Submitted by Taps Coogan on the 17th of June 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

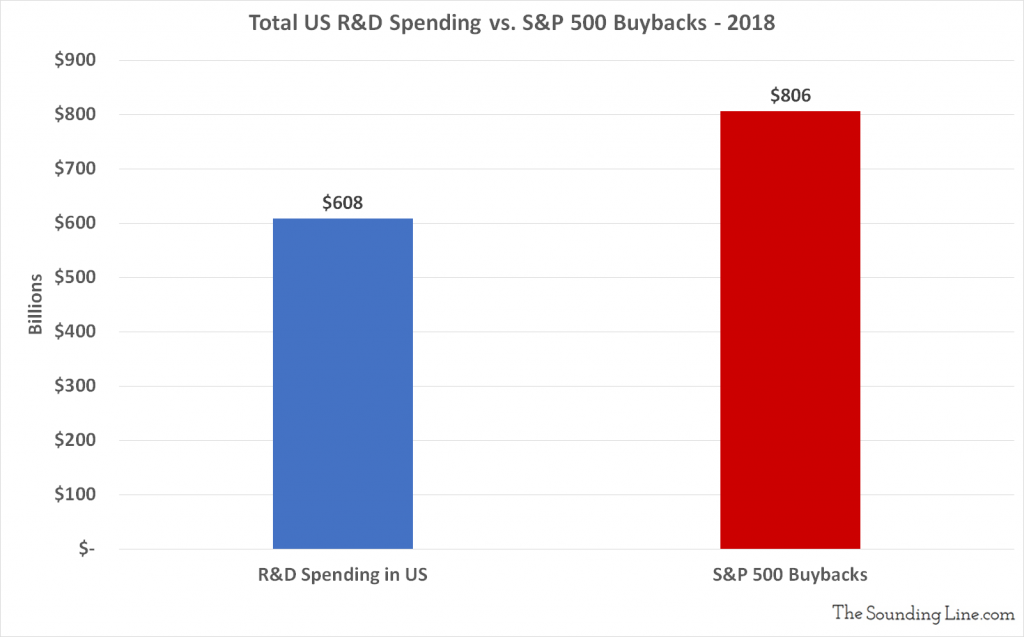

The United States engaged in roughly $608 billion worth of research and development in 2018. That figure includes R&D by all entities in the US, from universities to private and public corporations. During the same year, corporations in the S&P 500 spent $806 billion buying back their own stock. In other words, the 500 largest companies in the US are now spending 33% more on their stock buyback programs than the entire country is investing in R&D. Cumulatively, buybacks have now outpaced R&D investment for the last five years. From 2014 through 2018, total R&D investment in the US was roughly $2.736 trillion whereas S&P 500 buybacks totaled $2.978 trillion.

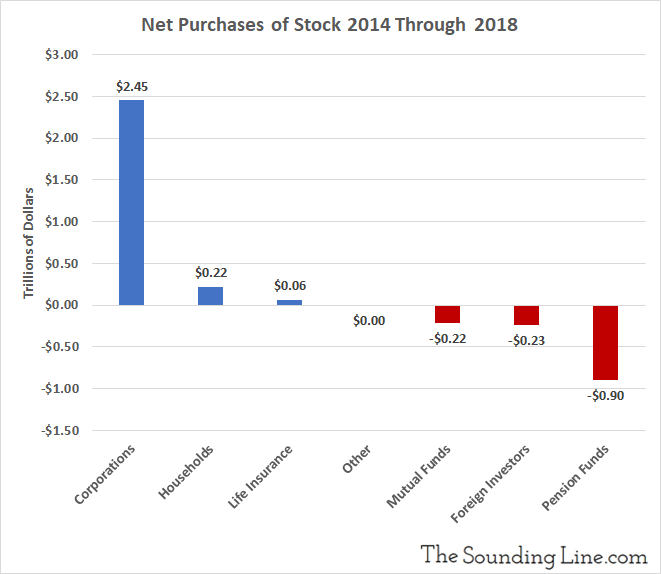

As we have recently noted, the accelerating pace of stock buybacks has made corporations the largest and only significant net purchaser of stocks for the last five years. Furthermore, S&P 500 dividends and buybacks have exceeded total reported earnings for the S&P 500 over the last five years and even exceeded the total increase in S&P 500 market capitalization.

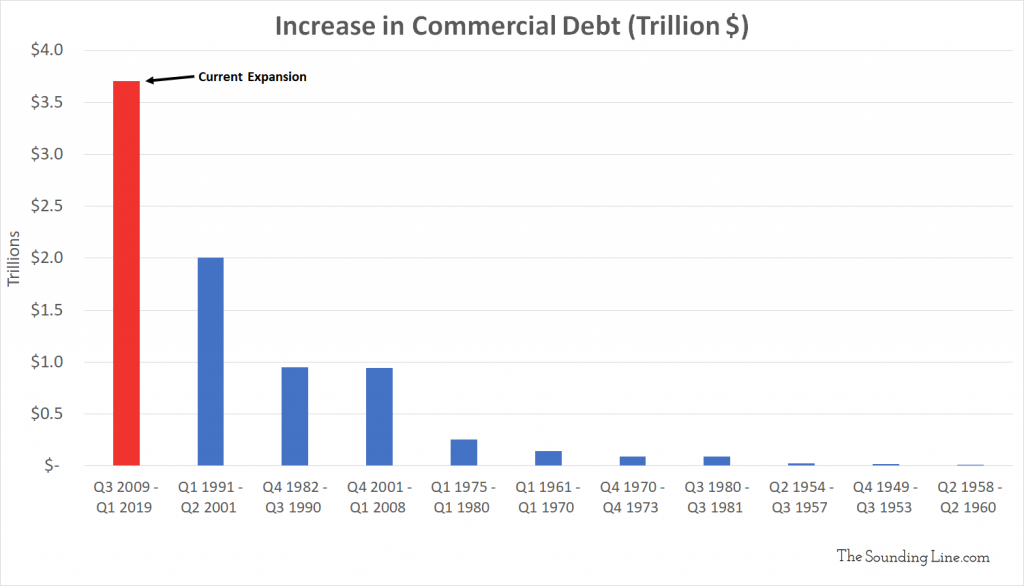

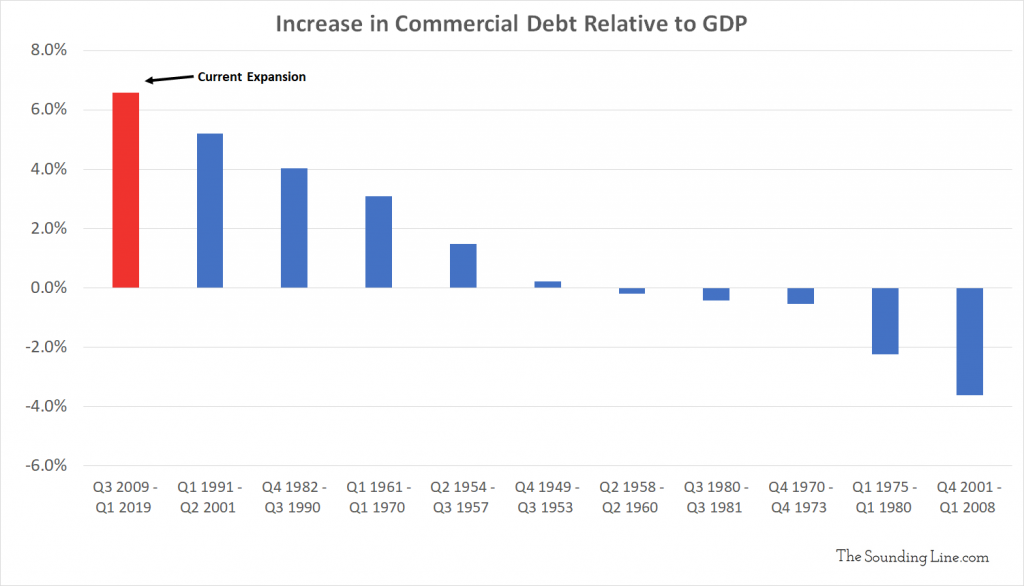

Meanwhile, we are in the midst of the largest increase in commercial indebtedness on record. Combined, corporate debt securities and commercial and industrial loans have increased by over $3.7 trillion since the Financial Crisis, a record for any expansion, both in absolute dollars and relative to the GDP.

Given the massive ‘investment’ corporations have made in their own equity, the need to sustain higher share prices with ever more buybacks creates a feedback loop that is drowning out real investment. All the while, corporations are burdening themselves with historic levels of debt.

If borrowing conditions ever tighten and companies have to focus on cleaning up their balance sheets, there is going to be a historic reckoning for financial markets.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.