Taps Coogan – October 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

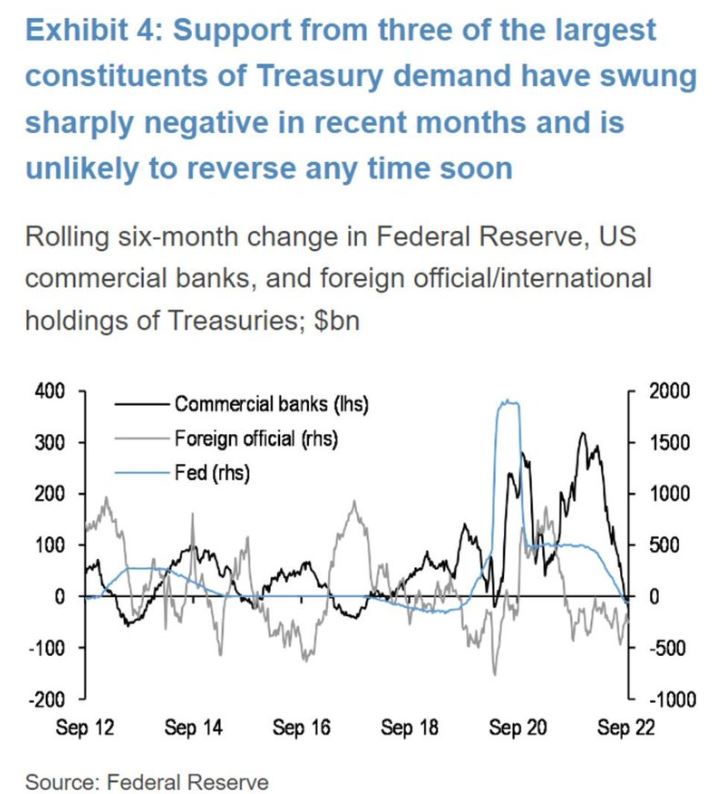

The following chart, via Win Smart, shows that demand for treasuries from foreign central banks/treasuries, commercial banks, and the Fed have all turned negative for the first time since at least September 2012.

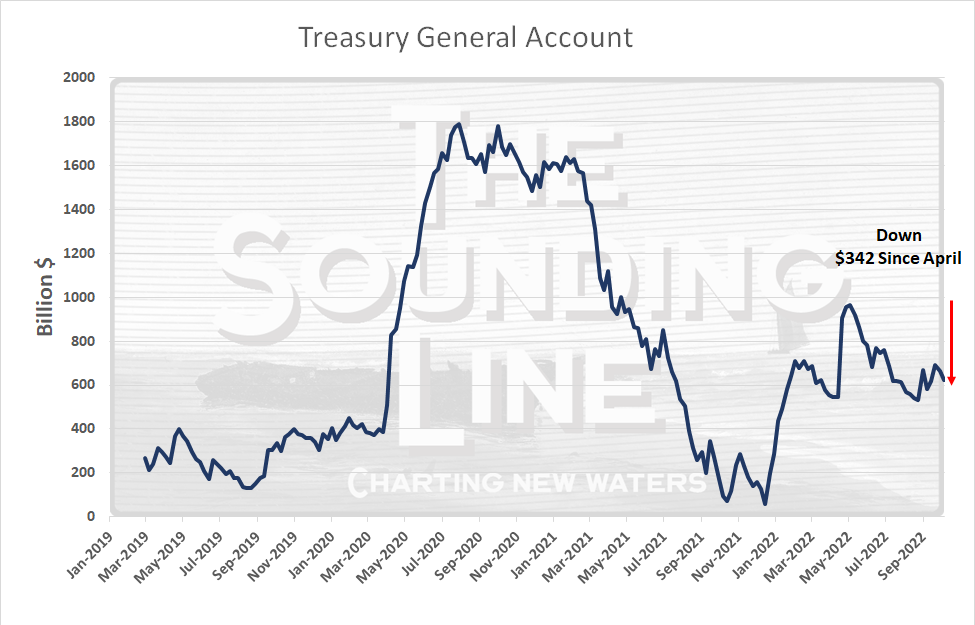

That lack of demand comes despite the Treasury running down their general account at the Fed by over a trillion dollars since September 2020 and by $342 billion since April of this year.

The drawdown since April is $342 billion of treasury supply that otherwise would have had to have been met by the market. Despite that, yields have risen to their highest level since the Global Financial Crisis.

While the Treasury could allow their general account balance to draw down by another two to three hundred billion dollars to give the treasury market some additional breathing room, the realities of our insane deficit spending are fast colliding with the fact that the marginal buyer of the past decade, the Fed, is out of the game, along with seemingly everyone else.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

If the US Treasury market dries up, it may signal a Hindenburg moment that spills over into derivatives and the financial system. Reuters reports that on Monday, Bank of America warned rising illiquidity in the $14.8 trillion U.S. Treasuries market could spill over into other financial markets. More on this important development and why it is important in the article below.

https://brucewilds.blogspot.com/2022/10/major-problem-us-treasury-market-is.html