Taps Coogan – December 27th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

CNBC’s Rick Santelli has been given relatively few opportunities to speak for more than a minute or two since overdoing a rant about how the early lockdowns and market collapse were an overreaction. Gone are the days when he was allowed to interview guests and share his unvarnished opinions, something that was clearly unwelcome by nearly everyone else on CNBC. Nonetheless, Rick Santelli was recently allowed to talk for a few minutes after reading the last scorching hot Producer Prices inflation numbers.

Here is what he had to say about inflation:

“Remember that in the 1980s we changed the way we look at houses and rent and this is a big deal… The problem is that even though rents have gone up and it’s captured in some of these reports, the actual price of a house has gone up much more aggressively. So there are many aspects to measuring the data. I’m not saying they are inaccurate, just different. But the feeling when you… look at things like college, healthcare, home equivalent rent, …hedonic accounting, meaning you can’t include the price of a car that’s stripped down… all of this makes the cost of living much more expensive…”

“There were many years when we said that the anomaly to inflation was the 1970s and 1980s, the high water mark that we were most afraid of, that outside of about a 15 year patch there, maybe even a bit less, interest rates were historically lower. So we are going to change that perception this time around and I also caution, there are so many difficult things to explain…. We literally unplugged the US economy and to think that we could unplug it, have it all go dark, and then plug it back in and not think that we are going to experience some very strange activity, and I think that the policies and the activity combined are just going to make these prices hot-hot-hot for a long time.”

For more on the significance of the hot PPI inflation numbers that Mr. Santelli read at the beginning of the interview, we recommend reading this from Wolf Street.

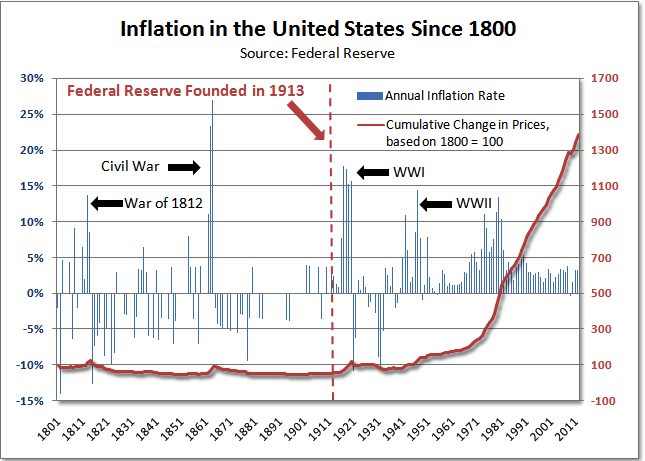

When the Fed was founded and given a sole mandate of price stability there was no doubt that that meant actual price stability. Over the 110 years prior to the Fed’s founding in 1913 there had been significant net deflation. Purchasing power of the dollar had increased by about 70% from 1800 to 1913, a period that saw rapid economic and population growth, huge increases in life expectancy, enormous technological advancement, large increases in per capita wealth, and the start of the industrial revolution.

Since the Fed’s founding in 1913, the purchasing power of the dollar has decreased by 96.5%.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.