Taps Coogan – May 12th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Exactly why the Fed and other central banks have become so obsessed with inflation targeting is the subject of much debate as none have shown why exactly 2% PCE inflation at all times, in all developed economies would be optimal for growth, employment, or anything quantitative.

Personally, I subscribe to the explanation that central banks themselves tend to offer up. They believe that having inflation in the ballpark of 2% gives them the space to provide negative real rates without having negative nominal interest rates and outright wage deflation during recessions. That is not to say that ‘exactly-2%-at-all-times-for-all-conditions’ is optimal for the economy. It simply makes monetary policy more ‘pleasant.’ It minimizes negative signs on financial asset performance and avoids deflation, the kryptonite of big banks through whose lens the Fed views the world. Of course, to make achieving 2% inflation the objective of monetary policy because 2% inflation makes monetary policy easier creates a classically ‘post-modern’ self-referential loop void of deeper meaning.

As it were, non-central bankers understand that inflation driven by rising wages and a strong economy operating at full capacity is different than inflation produced by print-and-spend economic policies and incentivizing people not to work in an economy operating well below capacity. The former evokes thoughts of an economic boom. The latter evokes thoughts of the decline and fall of the Roman Empire. It’s not hard to spot the difference.

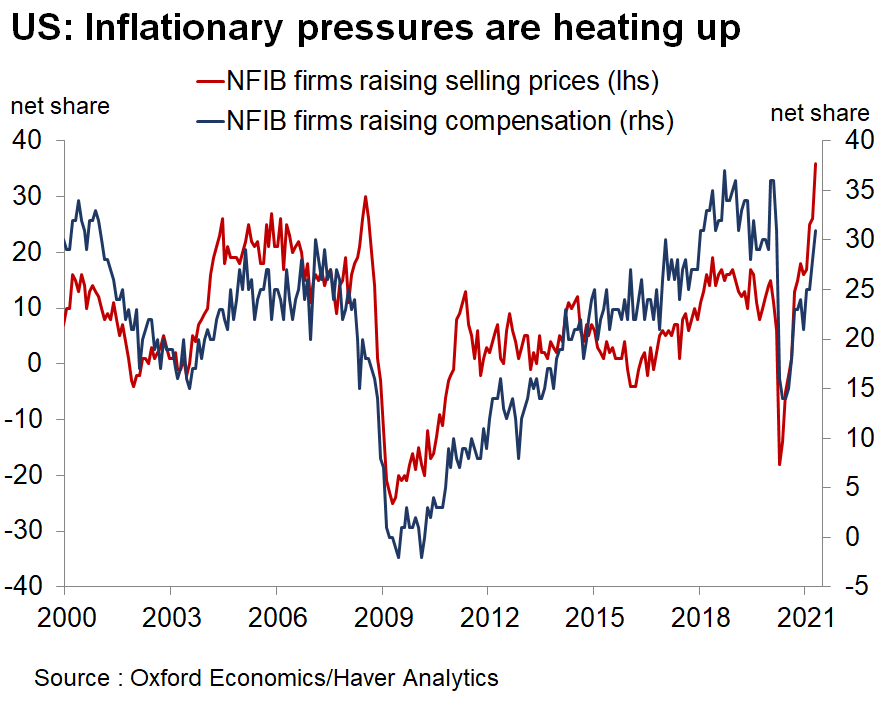

The chart below, via Oxford Economics’ Gregory Daco, sums up the difference between wage driven inflation and price inflation.

From late 2015 until Covid, the economy was able to generate the fastest inflation adjusted increase in median household income on record while simultaneously tolerating (barely at times) several interest rate hikes, a reduction in the Fed’s balance sheet, and a trade war with China. That was a period of wage-driven inflation.

Today’s inflation is the kind where companies are raising prices faster than wages. That, by definition, is going to give people that rely on their wages (as opposed to surging government transfer payments or investments) a sense that they are falling behind economically. They’ll feel that way because that’s exactly what’s happening to them.

We all now know how people react to years of inflation outpacing wages while central bankers and politicians tell them that the economy is doing great and financial markets surge endlessly, because that’s precisely what happened the last time we kept interest rates at zero for years and did QE program after QE program, swelled the deficit, told people inflation didn’t exist or didn’t matter, and masked the need for actual pro-growth economic reform.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

So, is BTC an example of supply & demand?

Not sure if get the connection, but yes of course it is

Trading nominal GDP futures would be a way for the Fed to get direct feedback on where the market thinks the economy is headed. Targetting this metric would be far better than an inflation rate target, something which is beset with measurement difficulties.

Targetting the level, probably setting a steady annual growth rate of (e.g.) 5% would be a huge improvement on the current system.

I am pretty skeptical of the Fed targeting anything though an argument can be made that targeting real GDP growth might be better than targeting inflation.

The Fed should maintain its balance sheet at a low but more or less constant percent of GDP and progressively expand the overnight target range until it is irrelevant. The only stimulus that matters in the long run is good economic policy (taxes, regulation, trade, etc… not monetary stimulus)

You make it clear, we need some serious reforms.