Taps Coogan – June 26th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

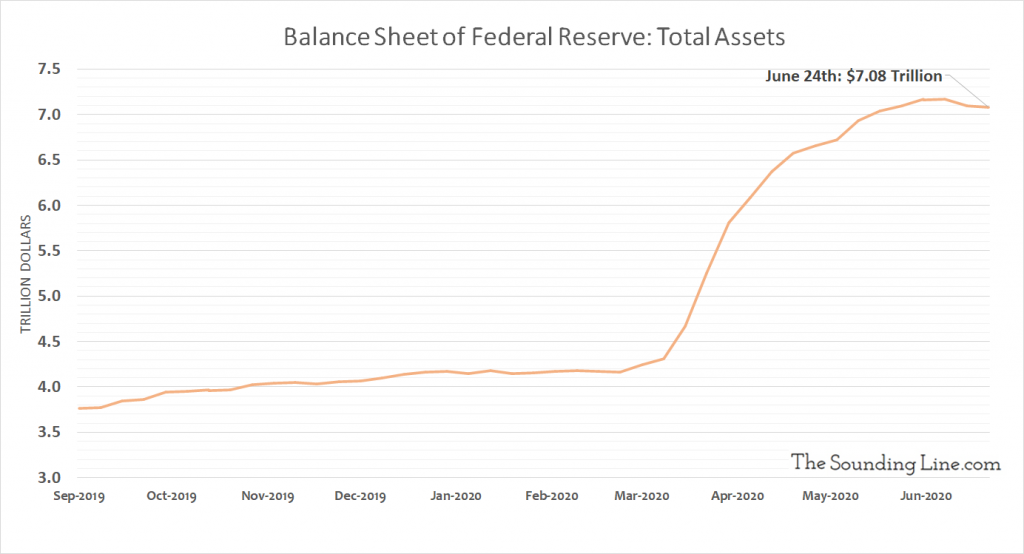

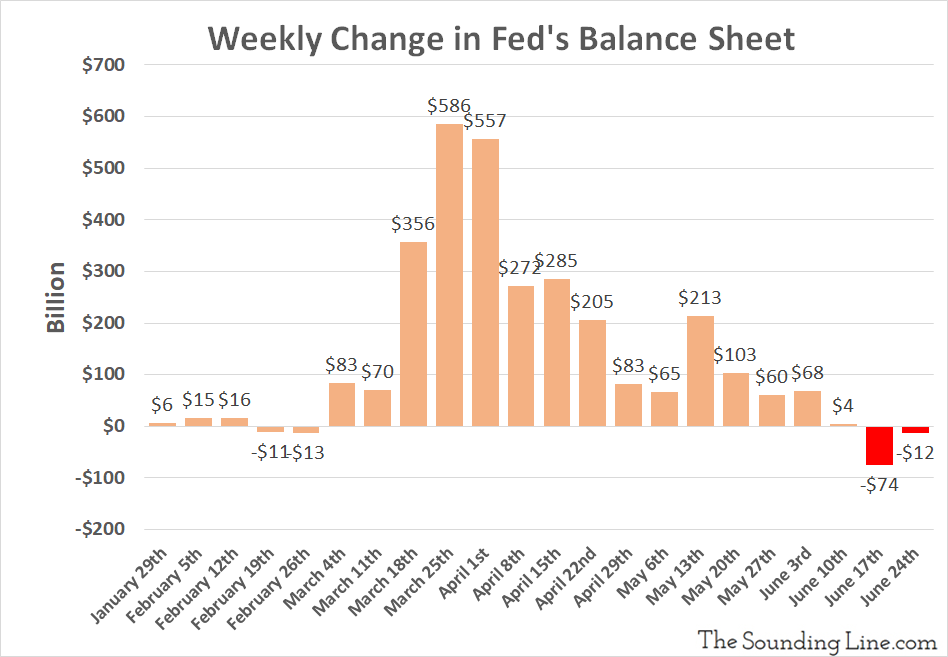

For the second week in a row, the Fed’s balance sheet has shrunk. QE-Infinity is on hold, at least for now.

Based on data released last night, the Fed’s balance sheet, the amalgamation of all of its increasingly varied asset holdings, shrunk $12 billion for the week ending June 24th, 2020. It follows a $74 billion contraction the prior week, and just a $4 billion increase the week before that.

What Gives?

Has the ‘Bizzaro World’ disconnect between near record financial asset valuations and the biggest economic crisis in generations finally got the Fed second guessing the prudence of intentionally disconnecting financial assets from their underlying revenue streams and risk factors? Has the Fed finally seen the light with regards to the moral hazard of the ‘Fed Put’ or of a financial asset led economic ‘recovery’ that exacerbates the wealth divide? Perhaps they think that they have simply printed enough money given that stocks are back near their highs?

Likely not. Looking at changes in the various assets on the Fed’s balance sheet reveals a more mundane explanation. Every significant asset category on the Fed’s balance sheet saw net increases this week except for the two that the Fed doesn’t directly control.

This week the Fed’s net Treasury security holdings rose another $28 billion. Their net Mortgage-Backed Security holdings rose another $24 billion. The Fed slightly increased its overall position in its alphabet soup of Special Purpose Vehicles (+$329 million). It added modestly to its corporate bond buying facility (+1.7 billion) and its Main Street Lending facility (+$5.6 billion). It also funded its Term Asset-Backed Securities Loan Facility (TALF II) with $8.5 billion. TALF buys auto loans, student loans, credit card loans, equipment loans, loans guaranteed by the Small Business Administration (SBA), residential mortgage servicing advances, commercial mortgage loans, and other assets.

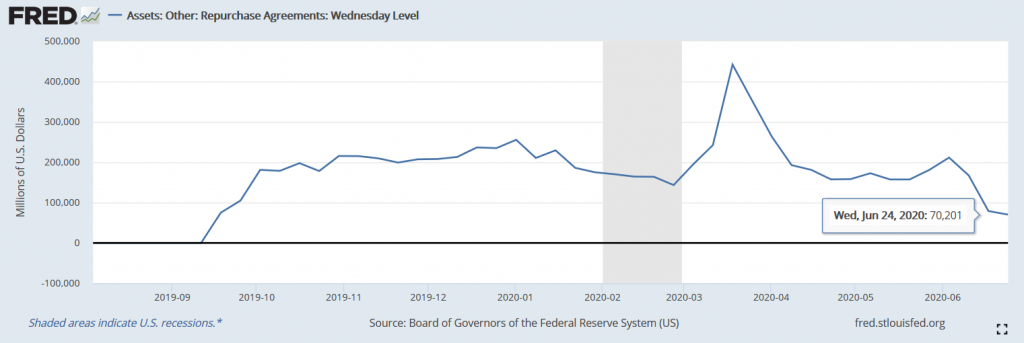

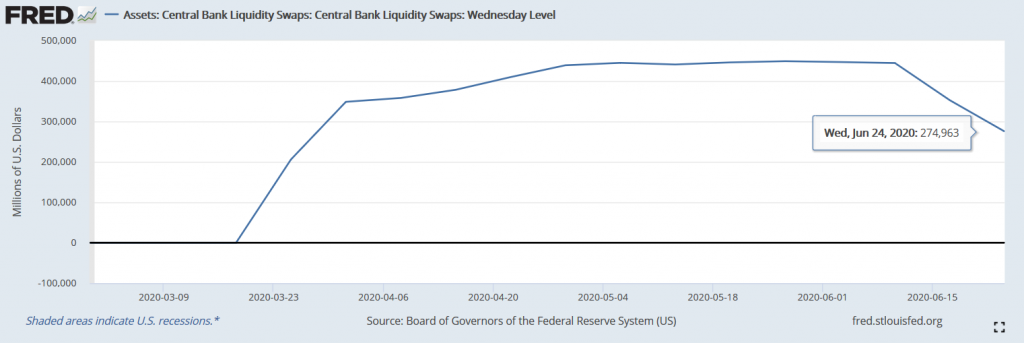

The two instances where the Fed actually shed major assets were: repurchase agreements (repos) and central bank liquidity swaps. It shed $8.8 billion and $77.5 billion respectively. What makes these two assets different from nearly all of the Fed’s other major assets, is that their size is mostly determined by the Fed’s counterparties, not the Fed. The Fed can make repos and liquidity swaps available to other banks and central banks, but how much get taken up is ultimately a question for the Fed’s counterparties, not the Fed. As the Fed has rebuilt bank excess reserves, banks’ need for repos have fallen. As currency markets have stabilized (for now), demand for liquidity swaps from other central banks has abated.

In other words, the Fed is still hurriedly ‘printing’ money and buying every stripe of financial asset from treasuries to auto loans. However, for the last couple of weeks, that buying has been offset by reductions in repos and liquidity swaps.

There are only so many repos and liquidity swaps left on the Fed’s balance sheet, $344 billion to be exact. If those draw down to zero, the Fed’s balance sheet could shrink for several more weeks, perhaps a couple months. However, that shrinkage is very unlikely to represent an active policy change by the Fed. All other major asset classes on the Fed’s balance sheet are steaming ahead and there is no indication that the Fed intends to change that.

Considering that the US is running a roughly $1 trillion-a-month budget deficit, and will likely be running multi-trillion dollar annual deficits in coming years, and considering that corporate America is borrowing like crazy to stay alive during this crisis, the Fed simply cannot stop printing without spiking interest rates and blowing up the economy.

One way or the other, this pause in QE-Infinity will be temporary.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.