Taps Coogan – June 30th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

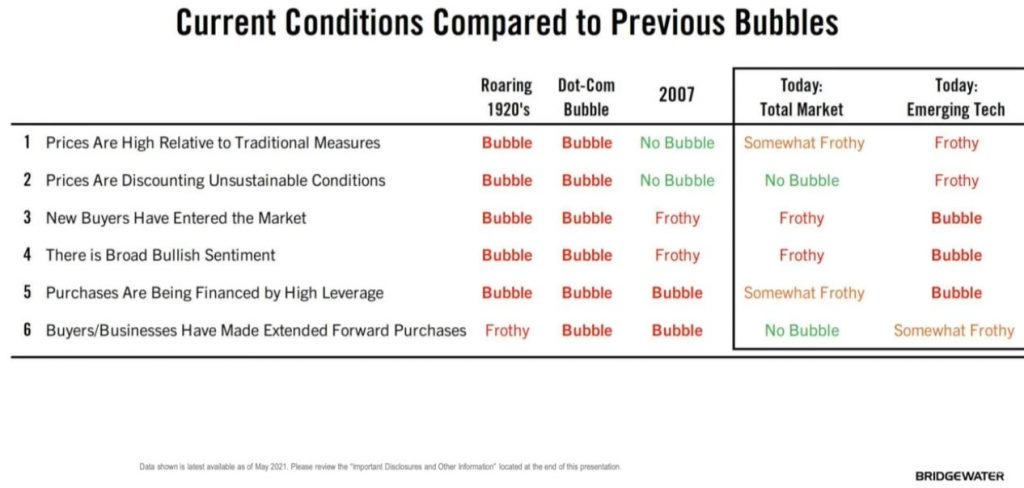

Ray Dalio, co-chairman and founder of Bridgewater Associates, the world’s largest hedge fund, recently spoke for a Robinhood non-profit event and broke down the methodology he uses to determine whether or not we are in a ‘bubble.’

Mr. Dalio uses six criteria and applies them to determine whether or not the overall market is in a bubble. Those criteria are summed up below:

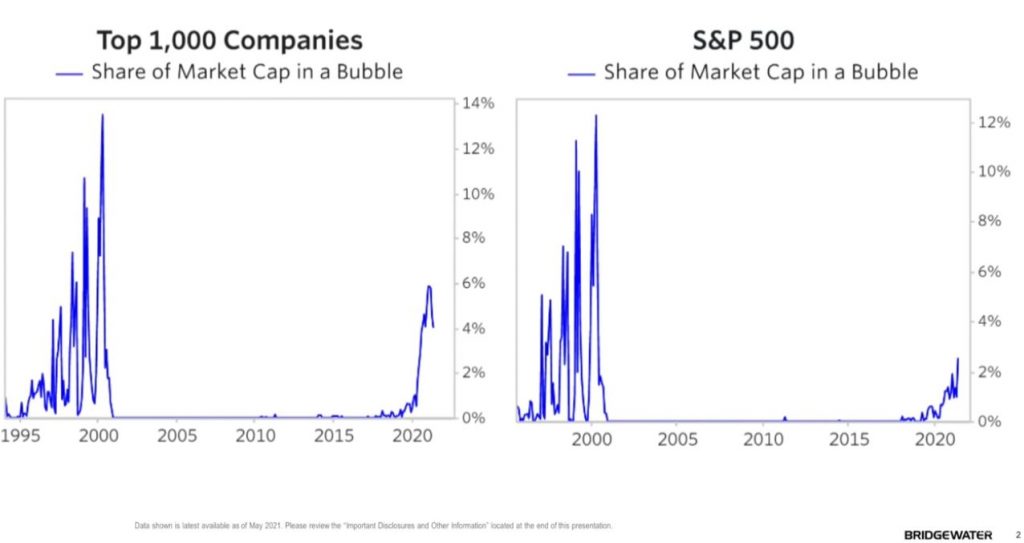

He then applies the same criteria to individual companies to come up with a ratio of how many companies in the market are ‘bubbly.’

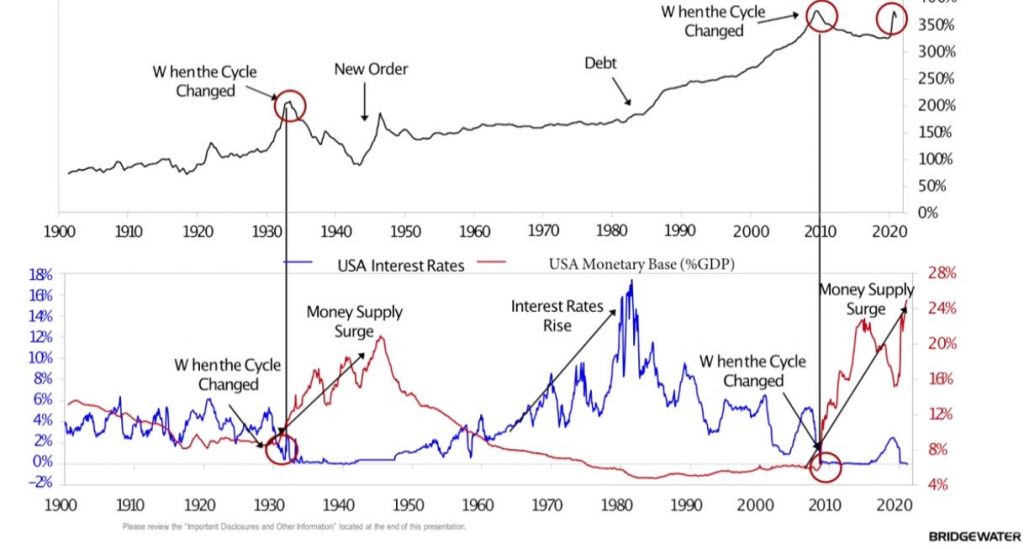

Regardless of how one debates the metrics Mr. Dalio lays out, the most interesting chart may very well be the following one below, which suggests that the best analogy for this moment in time may actually be the mid-to-late 1940s. Let’s hope…

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Fascinating post, I do hope he’s right, my concern is that the debt to GDP ratio is in a rather unsustainable place for a reserve currency.

Agree. The spending back then could be cut when the war ended. Now the spending is all entitlements, waste, and corruption. Much harder to cut. Plus no baby boom this time either. One can hope though