Submitted by Taps Coogan on the 2nd of November 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Back in August, we ranked the inflation adjusted GDP growth of 181 countries around the world since 2000. This led to the startling conclusion that several of the absolute worst performing economies in the entire world (according to this metric) were in Europe. The Greek economy, for example, has shrunk more in total value since 2000 than any other country we analyzed. Italy has barely grown 1% since 2000, only outperforming Yemen, Zimbabwe, Greece, and the Central African Republic.

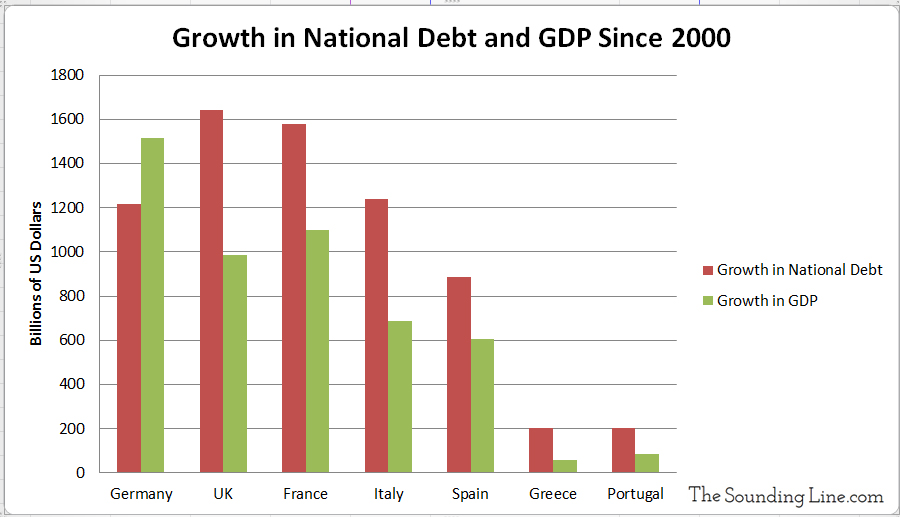

Not only have several EU countries seen little to no long term economic growth when accounting for inflation, but even without accounting for inflation, many of these same countries have seen their government debts grow by a larger amount than their entire economies over the same period. As the following chart shows, the national debts of the UK, France, Italy, Spain, Greece, and Portugal all grew more than their respective economies from 2000 through the end of 2016. Germany, on the other hand, has seen its economy grow by a larger absolute dollar amount than its national debt over the same period, despite its national debt growing substantially and as a percent of GDP.

Government spending on final goods and services (equipment, salaries, infrastructure, etc…) counts towards a country’s GDP. While welfare and transfer payments do not count towards GDP, when the recipients of welfare and transfer payments spend their benefits, this spending also counts towards GDP. Thus, because government spending adds to GDP in these two ways, essentially all of the economic growth that these countries have seen since 2000 can be linked to increasing government deficit spending, not sustainable economic growth. In Italy, for example, the government’s debt has increased by an average of $144 billion per year since 2000, while the economy has only grown at a rate of $108 billion per year.

The point is simple. When an economy’s growth can be attributed in its totality, directly or indirectly, to government borrowing, no sustainable growth has been achieved. Even the very modest economic growth these countries have experienced since 2000 is borrowed from the future and will have to be repaid. Historically low interest rates have masked this growing charade for nearly a decade and while it may continue for some time, it is quite literally unsustainable. Perhaps more importantly, this illustrates the failures of current economic arrangements, policy, and leadership to generate fundamental economic growth despite huge advances in both population and technology.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.