Submitted by Taps Coogan on the 14th of October 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

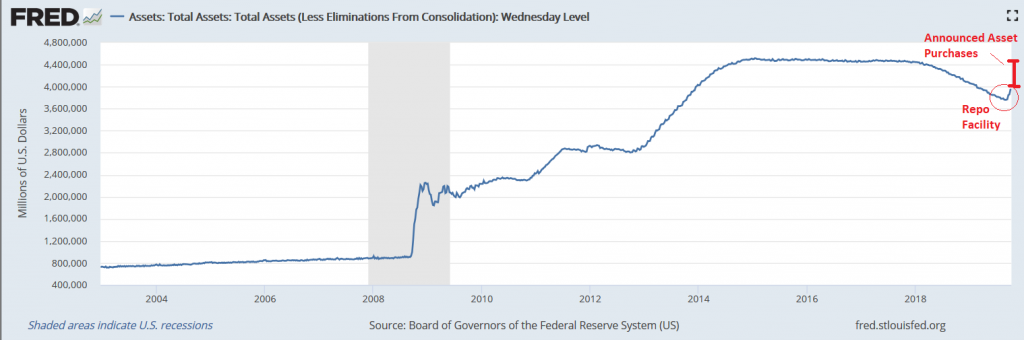

On Friday October 11th, the Fed announced that it will begin growing it’s balance sheet again. According to the Fed, large scale asset purchases will begin on October 15th (just two business days after the announcement), start at $60 billion a month, focus exclusively on treasury bills (treasuries with less than one year in duration), and continue at least through the second quarter of 2020.

Assuming that the program remains at $60 billion a month through Q2 2020, it will add $480 billion to the Fed’s balance sheet. That will increase the balance sheet from round 18.6% of GDP today to just over 20% of GDP by Q2 2020 (assuming 5% nominal GDP growth), just under its all-time record high of $4.5 trillion. The Fed will also continue to provide its recently introduced standing repo facility of up to $110 billion until at least January 2020. That repo facility appears to have already added about $200 billion to the Fed’s balance sheet in just the last few weeks. As a point of reference, the Fed’s QE3 program ran at a maximum rate of $85 billion per month.

The Fed’s Balance Sheet

The Fed has gone to great lengths to proclaim that this large scale asset buying program is not QE. Their argument seems to hinge on the fact that QE programs are intended to provide stimulus during recessions whereas this program is intended to relieve funding pressures that have been caused by insufficient bank reserves. It would be one thing if the Fed was proposing to grow the balance sheet inline with the broader economy, as it has historically done, and accept that funding pressures may push borrowing costs up at times. However, the Fed is proposing to grow its balance sheet well in excess of that pace, while intentionally pushing short term borrowing costs lower. The Fed’s program meets any common definition of quantitative easing.

The Fed’s unwillingness to call its newest program a QE program is nothing more than implicit acknowledgment that a QE program would be a bad idea right now. Why would it be a bad idea? Markets are at all time highs, the economy is growing at over 2%, CPI inflation is over 2%, and real wages are growing at the fastest pace since the 1970s.

The underlying cause of the recent overnight funding problems is a lack of sufficient liquidity in the financial system to fund record federal and corporate bond issuance at more-or-less the lowest borrowing costs in American history. The solution to that problem is not to flood the financial system with liquidity via a huge new repo facility and QE program. The solution is to allow the market to send the price signal that the current pace of federal and corporate borrowing is not sustainable.

Instead of allowing markets to do their job, the Fed will be pumping half a trillion dollars into an economy. The net result is that markets get their rate cuts, their QE, and a trade cease-fire all at once. Presumably that will buy this expansion another lease on life. While that aught to be a boon for investors, there is little to celebrate. Not only are we enabling the historic over indebtedness of the federal government and corporate America to become even more historic, the idea that we were ever going to normalize monetary policy is now effectively dead and buried.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Yeah, suck $60 Billion in HQLA every month in order to “control” front end rates… what could go wrong? lol

Have the bond vigilantes gone off the scene altogether?

I think they have all gone bust

The Fed has been forced to deal with a liquidity issue in repo rates since a sudden and dramatic surge began in September. While it is difficult to see the difference between QE and an injection aimed at maintaining liquidity, in this case, several reasons exist to believe this is not QE.

A strong dislike and distrust of the Fed should not blind us to the idea this may still play out in many ways. More on this subject in the article below.

https://brucewilds.blogspot.com/2019/10/qe4-or-necessary-liquidity-injections.html