Submitted by Taps Coogan on the 27th of September 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Although most measures of growth and inflation show that the US economy is still performing at or above average for the current expansion, the Fed’s outlook for the future has become increasingly negative. In an attempt to preempt a slowdown or recession that they believe is looming in the future, the Fed has now cut interest rates twice and has started to talk about expanding its balance sheet again. It might seem innocuous for the Fed to be providing stimulus in today’s environment, but it is anything but innocuous. They are transforming the Fed from a counter-cyclical institution, intended to moderate the intensity of the economic cycle, into a pro-cyclical institution that exaggerates the cycle.

Stop Forecasting

Over the decades, the expectation that the Fed would provide stimulus during recessions has transformed into the expectation that the Fed would prevent recessions. The Fed has fostered these expectations by transforming from an institution concerned with measuring and reacting to the economy in the present, into one obsessed with building models that forecast the future and then acting on those models.

This transformation was brought into clear focus by the Global Financial Crisis. Not only did the Global Financial Crisis reveal that the Fed’s forecasts had been wildly wrong, the public learned that the Fed’s policy had greatly contributed to the Financial Crisis. This was in no small part because the Fed was setting policy based on forecasts that were far too pessimistic in the early 2000s and then far too optimistic in the mid 2000s. As a result, their policy was far too accomodative and then far too tight for the economy of the day, creating asset bubbles and then popping them. The Fed was famously “not predicting a recession” in January 2008 when, in hindsight, the US was already in the largest housing bust in modern American history. It is a stark demonstration of the perils of trying to predict the future instead of looking around at the present.

Doubling Down on a Bad Idea

Instead of learning the lesson that setting policy based on predictions of the future was a mistake, the Fed apparently learned the lesson that it needs to try even harder to predict the future more accurately.

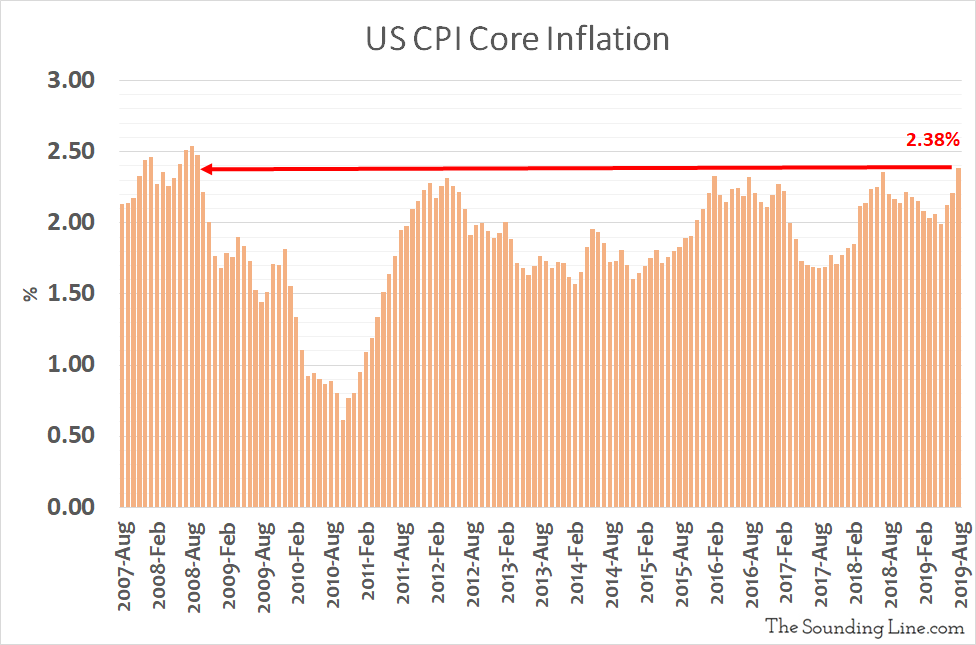

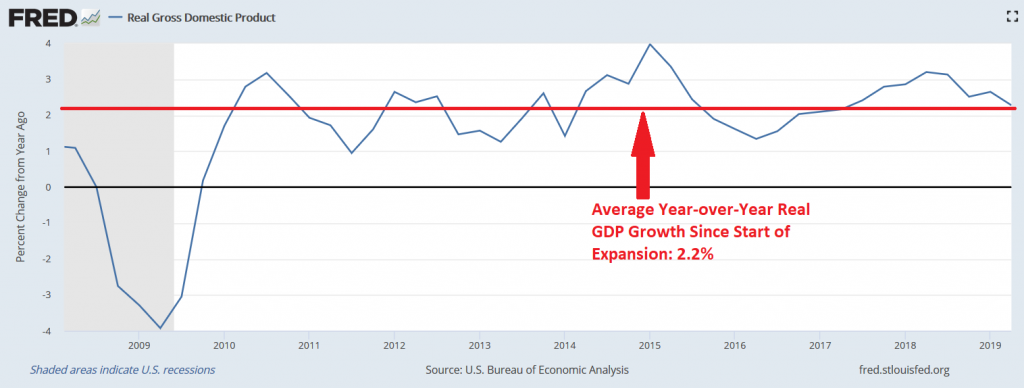

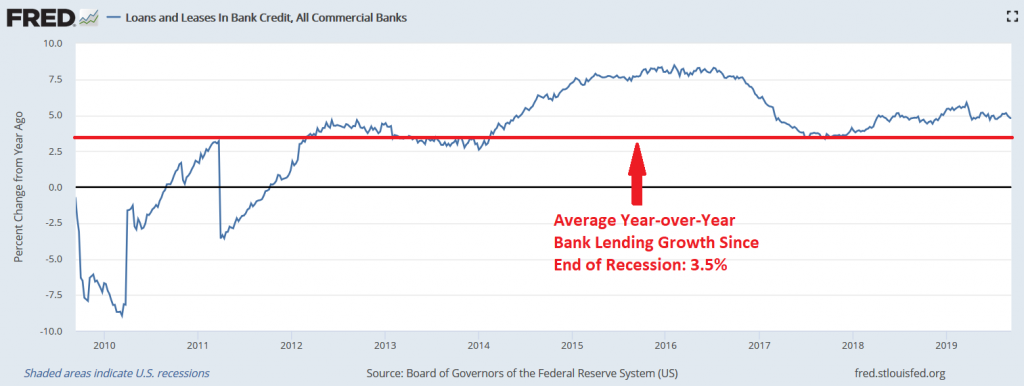

Today, the Fed is cutting interest rates and talking about regrowing its balance sheet. Why? Because they predict that growth is going to continue to slow in the future. Whether that forecast proves correct or not, CPI inflation is presently at the highest rate in 11 years and rising, money supply growth is at its fastest pace in three years and rising, bank lending is growing above average for this expansion, and GDP growth is above average for this expansion.

Broad Money Growth – Year-over-Year

Real GDP Growth – Year-over-Year

Bank Lending Growth – Year-over-year

Whether the Fed is correct that the economy will slow in the future is irrelevant. Providing stimulus while the economy is functioning at healthy levels will, at best, extend the current expansion. But doing so will put the Fed in a position where they have already deployed much of their limited stimulus before the next recession arrives. The next recession will, of course, eventually arrive. At worst, they will over stimulate the economy today and lead to excesses that exacerbate the next recession. Either way, preemptive stimulus is a recipe for intentionally extending and exaggerating expansions at the expense of having fewer tools during actual recessions that, while less frequent, must navigate more exaggerated systemic risks. That is the literal definition of a pro-cyclical force on the economy and the exact opposite of what the Fed was envisioned to do.

Predicting recessions is not the Fed’s job, nor are they very good at it. Delaying recessions is also not the Fed’s job, nor is it a wise objective. Moderating recessions and inflation, when they naturally occur, is the Fed’s job. The sooner they, and the American public, are reminded of that fact, the sooner we will get back to healthy expansions and survivable recessions.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.