Submitted by Taps Coogan on the 28th of May 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

For quite some time, one of the more concerning charts for long term equity bulls has been the ratio between the S&P 500 and US GDP. Even after the ~35% swoon in markets in March, the ratio between the two has remained near its Dot-Com bubble peak level, when stocks were their most expensive relative to the economy since 1920s and 1930s.

However, one thing that doesn’t factor directly into the chart above is the monetary stimulus that the Fed began rolling out in 2008 and which the Fed has dramatically accelerated in the last few months.

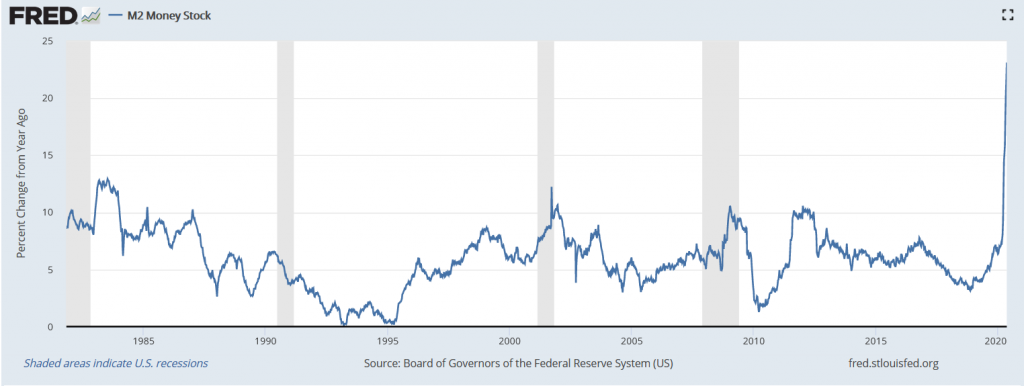

That stimulus has had questionable effects on the real economy and, until recently, only moderate ‘success’ in overcoming declining bank lending ratios to grow the overall money supply. However, the massive QE-Infinity program unleashed by the Fed over the last few months, combined with stimulus checks and expanded unemployment from the federal government, has had a profoundly different effect on the nation’s money supply than past stimulus.

The M2 money supply is now growing at an astounding 23% year-over-year, wildly faster than at any prior period on record and very likely the fastest pace since the Fed’s founding in 1913. The Fed’s prior QE programs simply don’t compare, a point that we have been emphasizing over the last couple months in light of the near universal calls for a double dip crash and protracted depression, calls that are looking increasingly tenuous.

So while stocks remain historically expansive relative to GDP, relatively to the money supply…. not so much.

Further evidence that valuation varies from metric to metric … S&P 500 market cap to M2 money supply sits below 20y average—well below 2000 & 2007 highs pic.twitter.com/2Xu6QN2vsZ

— Liz Ann Sonders (@LizAnnSonders) May 27, 2020

All of which begs the question: What matters more to stocks, the money supply or the economy? I suspect that the answer depends on one’s time horizon.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.