Submitted by Taps Coogan on the 26th of February 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The stumble in global markets over the last few days is a sign that investors are once again contemplating the existential question of this expansion: Is history’s most apathetic market finally reconnecting with reality?

This expansion, the longest in American history, has been driven in a decidedly ‘cart-before-the-horse’ fashion. Endless accommodation and hand-holding by central banks around the world has been part of a conscious strategy to launder artificial gains in financial assets into some sort of self-sustaining expansion. Although the gains in financial assets have been astounding, the transfer to the real economy has always been pyrrhic. The horse still hasn’t made it in front of the cart.

Central banks have plowed through all manner of crises over the last 11 years: a couple European sovereign debt crisis, declining corporate profits, record corporate debt levels, Brexit, massive government deficits, declining commodity prices, contractions in industrial production, trade wars, half-a-dozen actual wars in the Middle East, repeated yield curve inversions, etc… The net result is that investors have been heavily, heavily conditioned to be apathetic towards anything other than monetary conditions.

Investors that have taken those risks seriously have had their hats handed to them time and time again, not necessarily because they were wrong about the underlying problems, but because they were wrong that anything could matter for longer than a few weeks before central banks rode to the rescue.

Seemingly, the only investors left in the game are the ones who have learned to write off all of the bad news. It has created an impressive feedback loop of apathy.

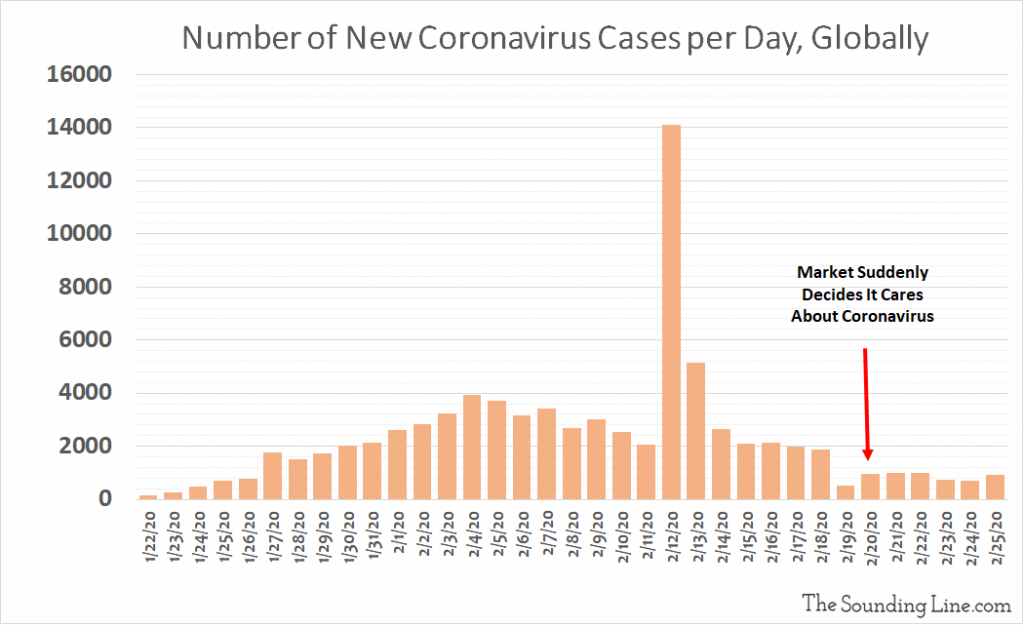

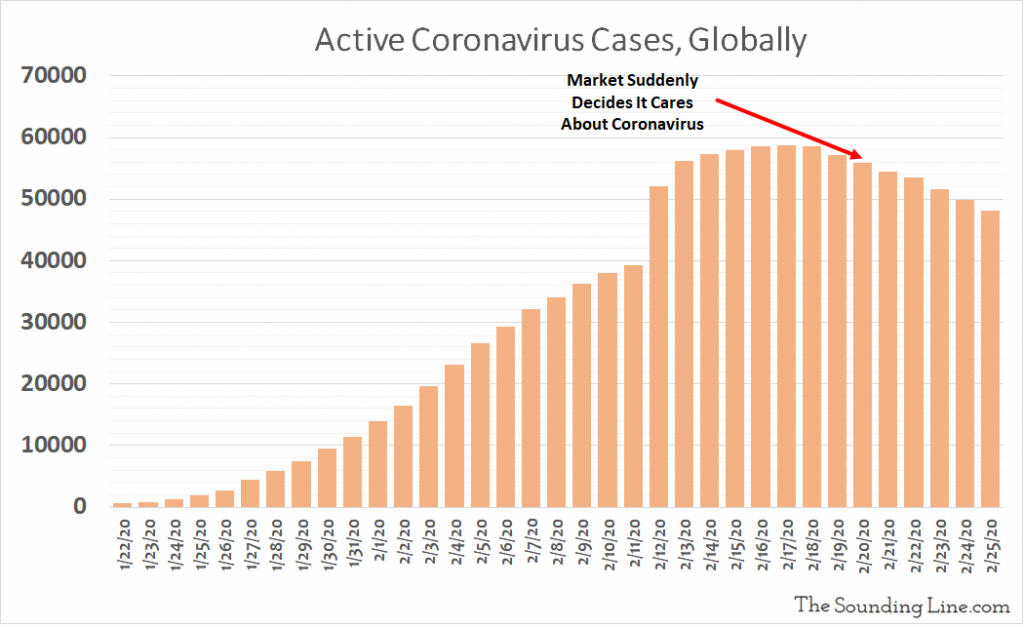

Even the current Coronavirus outbreak was well on its way to being completely ignored by financial markets until just a few days ago. The S&P 500 hit an all time high on February 19th, despite over 75,000 cases having already been confirmed over the prior month.

Indeed, the market only started to meaningfully care about the Coronavirus outbreak after the total number of active cases had begun to fall.

Even though the situation in China is slowly improving, the virus is now spreading in countries that are obviously incapable of containing it. Despite the moderating active case count, there is no doubt that Coronavirus will remain a major public health crisis for the foreseeable future.

However, the question for investors is not whether if this is a public health crisis, or even a potential economic crisis. The question for investors is whether anything other than monetary policy can matter to financial markets for more than a few weeks.

To answer that question requires investors, lost down the rabbit-hole of this reality distorting expansion, to tug on their life-line of sanity and attempt to answer an irrational question: how cynically apathetic should we be right now?

Whatever your answer to that question is, it’s likely to spell bad news in the long run.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.