January 1st, 2017 marked the start of a deal between OPEC and several non-OPEC oil producers (most notably Russia) to cut oil production by 1.8 million barrels a day of for the first six months of 2017. OPEC compliance with the deal is reported to be very high though non-OPEC compliance is estimated to be around 60% (healthy skepticism is advised on both figures).

Enjoy The Sounding Line? Click here to subscribe for free.

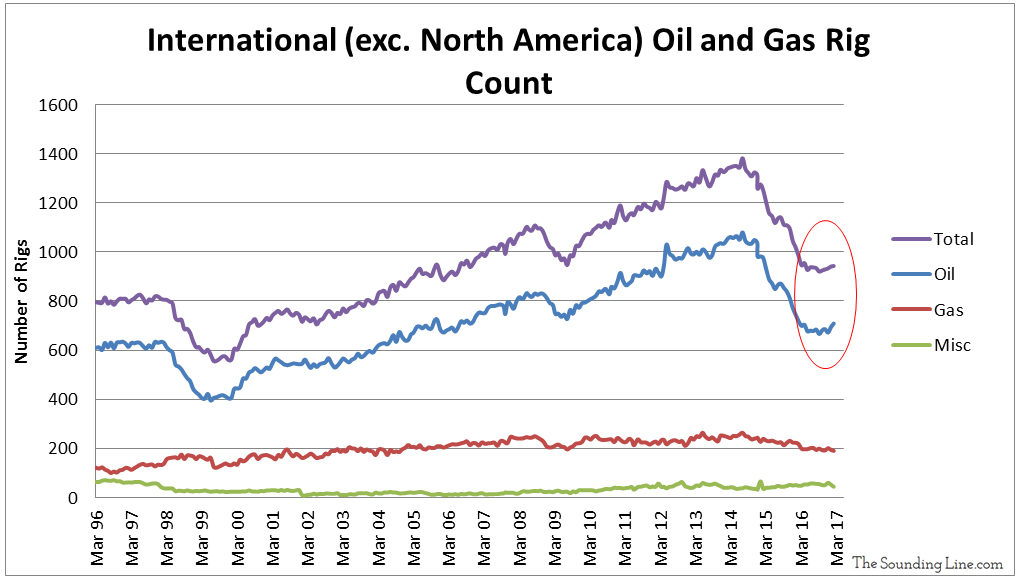

However, despite the supposed production cut deal, the number of active oil rigs intentionally has seen its largest increase since oil prices collapsed in 2014. As the following chart shows, the increase isn’t just limited to US producers. Since the start of the year, rig counts have increased in Europe (+10 rigs), the Middle East (+11), Africa (+1), Latin America (+16), and Asia Pacific (+1).

Not only would a failure of the OPEC deal jeopardize the finances of oil producers around the world, it would also bring into question the raison d’etre of OPEC itself. Long gone are the days when OPEC represented the majority of global oil production. A cartel (OPEC is a cartel) that doesn’t control the majority of production simply doesn’t work well. OPEC giving up more market share just to see its competitors make up the difference doesn’t support prices. Even if it did, OPEC’s competitors would benefit more than OPEC. That is not a compelling reason for OPEC to continue to cut.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.