Taps Coogan – March 3rd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Here are two charts which, when taken together, show that the Fed’s win-win Goldilocks Zone has disappeared.

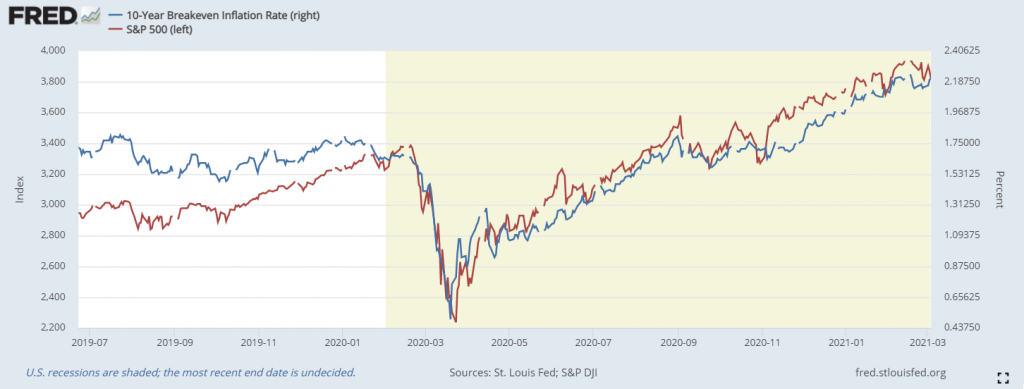

1.) The S&P 500 and 10-Year breakeven inflation rate has been strongly correlated since the Covid pandemic.

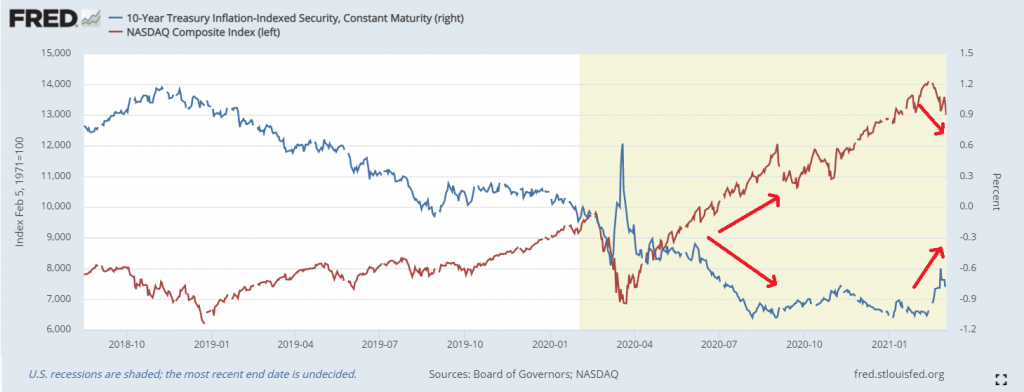

2.) The tech dominated Nasdaq, and to a slightly lesser extent the S&P, have been inversely correlated with real 10-year yields. Falling real long rates have been the backdrop (driver?) of the market recovery going all of the way back to the selloff in late 2018.

What Does It Mean?

Since the Covid pandemic, rising equity valuations have mirrored rising inflation expectations. Perhaps inflation is driving stocks. More likely, they are both measuring the fusion of growing monetary/fiscal stimulus and reopening hopes.

Meanwhile, equity prices have been feeding off of increasingly negative real rates since 2018. Think TINA – There Is No Alternative to overpriced stocks.

For a while post-Covid, rising inflation expectations were not pulling real 10-year yields higher. The Fed’s goldilocks zone was intact. Rising inflation expectations were not coming at the expense of either equity or bond prices.

Now inflation expectations are pulling real and nominal yields higher. If that continues and the correlations above hold, it should be bad for both stock and bond prices.

Why are rising inflation expectations finally pulling real yields higher? First there is the question of who actually wants to buy Treasuries with a deeply negative real yield when the economic outlook points to improvement.

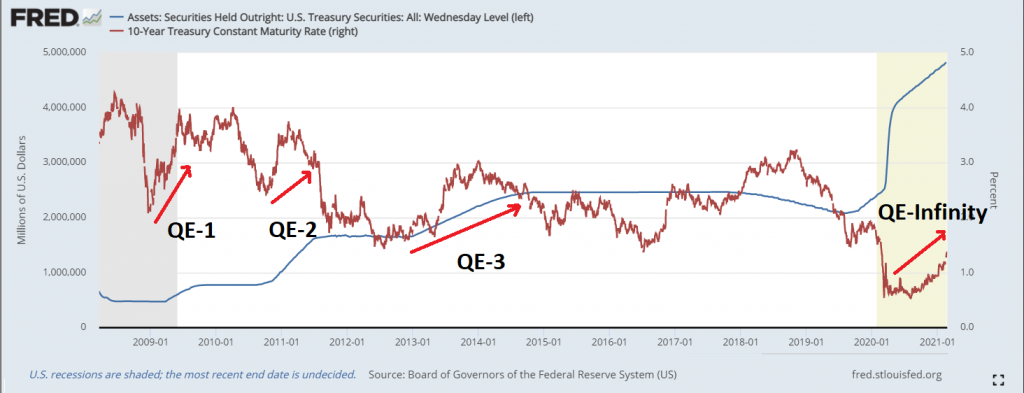

Perhaps it is the realization that the Fed is not monetizing enough at the long end of the Treasury curve to keep up with the expanding treasury issuance, but that if they did monetize more, nominal yields would probably just rise faster. Ironically, nominal yields rise when the Fed is expanding its Treasury holdings.

The Fed has a few tools to keep the game running a bit longer. They should probably do an Operation Twist. They can extend the suspension of the SLR requirement for banks. That may snap the short term rally in nominal yields.

However, these are relatively small tools in the face of multi-trillion dollar spending bills that just never stop coming. Congress is already working on the next $2 trillion bill and they haven’t even finished the current $1.9 trillion bill, which followed a $900 billion just three months ago. A madness as swept the land.

It’s hard to imagine anything but yield curve control (an actual peg for the 10-year) pushing real rates more negative if an economic recovery is really going to happen. Yield curve control might be good for equities, but do bond holders really want to get pegged at a negative real rate for years with little prospect for price appreciation? Can the Fed really accelerate its treasury purchases enough to enforce that peg in a reflationary environment? If they have to buy the whole market like the Bank of Japan, will treasuries still matter as a benchmark? What will happen to the Social Security Trust Fund?

The days of the Fed’s endless ‘win-win’ manipulations in financial markets are over.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Great FRED chart!