Taps Coogan – June 26th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

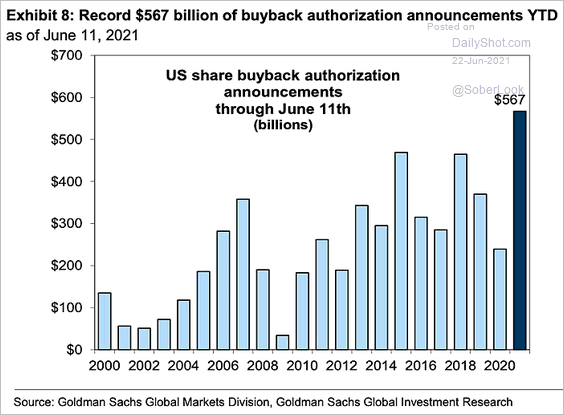

Well that was fast. Barely a year after the biggest taxpayer funded corporate bailout in history, and stock buyback authorizations have hit a new all time high according to the following chart from Goldman Sachs via The Daily Shot.

Companies can decide for themselves how prudent it is to be doing record buybacks as the market reaches its most expensive level ever and corporate indebtedness skyrockets. That’s their prerogative. However, continuing to throw hundreds of billions of taxpayer dollars at corporations via bailouts every time such behavior blows up in companies’ faces must stop.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Do not underestimate the power of stock buybacks. For decades stock buybacks were illegal because they were considered to be a form of stock market manipulation. They were legalized in 1982 by the SEC and since then have become a tool for companies and management to boost share prices. This is where I remind you it is major investors that sit on the board or hold executive positions and the same CEOs and other top managers who have received much of their compensation over the years in stock options. Yes, these are often the shareholders in the company that have… Read more »