Taps Coogan – July 15th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

However undistinguished the late 1970s and early 1980s may have been in terms of general US history, it was a major turning point in US economic history.

The following charts illustrate why:

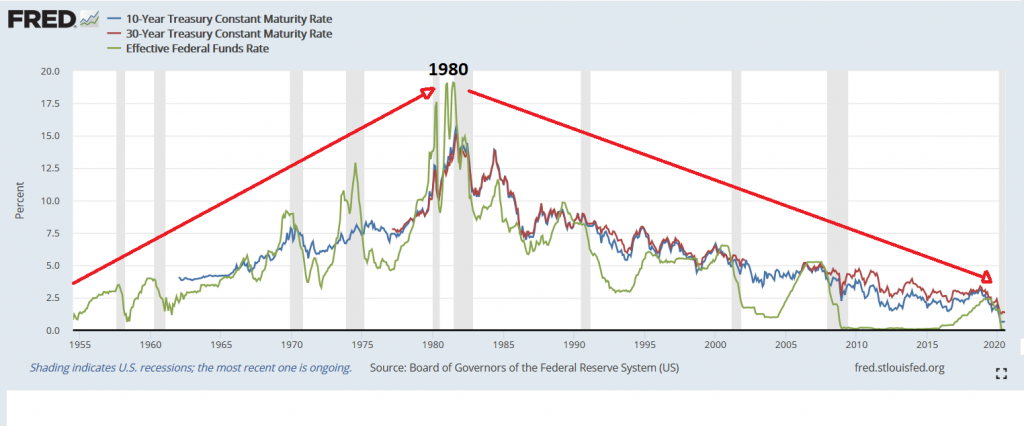

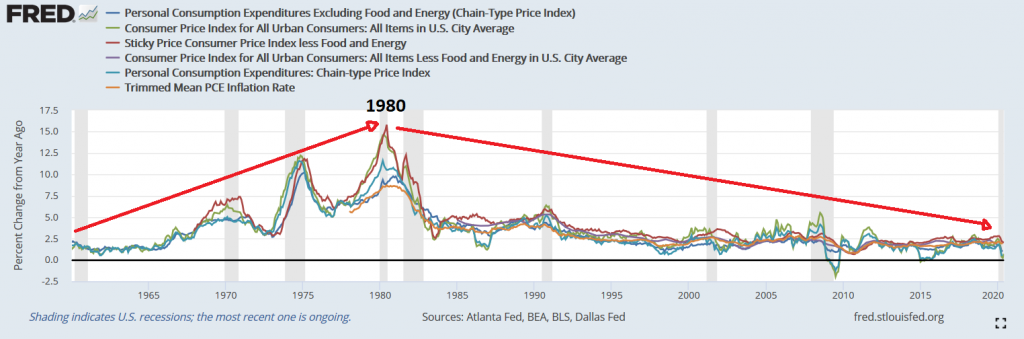

After rising for decades, interest rates and inflation peaked in 1981 when the overnight Fed Funds rate reached nearly 20%. Both benchmark interest rates and official inflation measures have been trending lower ever since and are now precariously close to 0%, as the following charts show.

Benchmark Short and Long Term Interest Rates

Various Measures of Inflation

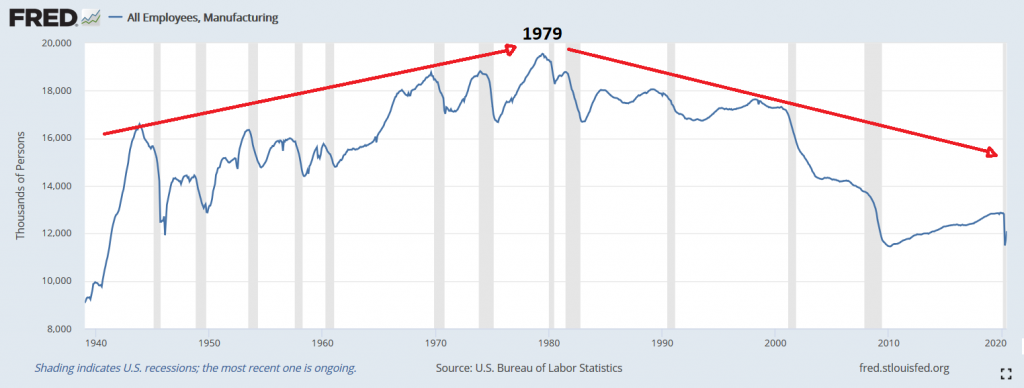

The number of manufacturing jobs in the US peaked in 1979 and has been trending lower ever since. In April 2020, less than 11.5 million Americans were working in manufacturing jobs, less than the number prior to Pearl Harbor when the US population was just 40% of the size today.

Total Manufacturing Jobs in the US

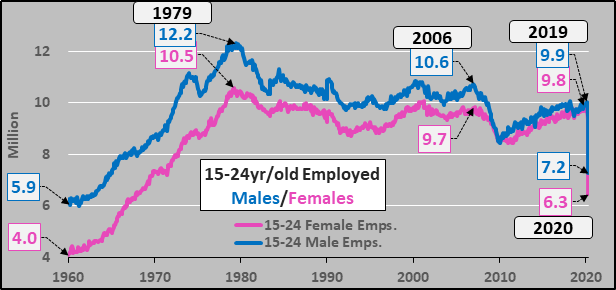

The number of young working Americans (15 to 24 years old) peaked in 1979, as the following chart from Econimica details, and has been trending lower ever since.

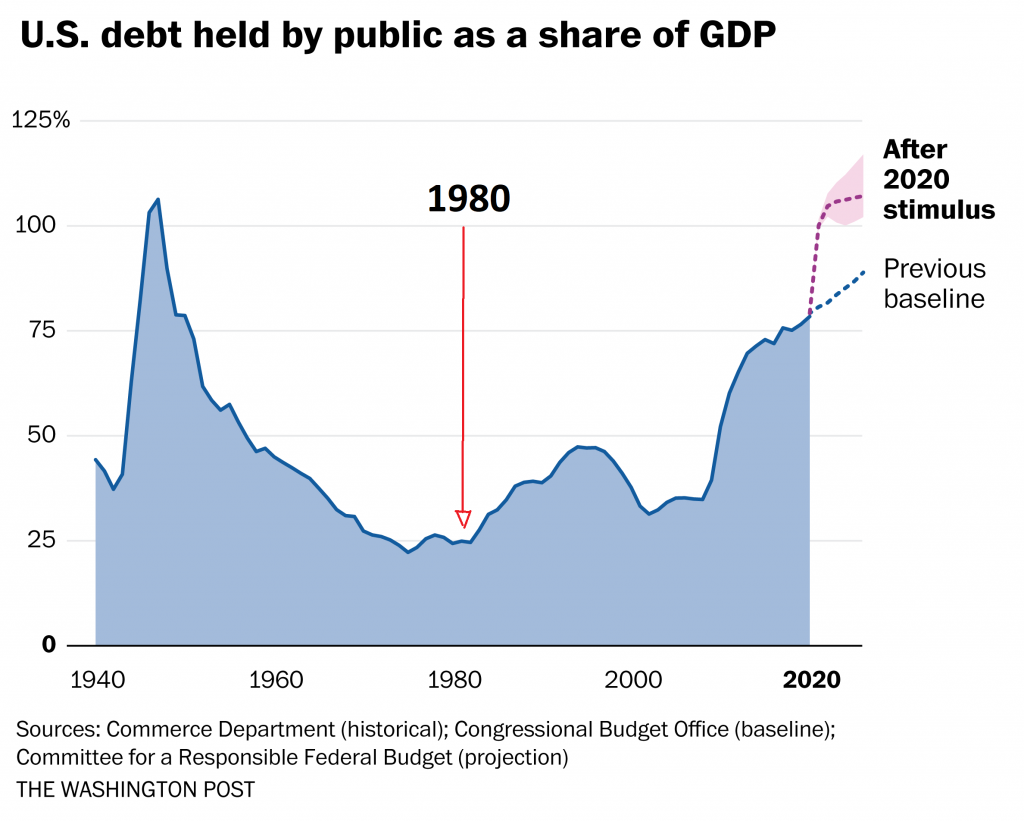

The US national debt-to-GDP ratio also hit its post-war low in 1980 and has been trending higher ever since.

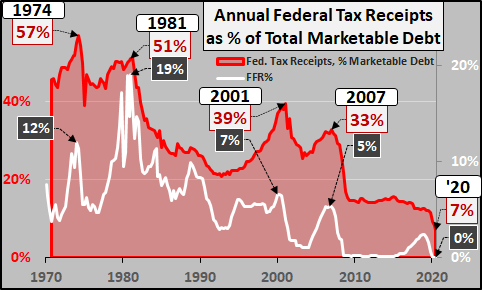

As the following chart from Econimica shows, the ratio between federal tax revenues and the national debt has been trending lower since 1981 and has now reached a nightmarishly low 7%.

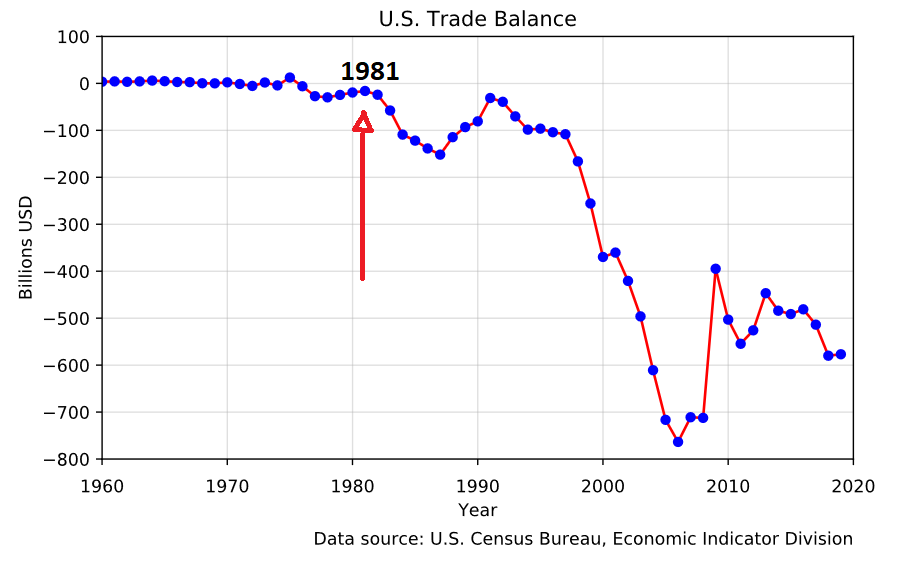

1981 was also the last year that the US came close to having balanced international trade.

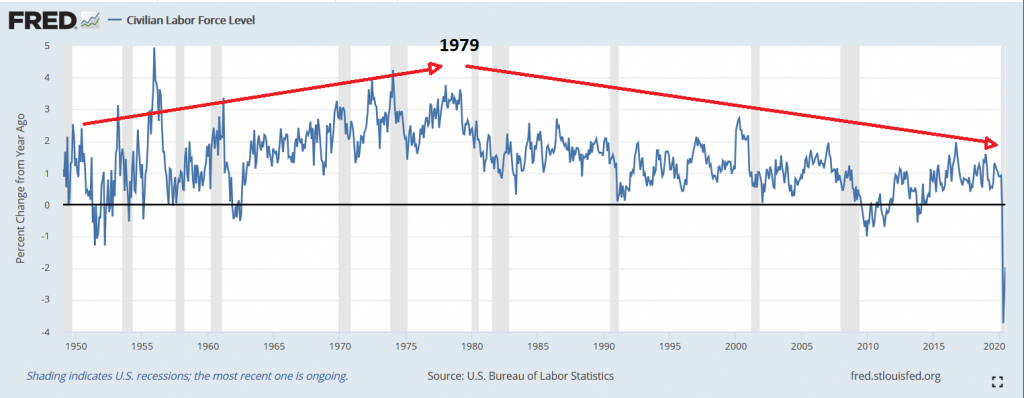

1979 represented the end of the era of accelerating growth in the US labor force, which has been slowing ever since, and is currently negative.

Year-Over-Year Growth in the US Labor Force

As the charts above attest to, numerous economic trends reached their respective highs or lows around 1980 and have been trending in the opposite direction for the last 40 years: employment, deficits, debt, demographics, trade, interest rates, etc…

Many of those trends have reached a natural terminus. Interest rates and inflation have fallen to near-zero levels. Manufacturing employment has fallen so low as to be essentially negligible (~3.5% of the population). Growth in the labor force has fallen below zero and growth in the number of working age Americans is now roughly flat. The budget deficit has become so large that it cannot be supported without zero interest rates and massive money printing. The trade deficit has become so large that it is now a bona-fide political crisis and perhaps the single greatest determinant of US foreign policy.

Whatever was set in motion in 1980 appears to be reaching some sort of crescendo, perhaps not this very day, but certainly in the coming years.

As a highly generalized statement, the period since 1980 has led to increasing financialization and indebtedness, increasing globalization, slowing population growth, and falling interest rates. It’s been a massive boon for investors and asset owners and, generally speaking, a tough slog for savers, blue collar workers, manufacturing, and the “real economy.”

Perhaps what comes next is the opposite. Perhaps it’s something different all together. Either way, the relevant historical analogues are probably much farther back in history than the last 40 years. Unfortunately, widespread economic data gathering really only accelerated in the last 40 years. That means that we are likely going to be sailing blind until the new trends become clearly established.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Thanks Reagan.

With our national debt soaring nothing is as sobering as looking at future budgets. Several years ago our government predicted that by 2019 the national debt would top 12 trillion dollars, not the 23 trillion it hit. Global debt has surged since 2008, to levels that should frighten any sane investor because debt has always had consequences. In 1981 Federal Reserve Chairman Paul Volcker is widely credited with ending the stagflation crisis where inflation peaked at 13.5%. Volcker did this by raising the fed fund rate which averaged 11.2% in 1979 to 20% in June of 1981. More about this… Read more »