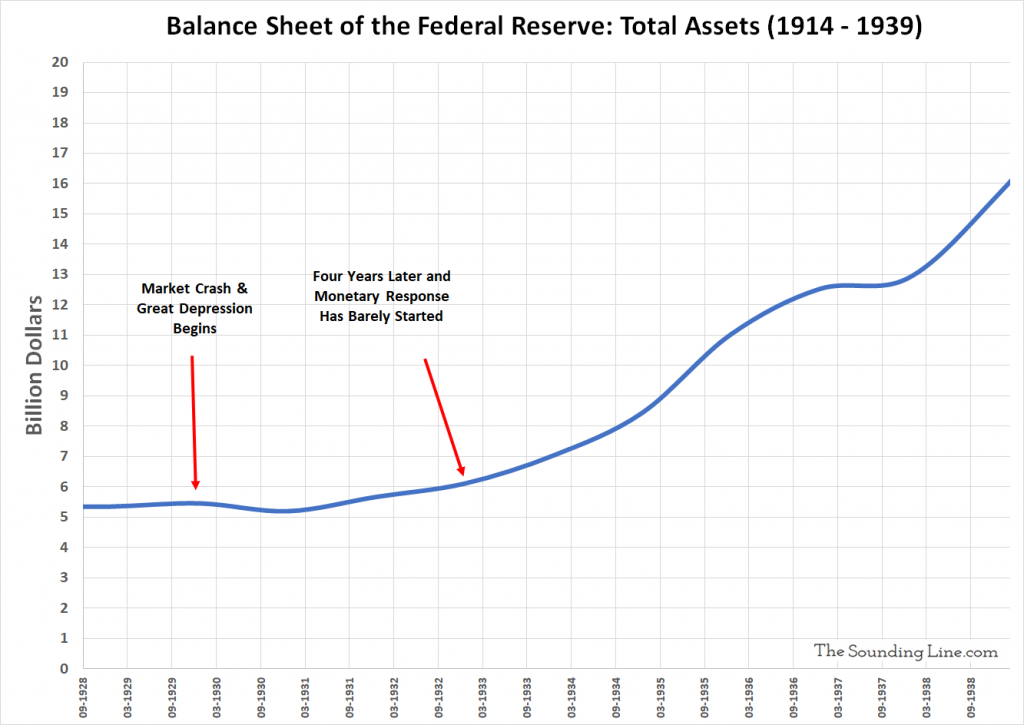

As a point of comparison, here is what the Fed did (or didn’t do) during the Great Depression.

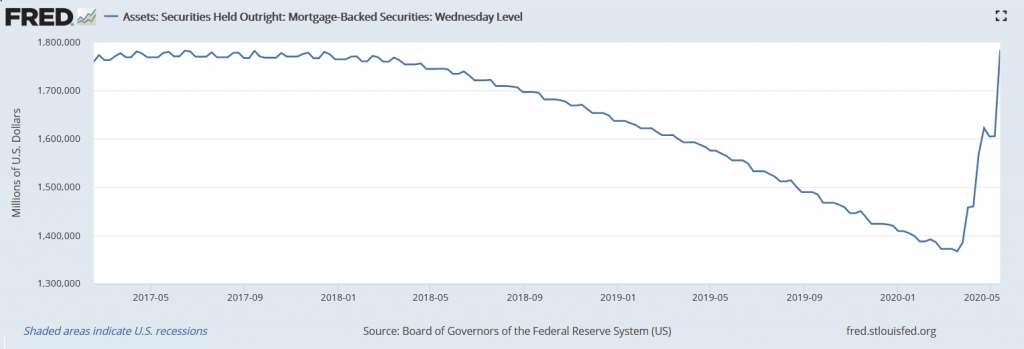

The primary driver of the $213 billion jump in the Fed’s balance sheet over the past seven days was $178 billion of Mortgage-backed Securities (MBS), of which the Fed now has $1.78 trillion, the most ever.

The Fed also bought another $37 billion of Treasury securities, provided another $1.5 billion in loans to its alphabet soap of Special Purpose Vehicles (SPVs), shrunk its repo holdings by $15 billion, and shrunk its central bank currency swaps by $3.9 billion.

Given the bewildering scale of the Fed’s ongoing monetary stimulus, it is amazing that stocks are only up 30% from the lows. Welcome to the new ‘new normal.’

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.