Taps Coogan – June 25th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

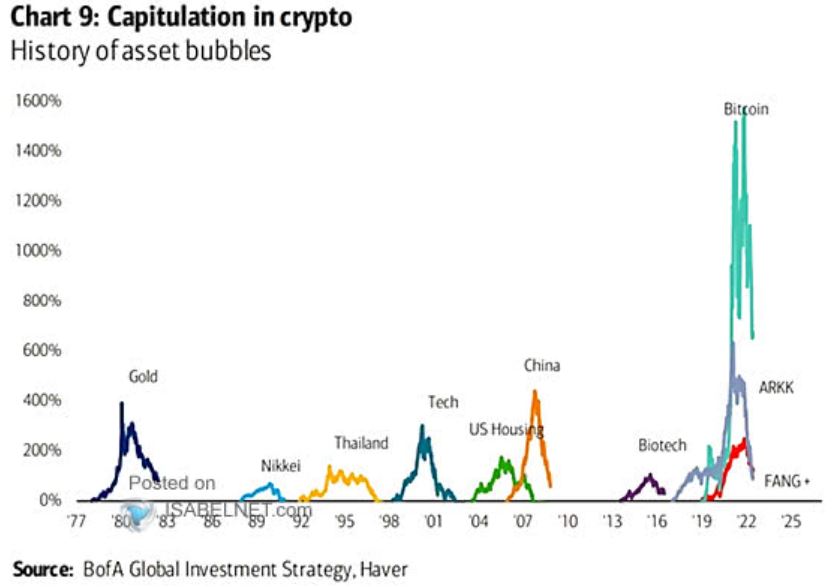

The following chart, from Bank of America via Isabelnet, helps put the various financial bubbles since 1977 into context.

The punchline is that Bitcoin is by far the ‘bubbliest’ financial bubble of the last 45+ years.

Bitcoin has been billed as many things over the past several years, much of it apocryphal.

Bitcoin has been billed as anonymous, but in reality it is an immutable public record of every transaction ever made in Bitcoin. The only anonymity is provided by a single pseudo-anonymous layer, an address that is linked to your legal identity unless you go through lots of legally dubious (and probably ineffective) hoops.

It has been billed as ‘digital gold,’ with the implication being that it is a long term store of wealth. However, its price is not correlated to inflation or to other such assets like gold and long term TIPS yields.

It has been billed as a currency for everyday use, but transaction fees vary from $1 to over $60, making it prohibitively expensive for everyday items. Because the transaction fee goes up with transaction congestion, the more that people use it, the less practical it gets. For larger items, it’s value fluctuates so much that if you buy something in Bitcoin today and return it for Bitcoin within 30 days, either you or the vendor are very likely to make or lose 40%+ of the value of the item on the refund.

It has been argued that because it is ‘scarce,’ its value is essentially infinite. Ask gold traders how that logic works in real life. There is only so much demand for non-yielding store-of-wealth assets.

In healthy markets, capital is invested in businesses that generate profits and cash flows. That’s the societal benefit of investing, unfreezing capital and putting it to work in a way that produces something that people are willing to pay for.

So what is Bitcoin? Time will tell whether it is a very volatile non-yielding store-of-wealth. For now, it appears to simply be a speculative bet on excess liquidity.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Extremely ignorant take. Learn the difference between settlement and payment. Learn about the Lightning Network where fees are much lower than every other form of digita payment (including fiat). This is just sad.

Still not getting it are we? Volitlity is not a desirable quality for a medium of exchange. No yield, profits, or cash flow is not a desirable quality for an investment

Manhattan was bought with some beads and blankets.

“In healthy markets, capital is invested in businesses that generate profits and cash flows”

That’s such old school thinking. Now it’s all about market share, profits be damned. Just ask Uber.

/sarc