Submitted by Taps Coogan on the 28th of January 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

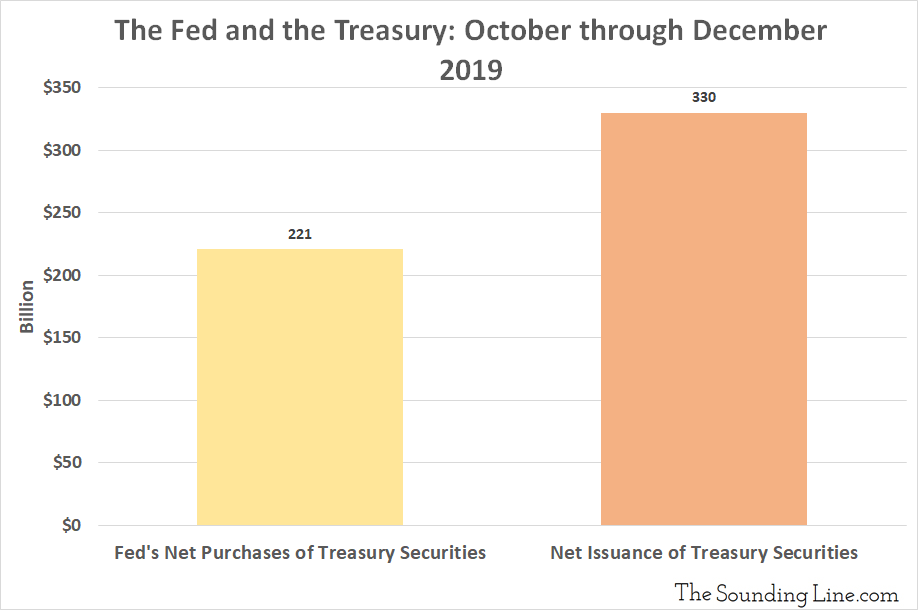

As the debate continues about whether the Fed’s ‘Not-QE’ program is Quantitative Easing or not, the Fed has been busy buying up 70% of all net treasury debt issued since the start of October 2019, shortly after their ‘Not-QE’ program started.

According to the Securities Industry and Financial Markets Association, the net increase in outstanding US treasury securities from October through December 2019 was $330 billion. During the same period, the Federal Reserve’s holdings of US treasury securities increased by $221 billion. In other words, the Federal Reserve has purchased roughly 70% of all net treasury debt to hit the market since starting it’s $60 billion-a-month large scale asset buying program that it refuses to call QE. Keep in mind that these figures do not include the roughly $256 billion net increase in the Fed’s repo holdings during the same period.

$210 billion of the Fed’s treasury purchases have been treasury bills (treasuries with a duration of a year or less), 5.5 times the net treasury bill issuance during the period, and nearly 9% of all outstanding treasury bills.

As we have previously noted, the Fed’s $60 billion-a-month ‘Not-QE’ program is equivalent to monetizing 70% of the anticipated monthly federal budget deficit for 2020. So, as economists debate whether or not the program constitutes QE, perhaps the more pertinent question is whether or not it is defacto Modern Monetary Theory (MMT). Seemingly, the only difference between the current program and MMT would be the technicality of the Fed purchasing its treasuries in the secondary market as opposed to directly from the Treasury. It’s a technicality that is becoming increasingly irrelevant. Many of the treasury bills that the Fed has been buying were issued by the Treasury just days prior to the Fed’s purchases.

Before the Financial Crisis, when the Fed’s balance sheet stayed around 6% of GDP, gradually growing its balance sheet in line with GDP growth had little effect on markets. Today, with the Fed’s balance sheet at nearly 20% of GDP and rising, these so-called technical adjustments to their balance sheet have become the most important factor to financial markets, as the last several months of unrelenting financial asset price inflation can attest to. While markets are currently panicking about the Coronavirus outbreak, and reasonably so, the true determinant of the market’s longer term directionality is likely to be what the Fed chooses to do with its balance sheet. As the last decade has shown, financial markets can ignore pretty much anything when they are being flooded with hundreds of billions of dollars in freshly printed money.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

So, when does this Ponzi Scam blowup? Or, can it go on forever?

It can go on until there is too much inflation and the Fed either feels compelled to raise rates to stop it, or it chooses not to raise rates and they rise anyways. Who knows when that will happen, but it probably requires the economy to get stronger first, not weaker, IMO. Until then, they can and will print away.

Since they decide the inflation rate I guess it actually can go on forever.