Taps Coogan – February 20th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

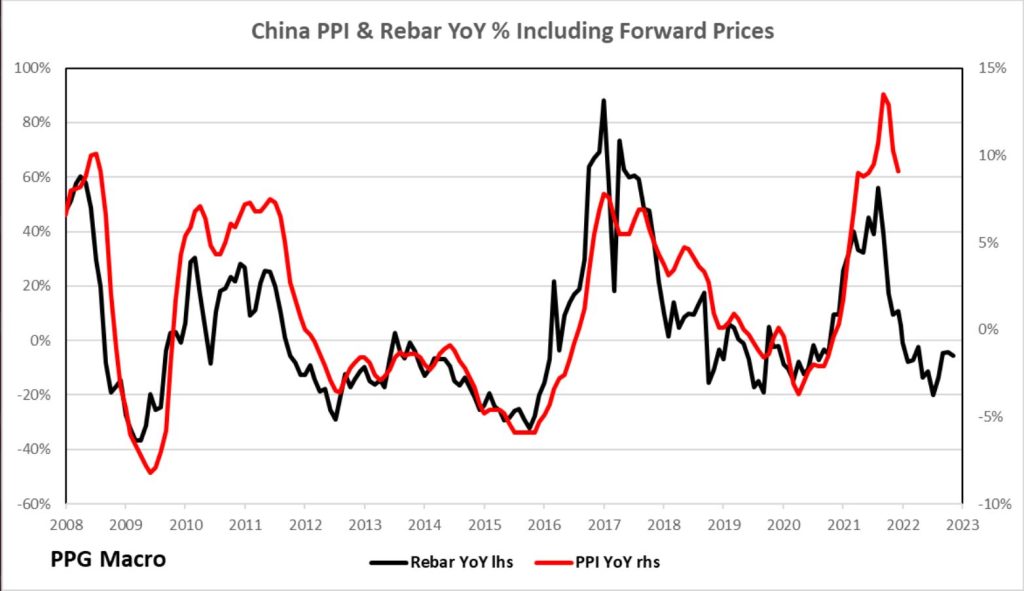

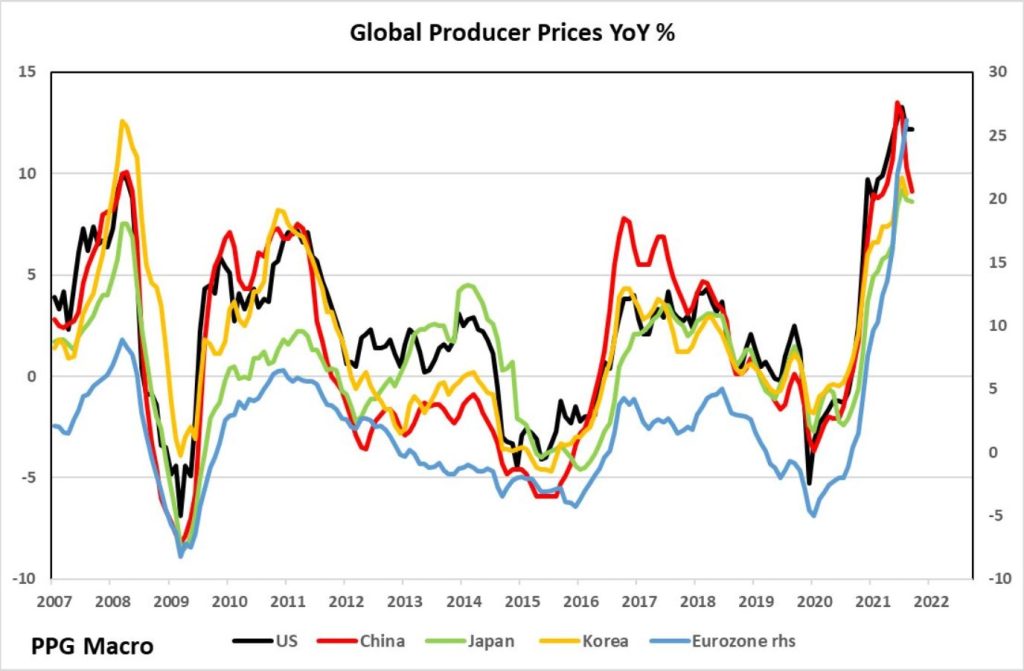

The following two charts, from PPG Macro, highlight the correlation between rebar price changes, Chinese Produce Price Inflation, and many other countries’ producer price inflation.

The first chart plots out rebar prices until later this year using forward prices. Forward prices are not predictive of actual future prices. They mainly just project forward the current price plus the carrying cost for the good and the risk free rate, but the point is that rebar prices have to keep accelerating to the upside to keep the year-over-year price growth rate high this year.

If that doesn’t happen, if prices just hold at current levels or drop, such a deceleration in year-over-year rebar price increases has traditionally be correlated in a drop in Chinese producer prices along with producer prices in the US and elsewhere.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.