Taps Coogan – August 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

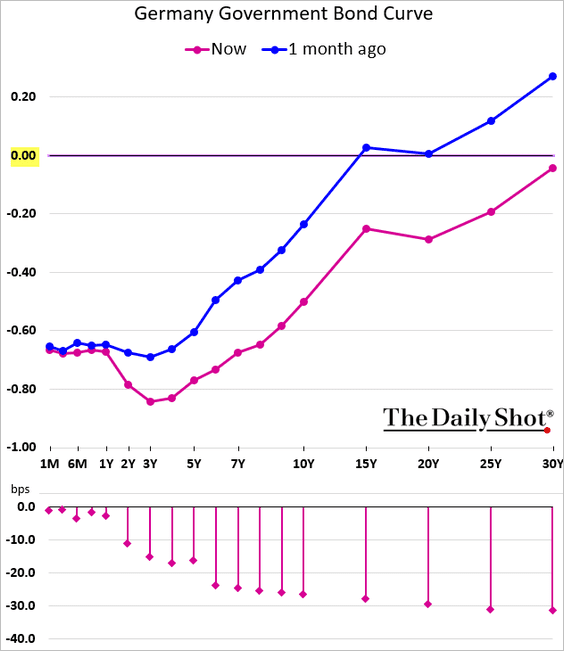

The entire German government bond curve, all the way out to 30 years, is back in negative territory, as the following chart from The Daily Shot highlights. Meanwhile, CPI inflation in Germany is running at 2.3%.

The first time the German 30-Year went negative was in mid 2019. At the time, many people believed that the only thing that could eventually stop central bankers from pushing interest rates even lower would be an persistent rise in inflation.

Apparently not. Inflation in Germany has risen to its highest levels in a decade and the entire yield curve is back in negative territory.

People are straining their minds to come up with reasons why investors would be taking guaranteed nominal losses for 30 years in an environment with high and rising inflation, the practical equivalent to paying for the chance to lose more money.

In reality, these markets have been captured by central banks and no longer contain information content beyond that fact. The only people buying these bonds are central banks, institutions that are compelled to by law, and a small cohort of traders making directional bets on interest rates.

It is long past time that investors and the general public realize that central banks, which were invented in large part to monopolize the authority to expand the base money supply, have surrendered that role back to governments and become willing accomplices in the perpetual monetization of however much government debt is needed to keep interest rates low enough to keep deficit spending growing.

We’re still carrying forward the increasingly irrelevant accoutrement of the old system. We worry about levels of government debt and fret over the interest rates on government bonds which fewer and fewer non-institutional market participants actually hold.

Practically speaking however, we’ve arrived at an era where governments finance their own spending by expanding the money supply at their own discretion and launder the whole affair through passive central banks.

While the Modern Monetary Theory (MMT) missionaries are wrong about a lot of the mechanics of money creation and government finance, they are entirely correct that the only limit on deficit spending is now people’s tolerance of inflation.

When push comes to shove, the majority of people almost always prefer inflation to less ‘free’ stuff. That’s exactly why central banks were supposed to be independent and exactly why they aren’t.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

> The only people buying these bonds are central banks, institutions that

are compelled to by law, and a small cohort of traders making

directional bets on interest rates.

Umm, there is thing called HQLA where gov trash is used as collateral and leveraged (via rephypotication) to back things like various flavors interest rate swaps and derivatives…

See “Eurodollar University”

THIS IS CORRECT:

In reality, these markets have been captured by central banks and no longer contain information content beyond that fact. The only people buying these bonds are central banks, institutions that are compelled to by law, and a small cohort of traders making directional bets on interest rates.

THIS IS INCORRECT:

It is long past time that investors and the general public realize that central banks, which were invented in large part to deny governments the ability to print money, have surrendered that role and become willing accomplices in the perpetual monetization of government debt.

CORRECTED:

It is long past time that investors and the general public realize that central banks, which were invented in large part to deny governments the ability to print money, have exploited that role to capture the markets, per the previous paragraph.

Central banks are doing exactly what they were intended to do — exactly what they have always done — ending naturally free markets by using the currency units (their opaquely produced and privately owned property) to outbid all other market participants, who can obtain the same only via the sacrifice of private labor or private property. Central banks are by far the most effective tool of destruction on earth; responsible for the deaths of countless millions of people and responsible for the unnatural, tyrannically imposed impaired condition of billions of people. Wherever central banks are allowed to continue to exist,… Read more »

Apparently you’re investing in Bitcoin. But I doubt that would resolve the issue of regulatory overwatch either. Are there any other alternatives to discuss?

Yeah my wording wasn’t as intended. I changed it a bit