Submitted by Taps Coogan on the 28th of May 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

It is common knowledge that the US housing bubble bursting was a key cause of the global financial crisis that started in 2008. In the years preceding the 2008 crisis, the Federal Reserve had been maintaining artificially low interest rates and banks lent excessively to people who were not credit worthy. Widespread speculation, extraordinary leveraging and fraudulent repackaging of failing mortgages led to unsustainably high home prices and rapid housing debt growth. The bubble burst and the rest is history.

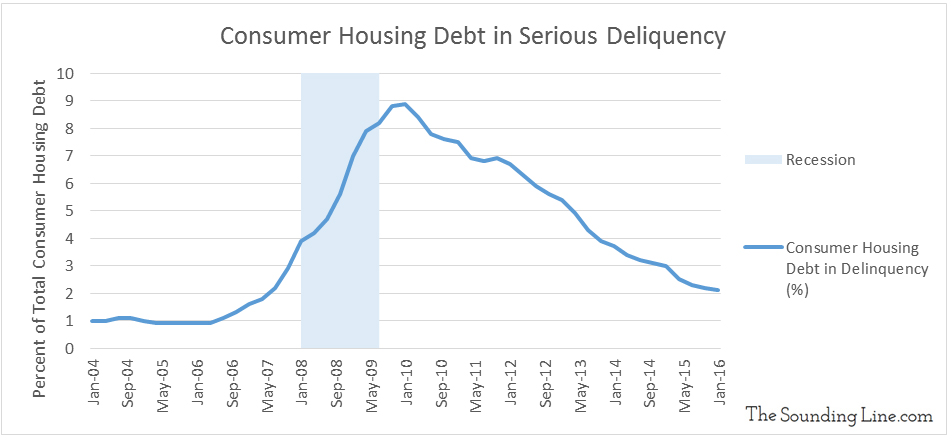

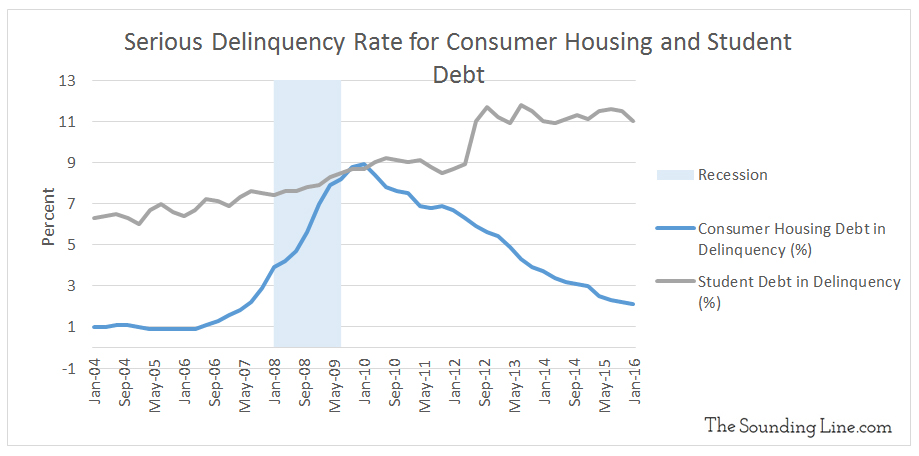

While the events that began in 2008 took most of the world by surprise, particularly central banks, those who monitored the delinquency rate of housing debt in the few years preceding the crisis found ample evidence that trouble was brewing.

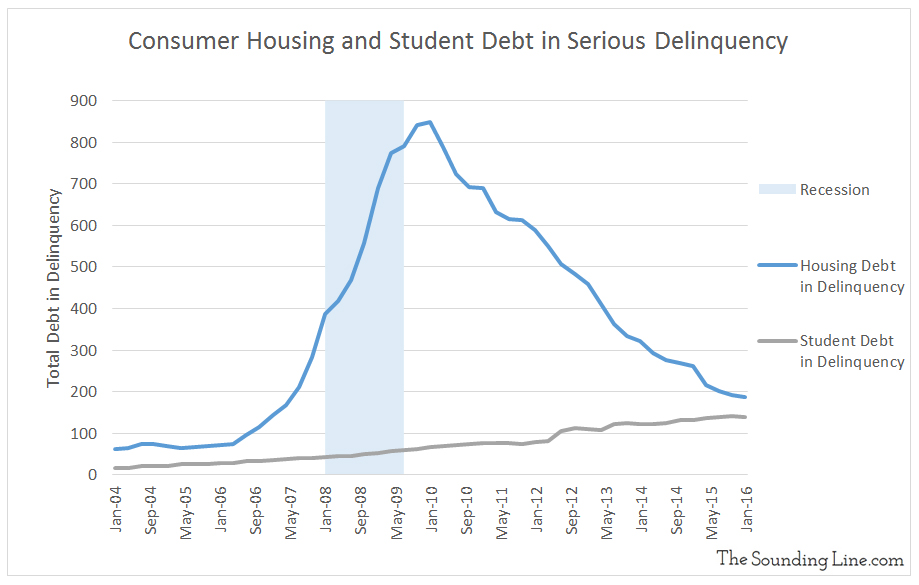

The amount of housing debt in serious delinquency (+90 days without payment) had exploded from about $60 billion or 1 % of consumer housing debt at the start of 2004 to about $280 billion or 3.9% in the last quarter of 2007, a 467% increase in the total amount.

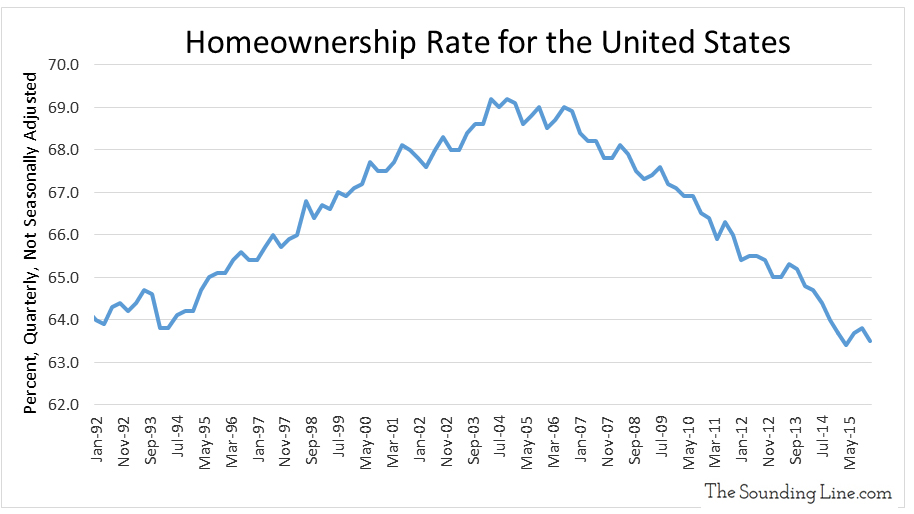

In the years following the crisis, the delinquency rate on housing debt has improved. This is largely due to the fact that fewer and fewer Americans now own homes, leaving only the most credit worthy buyers in the market. It is a sad fact that an increasing number of American’s simply can’t afford to own homes and have turned to renting instead.

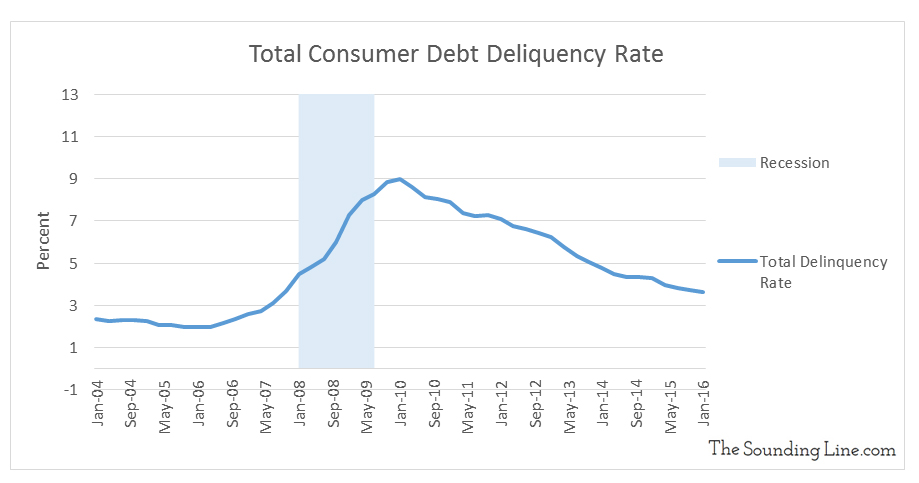

The fact that the rate of delinquency of American consumer debt has improved not only for housing debt, but total consumer debt as well is a welcome ray of light in today’s anemic economic times.

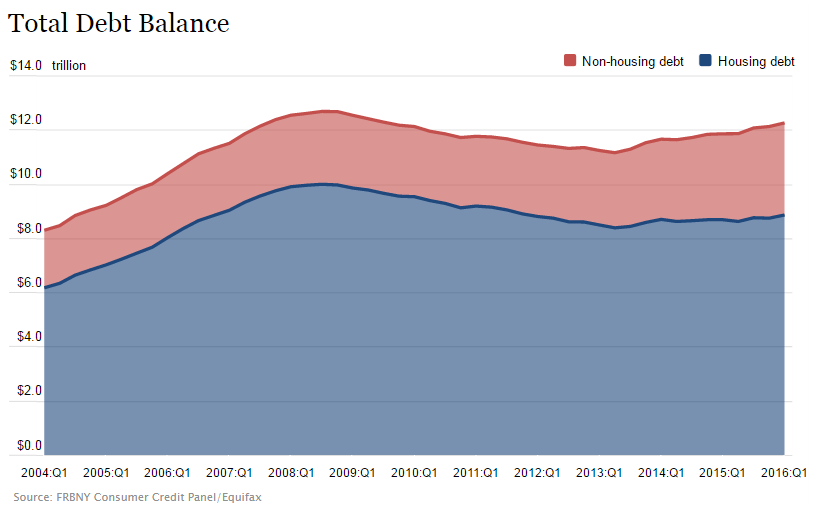

Yet Americans have not turned away from debt completely. Total consumer debt has worked its way back up to $12.24 trillion, just shy of the $12.68 trillion high in Q2 2008. That is right. Debt is back to where it was before the recession.

In the place of housing debt, student debt has become the fastest growing segment of consumer credit. Just as delinquencies spelled trouble for housing debt in the run up to the financial crisis, delinquencies in student debt may be a clarion call that trouble lies ahead.

The total student debt in serious delinquency is currently $139 billion or 11% of all student debt. While that is less than the $282 billion of housing debt that was in serious delinquency in Q4 2007, the percentage of student debt in serious delinquency is nearly four times higher than housing was on the eve of the financial crisis. When one realizes that there is no actual asset to recover as opposed to the case in the housing market, the seriousness of the trouble ahead is of great concern. The loss in the case of student debt defaults are absolute, the creditors have no recoverable asset to salvage. And, as the administration has increasingly moved debt from the private banks to the Federal Government, taxpayers are on the hook in a situation comparable to “To Big To Fail.” Let us also not forget that with nearly $20 trillion in public debt and $127 trillion in unfunded liabilities, the collective American taxpayer is already the most heavily indebted entity in the history of the world. In fact, the American taxpayers’ unfunded liabilities are twice global GDP (link here); each American is on the hook for more than $1 million.

Because total student debt is much smaller than housing debt, it is unlikely that a student debt bubble, in and of itself, poses anywhere near the same degree of risk that the housing bubble did. Furthermore, while high, the student debt delinquency rate has not started to increase exponentially like housing delinquency rates did before the recession. However if the job market stalls, it very well may.

In today’s interconnected yet fragile global economy, it would be prudent to keep a close eye on student debt.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.