Taps Coogan – October 15th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The oft-stated reason for Germany’s decision to double down on Russian natural gas via NordStream1 and 2, while refusing to build LNG import terminals, was to gain access to ‘cheap’ Russian pipeline gas.

While there is no doubt that Russian gas could be delivered more affordably to the EU than LNG because of the advantages of pipelines, Russian pipeline gas rarely was much cheaper than LNG.

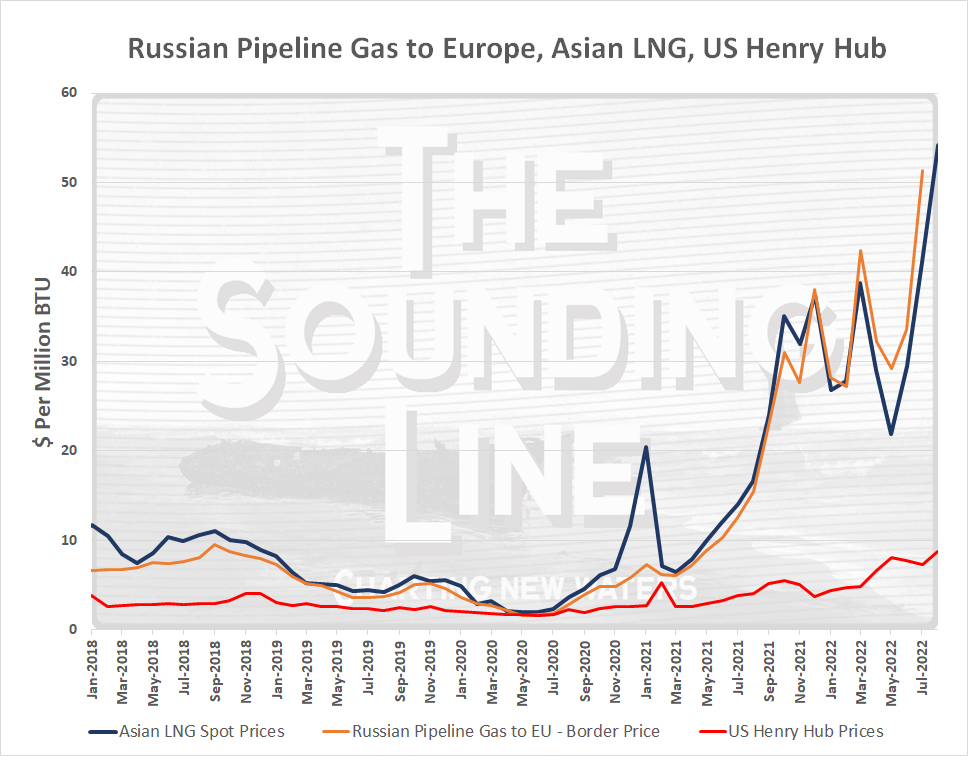

As the following chart highlights, Russia has been charging essentially LNG prices for its pipeline gas to the EU for years.

Since 2017, the average price paid by the EU for Russian gas has been $10.37 per mBTU. The average price of LNG delivered to Asia was just slightly higher at $11.98 per mBTU and includes greater shipping distances than incurred on US LNG going to Europe. The average cost of US natural gas during the same period was just $3.36 per mBTU.

The cost of US LNG in Europe prior to the current energy war had long been reported as the Henry Hub price plus 15% and then around $3.50 per mBTU for shipping. Using that formula, US LNG delivered to the EU likely cost an average of $7.36 per mBTU from 2017 to 2020, slightly less than the Russian pipeline gas price of $7.49.

That’s why there was a healthy but small trade in US LNG exports to the EU for years prior to the current energy crisis. However, the EU lacked sufficient LNG import capacity and interconnector pipelines to meaningfully create price competition in EU gas markets.

Ironically, more LNG infrastructure and interconnectors in the EU and at exporters, not another pipeline to Russia, would have been the best way for the EU cap Russian prices back then as less than US prices plus shipping and avoid Russia having the leverage to cut off supplies and boost prices now. What was missing was always price competition, not pipelines. Germany did the exact opposite. Now they have neither sufficient Russian gas nor LNG.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Price of energy fungible depending on overall world supply and demand plus landed cost and therefore reatively close in price., but known reserves also a consideration of reliable supply in long term.

Natural gas known reserves:

Russia –24%

Iran -18 %

Iraq -17 %

U.S.- 5 %

1. Unconventional gas deposits like shale aren’t counted in reserve calculations. They’re useless.

2. LNG terminals let you import from anyone with an export terminal: the US, Qatar, Australia, Egypt, even Russia. So you get access to ‘all’ reserves. Not just one country’s reserves.

“In a spirit of great friendship, we will say to our American and Norwegian friends: ‘You’re super, you supply us with energy and gas, but one thing that can’t go on for too long is us paying four times more than the price you sell to your industry,'”

— Macron

You make a fair point but you missed a bit – obviously this works in reverse and Russian pipelines compete with US exports – but not anymore! I guess US gas is so good you blew away the competition 😉

Russia chooses not to sell in order to boost gas prices. Russia started to reduce gas supplies to Europe a year before the Ukraine invasion. Why were Gazprom storage sites in Germany empty in 2021? Nordstream 1 wasn’t operating when it blew up. Why? Why doesn’t gas flow through the Yamal pipeline? EU sanctions don’t apply to oil and gas. Germany, Italy, Czechia, etc… agreed to pay in Rubles. Europe is not owed cheap energy from anybody. They have to create the conditions to get cheap energy. That means creating diverse and competitive supply options. Blocking LNG terminals was unwise.… Read more »