Taps Coogan – August 21st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

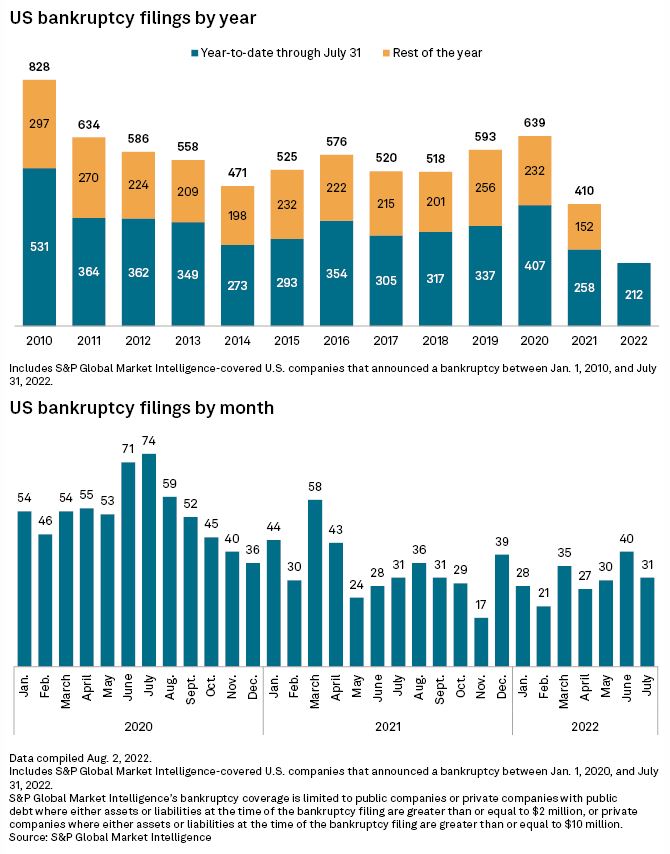

Given the extreme levels of economic pessimism out there it may come as a surprise that S&P Global has recorded the lowest level of bankruptcies in the first half of this year in its data going back to 2010.

S&P Global looks at public companies and private companies with publicly traded debt with assets or liabilities of at least $2 million. They also look at private companies with assets or liabilities of at least $10 million.

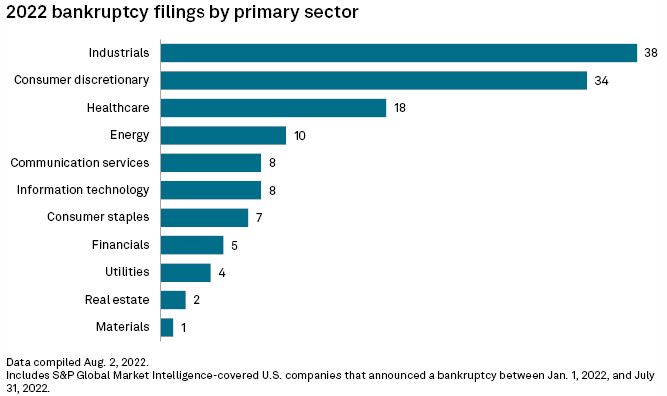

Those bankruptcies that occurred where mostly concentrated in the industrial sector.

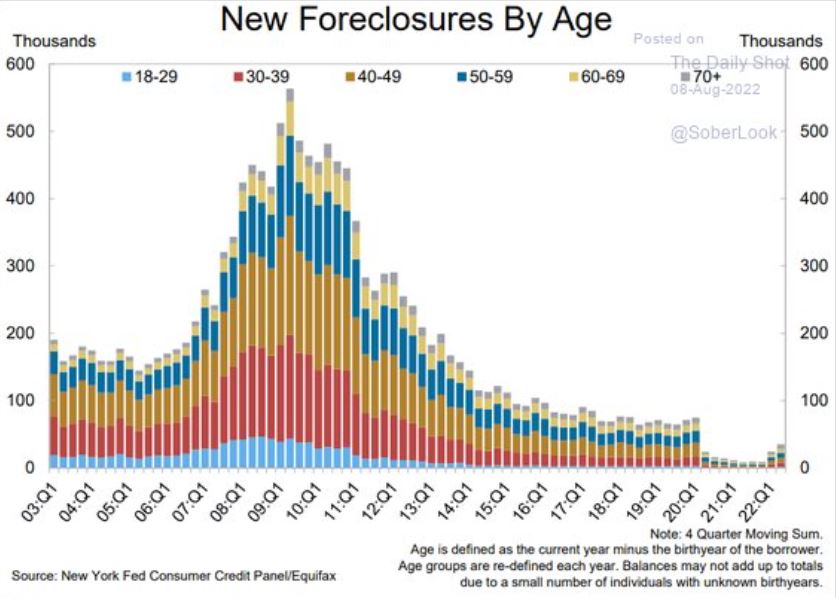

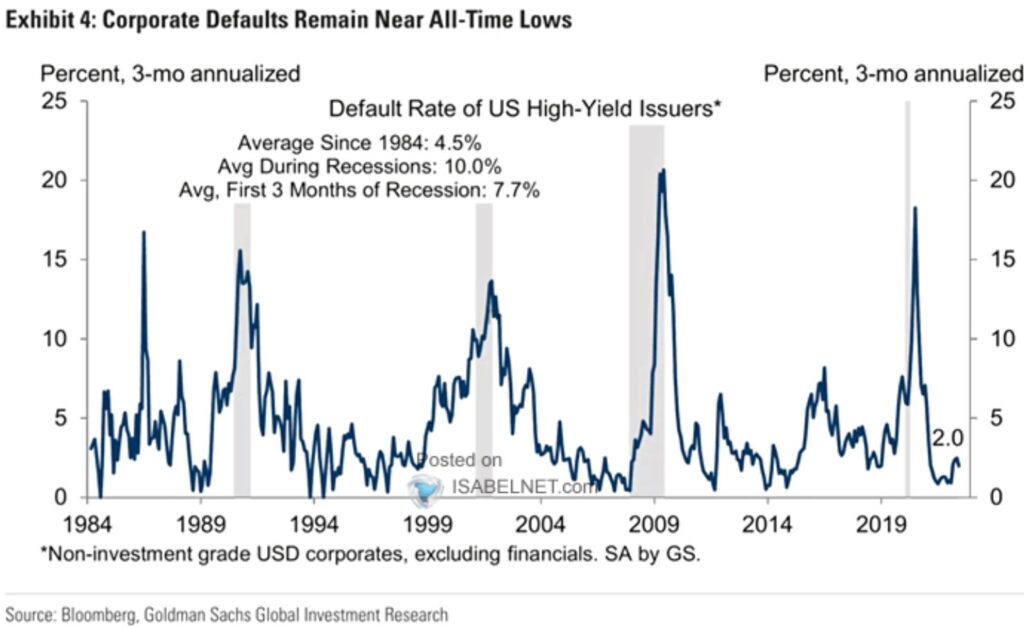

We’ve previously noted that foreclosures and corporate defaults remain exceptionally low as well.

There is little doubt that the reason for the low bankruptcy/default/foreclosure trends is the avalanche of stimulus and helicopter money over the past two years.

It is also reasonable to assume that these bankruptcy trends will return to more normal, higher levels.

For people looking at year-over-year changes in these data sets, that’s likely to produce some scary looking charts in the coming quarters.

However, and this may seem like splitting hairs, the historically extreme levels of economic pessimism right now, which correspond to levels seen during the worst parts of the Global Financial Crisis – not the run up to it, just doesn’t jive with the absolute levels of these various data sets.

As far as I am aware, there has never been a recession that ‘everyone’ predicted in advance, but right now sentiment overwhelmingly is forecasting not just a recession, but a very deep one.

Something doesn’t add up and I can’t help but wonder if sentiment, while directionally correct, is simply way excessively negative.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.