Taps Coogan – April 27th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

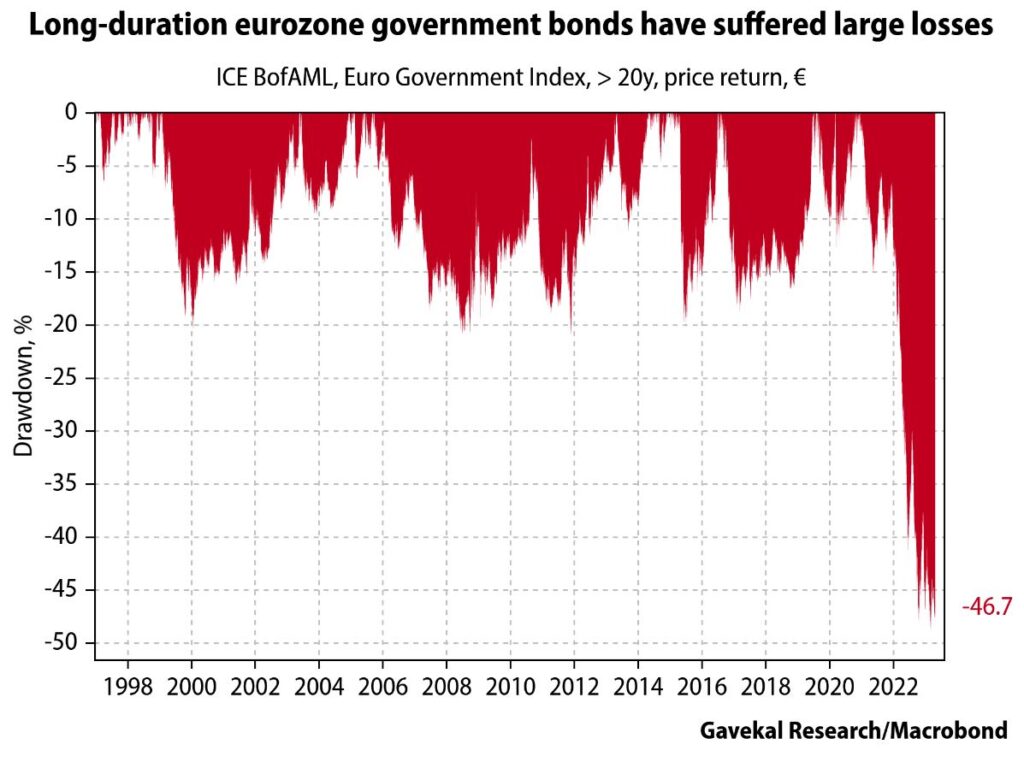

In what may be the least surprising development in the last few thousand years of finance, the trillions upon trillions of dollars/euros worth of long duration Eurozone government bonds issued mostly at zero and negative yields over the past decade have turned out to be terrible investments. Via Gavekal:

Buyers of most of these bonds signed up to lose money from day one, and if they hold them until maturity, they can do exactly that, plus eat the losses associated with inflation every year. For those keeping track, there’s been a roughly 20% loss of purchasing power in the Euro in just the last two years. Imagine what the inflation losses will be when these bonds start maturing in 2043!

The ‘good news’ is that very few private individuals were dumb enough to buy these bonds. The bad news is that European banks, central banks, financial intuitions, and insurance companies did buy them, often because they were required to, embedding trillions in mark-to-market losses in the Eurozone financial system. Now those entities get to make the choice between losing that money slowly for 20+ years or taking a 46.7% haircut today.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

And negative price oil futures had yields to infinity.

Go figure.

And so next, insurance premiums have to go up but won’t show up in inflation because they are not in the CPI.

Extra whammy, whatever you want to insure is thanks to inflation more expensive so another force to jack up the spenditures on insurance for us little sucked dry flies on the wall