Taps Coogan – February 3rd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

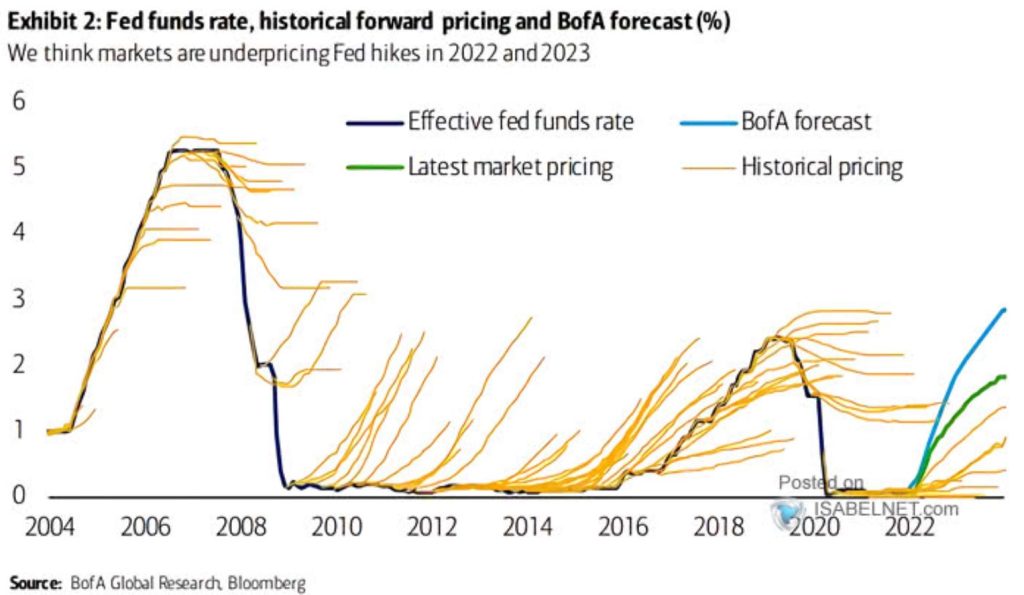

The following chart, from Bank of America via ISABELNET, shows how bad the market’s track record is at pricing in the path of rate hikes.

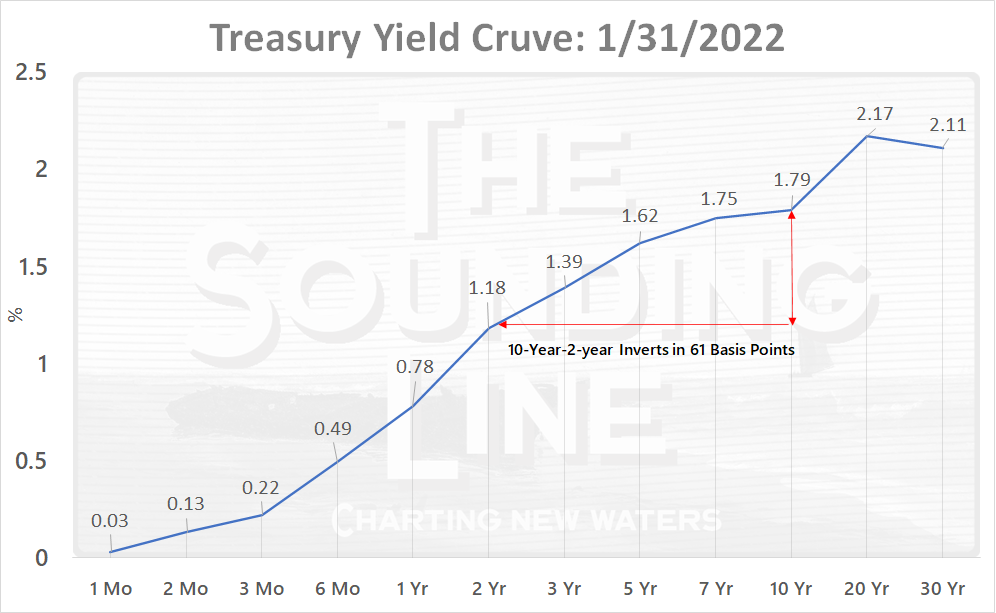

The market is currently making a copy-paste repeat of the post-Global Financial Crisis tightening forecasts and Bank of America is one upping the market by calling for something like 12 rate hikes in 2022 and 2023. Meanwhile, the 10-Year to 2-Year inverts in 0.61% and the 30-Year and Fed Funds Rate would invert in nine rate hikes unless long rates start rising significantly.

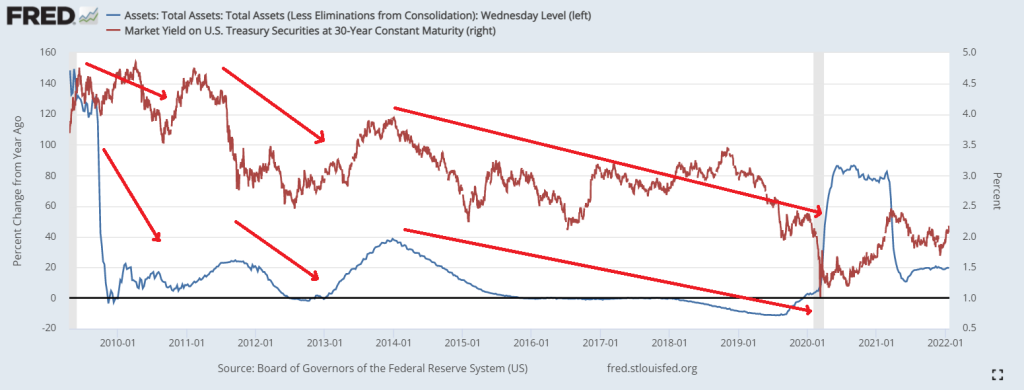

So, could long rates rise significantly? Of course, but they have tended to do the opposite every time the Fed has tapered QE or reduced its balance sheet.

That’s because the Fed always ends up waiting until the economy has started to slow before it starts to tighten.

Speaking of slowdowns, here is the Atlanta Fed GDPNow real GDP estimate for the first quarter. What a time for the Fed to slam on the brakes…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

But these are our Top men, top men I say….