Taps Coogan – October 7th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

As you have likely heard, the G7 nations seem poised to implement a price cap scheme on Russian oil.

This article from Foreign Policy offers a detailed description of how the price cap would work.

The CliffsNotes version is this: The G7 countries will establish a maximum price that can be paid for Russian oil (presumed to be around $60 a barrel). Any company, ship, etc… that trades Russian oil and can’t prove that they paid less than the cap will be denied insurance, financing, etc… or otherwise fined/sanctioned.

The plan emphasizes that the G7 countries control 90%+ of the ship insurance market and insurance is a practical necessity for shippers and ports. The plan then argues that multinational companies in energy, shipping, insurance, etc… will not risk sanctions and thus will comply with the price cap. That’s probably true.

Obviously, ship insurance isn’t a technological marvel only available from the West. However, while this plan may end the G7’s dominance in ship insurance, where you buy your insurance won’t remove the threat of sanctions for breaking the rule. The existence of sanctions-indifferent insurance providers means there will likely be some ships available to move some Russian crude. However, it doesn’t mean that the price cap won’t work. Even countries that might evade the sanctions (China, India, Turkey, North Korea, etc…) would still use the threat of sanctions as a reason to demand big price discounts from Russia.

The plan’s proponents then assert that Russia would rather sell all the oil it wants at $60 (or whatever the price cap is) than very little oil at a similar discount.

Based on all that, if you avoid thinking about any second order effects, the Russian oil price cap would work. Russia should keep pumping, most companies controlling most ships should follow the rules, and those that don’t should demand a big discount anyways.

But about those second-order effects…

Let’s imagine that the plan works and Russia chooses to keep selling oil. What would that mean?

It would mean that people could legally buy all the oil that Russia could sell at a guaranteed discount to the market price.

How do you think Saudi Arabia and the rest of OPEC will feel about having to compete with unrestricted volumes of legal Russian oil that sells at a guaranteed discount to market prices?

It will apparently surprise some policy makers in Washington to learn that oil producers compete for market share just like players in every other industry. Russia fought an oil price war with Saudi Arabia as recently as 2020 to try and gain market share.

Not only will the price-cap plan incentivize sanctions evaders to ask for discounts on Russians oil, it will incentivize everyone to ask for discounts on all oil.

A $60 Russian oil price cap (or whatever the price cap is) would pull the whole market pricing towards that price as Saudi Arabia’s customers started demanding discounts to not switch to Russian crude.

Guess why OPEC was created? To avoid exactly such a market share fight among producers.

The Russian oil price cap deal is a direct and existential threat to OPEC and, as such, turns OPEC into an ally of Russia. It becomes imperative for all of OPEC, not just Russia, that the price cap scheme fails.

So what is the natural response of OPEC going to be to an attempt to kick off a price war via the threat of sanctions on an oil exporter? Obviously the response is to do exactly what OPEC announced Wednesday: dramatically reduce oil production and support prices.

Not only are the cuts intended to send a message, they ensure that if Russian oil is going to be discounted to market prices, market prices will increase by at least at much as the discount.

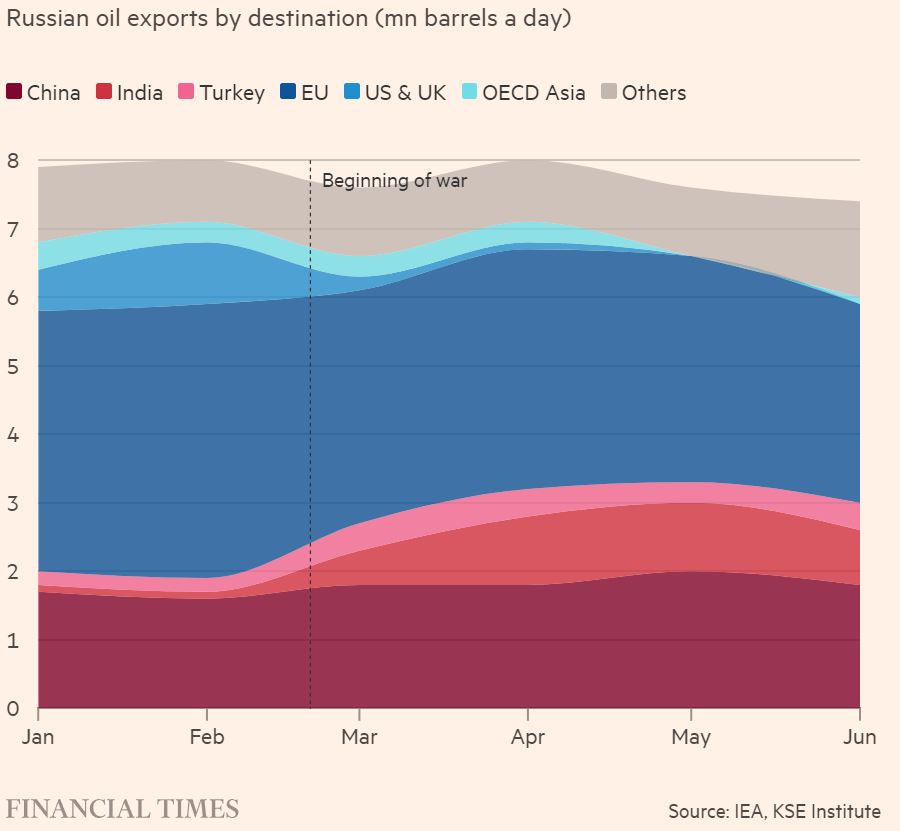

Furthermore, let’s check our assumptions about Russia choosing to sell under the price cap scheme. About a third of Russia’s crude exports now goes to China, India, and Turkey, countries that may not comply with the sanctions regime.

Would Russia rather sell eight million barrels a day at $60 and establish a very dangerous precedent that benefits their enemies or would Russia rather sell two or three million barrels a day at a $60 discount to the $350 oil we’d have if Russia cut exports by six million barrels a day in an already tight environment? For a guess on Russia’s thinking, note that Russia is throttling gas supplies to the EU by 80% at this very moment.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.