Taps Coogan – July 20th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

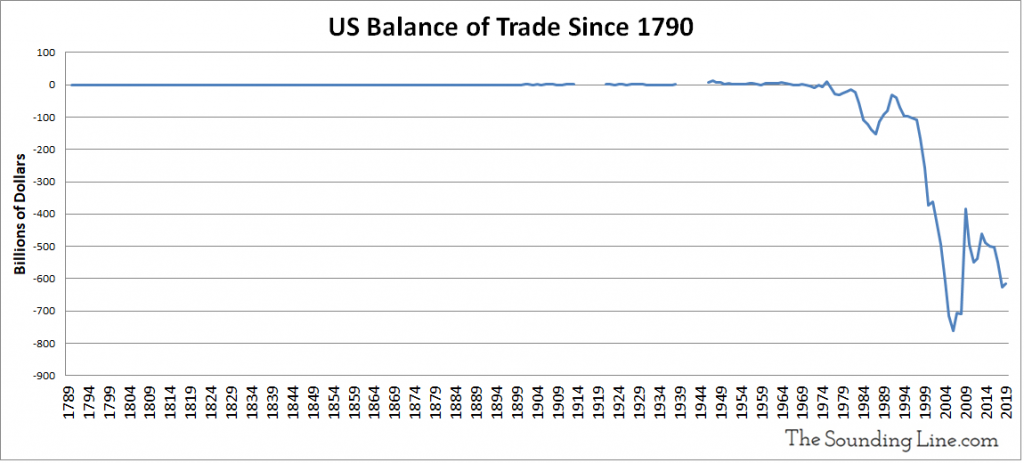

Piecing together data from a variety of sources, the following chart shows the US balance of trade since 1790, shortly after the country’s founding.

The US maintained very closely balanced trade for the first 200 years of the country’s history. From 1790 through 1975, the last year in which the US ran a trade surplus, the US exported a cumulative $86 billion more than it imported. In the 45 years since 1975, the US has run a cumulative $12.8 trillion trade deficit. In other words, in the last 45 years, the US trade deficit was roughly 150 times larger than the trade surplus it amassed during all previous American history.

What Happens to the Dollars We Send Abroad?

What do foreign countries do with all the US dollars they accumulate by selling products in the US? Why do they keep accepting dollars if they have no desire to buy an equivalent amount of American products or services with those dollars? Why hasn’t the dollar lost more value relative to other currencies?

The answer to those questions is that our trading partners take the dollars they gain through net exporting to the US and buy US dollar denominated financial assets. As we mentioned above, the US has run a cumulative $12.8 trillion of trade deficits since 1975. As it would happen, the US currently has a net international investment position of negative $12 trillion. In other words, foreigners own $12 trillion more of financial assets in the US than Americans own abroad, nearly the same value as our accumulated trade deficit.

The mystery of America’s massive trade deficit and relatively strong dollar is that our largest export is simply not counted in goods and service trade deficit data. America’s largest exports are stocks and bonds.

A Global Pump

The US trade deficit can be viewed as a massive economic pump. It sucks capital and jobs out of industrial America and sends them abroad to places like China, Mexico, Canada, Japan, and Germany. Those countries turn around and pump dollars back into the US via financial markets, funding massive federal budget deficits, keeping the US dollar stronger than it otherwise should be, keeping interest rates and borrowing costs low, propping up US equity markets, and keeping cheap imported consumer goods nice and cheap.

This phenomenon, which was birthed in the late 1970s and early 1980s, has been the engine behind the wealth divide, the divergence between US financial assets and their underlying economic fundamentals, the rapid increase in indebtedness without a corresponding rise in borrowing costs, and much more.

What Happened in the Late 1970s and 1980s?

One of the prerequisites for the aforementioned ‘pump’ mechanism is an ever increasing supply of American financial assets.

The first step in creating an unlimited supply of financial assets was achieved when Nixon killed the final linkage between the US dollar and gold in 1971. That ended the (weak) constraint that the linkage placed on the relationship between tangible and financial assets in the economy.

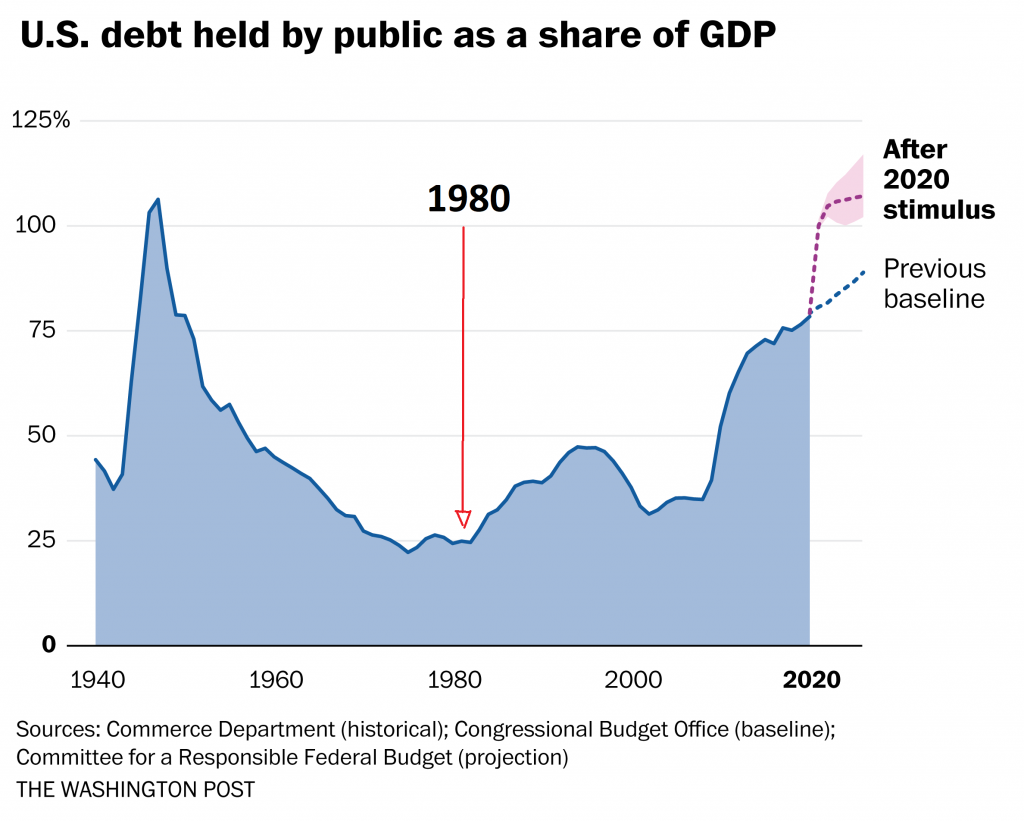

1980 marked the low point in the post-war US national debt-to-GDP ratio, after-which a surge in Cold War defense spending blew out the federal budget. This combined with the high borrowing costs of the time to rapidly grow the national debt.

In 1987, Alan Greenspan created the ‘Fed Put,’ the implicit promise that the Federal Reserve would do whatever it takes to bailout out financial markets during recessions and selloffs. It remains alive and well today.

Then there was the repeal of Glass–Steagall, the rise of credit cards, student and medical debt, costly wars in the Middle-East, housing bubbles, Covid lockdowns…, all of which have perpetuated ever increasing debt levels.

How Does It End?

This 40-year trend of increasing financialization and de-industrialization will end whenever the US starts to balance either of its deficits: the trade deficit or the budget deficit.

Unfortunately, for reasons that we have detailed over the years, the US cannot balance its budget deficit. It is simply not feasible. It is not feasible with 100% marginal taxes on the top 1% of income, nor by eliminating 100% of discretionary spending (including 100% of defense spending). That was the case before Covid-19 and before the deficit jumped by a factor of 12. The only way to get close to a balanced budget is an economy-destroying combination of extremely high taxes, massive spending cuts, and entitlement reform. We can also try and outgrow the deficit, but that will require even bigger deficits, even faster money printing, more stimulus, and more tax cuts. In other words, a game of inflation-roulette.

To make matters worse, despite all of the commotion over the past three and a half years on the subject, the trade deficit has actually grown from $502 billion in 2016 to $616 billion in 2019. At this pace, the trade war is going to take a long time.

Perhaps, somewhat paradoxically, it will be the realization that the trade war is permanent that will prove the catalyst for change. If tariffs keep going up, at some point supply chains really will move. Depending on the political winds, that realization may take hold this winter.Perhaps it will take longer. Whenever it sinks in, a whole lot of the trends of the last 40 years aught to start going in reverse.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

This article depicts what Richard Duncan has been explaining for years.

See here, for example:

https://vimeo.com/user20236372/review/142051023/ec1edd7328

Nice job!

So the only way to maintain a US Dollar reserve currency status and maintain lazy US consumer greedy appetites is for Fed to habitually print more fiat Dollars in order to maintain Global Trade by which we are deliberately causing more US trade deficits so export countries are able to buy our assets, stocks and bonds . Sounds like a prostitutes dream come true machine until the prostitute get religion or gets too old and loses her worldly good looks. The latter process seems to be underway.