Taps Coogan – September 6th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

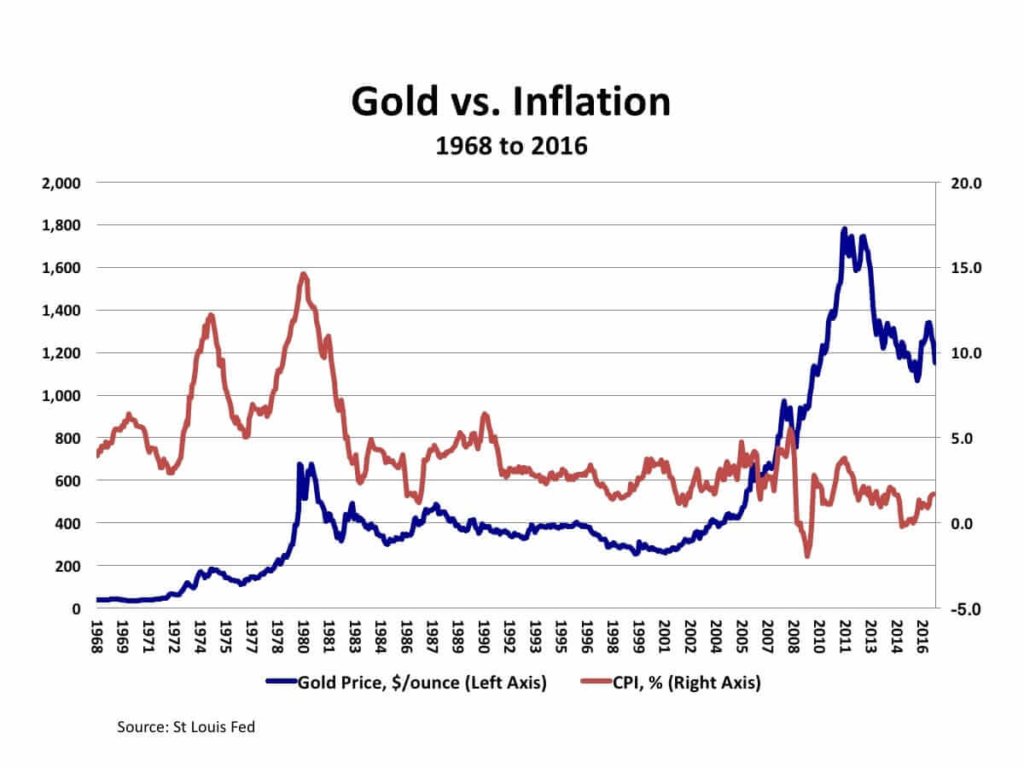

The popular narrative about gold is that it is correlated to inflation. In reality, no such correlation exists as any long-term comparison of CPI and the gold price will highlight.

Since the $35 dollar/gold peg was removed in 1971, gold has shown no consistent correlation to inflation. Sometimes gold has risen with inflation, sometimes it has fallen with rising inflation, and during the only brief period of deflation (2008-2009) it rose.

Gold is a long term store of value. Over very long timelines that can be thought of as the practical equivalent of an inflation hedge but on time-scales of less than a decade, they are not the same.

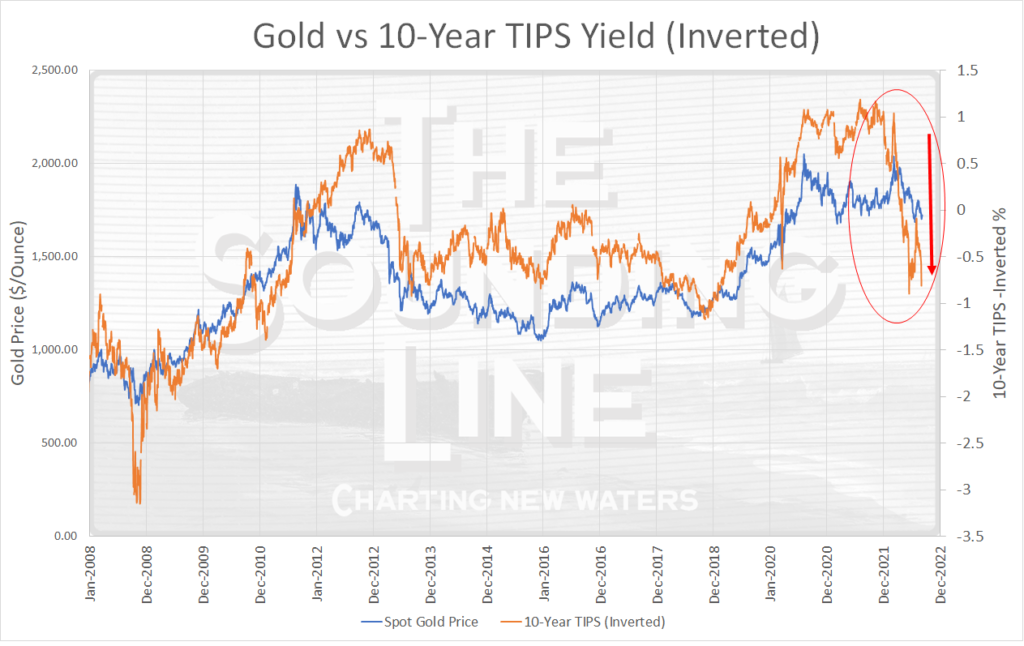

Nonetheless, for the past 17 years, gold has shown a striking correlation to the yield on the 10-year TIPS. That correlation makes sense. The price of gold – a long-term non-yielding reserve asset – can be thought of in relation to the yield on the benchmark long-term, yielding, inflation-hedged reserve asset, the 10-Year TIPS.

In April of this year, we noted that that correlation regime would have to break down for gold to move higher because rising rates were so probable. We described why that breakdown might happen (non-P&L motivated buying from central banks) and said ‘let’s wait and see.’

Fast forward to today and it’s pretty clear that the correlation has held. As anticipated, that has been bad for gold.

While many have argued that gold isn’t behaving as it should, we would argue the exact opposite. Gold is doing exactly what it has been doing for nearly two decades (and probably longer but TIPS are a relatively new thing): providing a hedge against declining yields on the world’s benchmark long-term ‘risk-free’ inflation-indexed asset.

The outlook remains little changed. Rising TIPS yields remain bearish for gold and, barring a dramatic pivot in monetary policy, it’s hard to see why TIPS would reverse and head to new negative lows.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Perhaps.

But you have to admit the M2, deficit spending,currency debasement, geopolitical events, macroeconomic environment, everything bubble, incompetent FED, money printing central banks, worldwide addiction to easy money stimulis, bitcoin failure, civil strife, a major political party calling 77 million Americans a”clear and present danger”, record gun sales,food shortages, gold’s 5000 year track record, lack of other things in which to confidently invest….hold a sec, I’m running out of breadth puff, puff….well these things all look pretty good for the barbarous relic.

In the long, sure