Taps Coogan – October 10th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

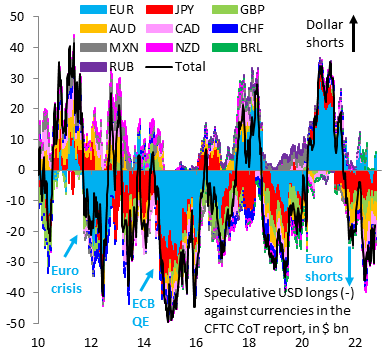

The following chart, from the always interesting Robin Brooks, shows the net short positioning of various currencies versus the US dollar as of October 4th. Colors below the horizontal axis represent net short positions in the respective currency versus the dollar.

The punchline is that the only major currency pairing where traders are short the US Dollar is versus the Euro.

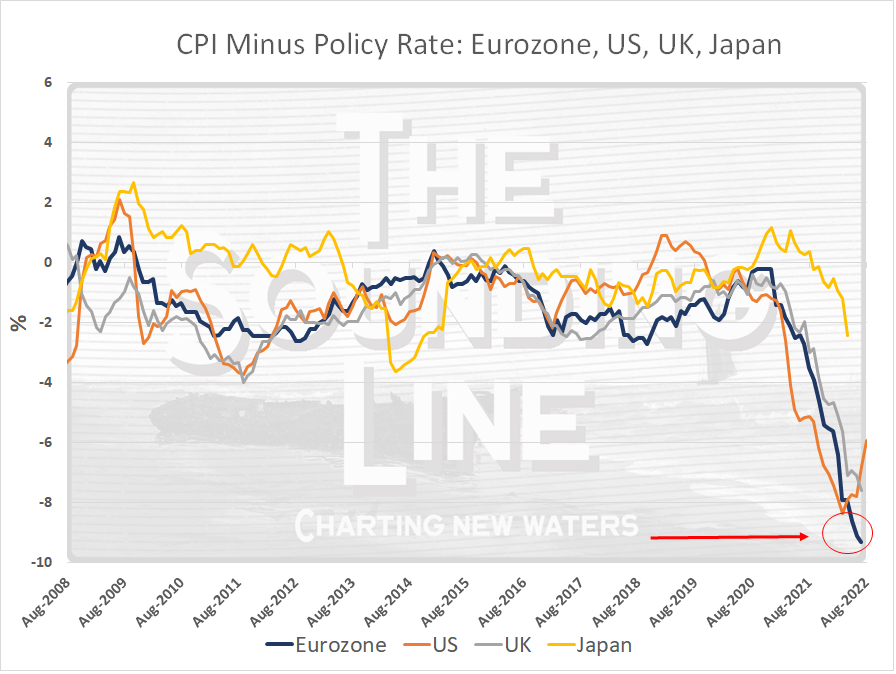

If there is a reason for the optimism on the Euro, we certainly are not aware of it. Of the ‘Big Four’ developed market central banks, the ECB is the farthest behind inflation.

Not only is the ECB falling behind inflation, Germany is planning to borrow nearly $200 billion this winter (over 4% of GDP) to try to cap energy bills.

The relative absence of German Bunds issuance and perpetual ECB quantitative easing have been the ‘saving grace’ that prevented successive Eurozone sovereign debt crisis over the past decade from going critical. Needless to say, those trends are now in reverse.

Germany’s increased pace of debt issuance come as yields on the weaker Eurozone members like Italian and Greek debt approach 5% (on the 10-year).

Then there is the very distinct possibility that the G7’s ‘Russian oil price cap’ scheme results in Russia doing exactly what they keep saying they will do and exactly what they are currently doing with natural gas: throttling supplies. The biggest loser of the ‘price-cap’ policy miscalculation will be the Eurozone.

If the relative bullishness on the Euro versus the Dollar is simply due to sentimentality around the ‘1’ exchange rate, that sentiment risks being expensive.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Versus Dollar *Except* Euro???

Yes sorry. Thanks