Taps Coogan – July 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Taps Coogan: an administrative note: we are still working through some technical issues associated with our upgrade to better servers. It looks like the Top New Stories links for the last couple days were lost in the shuffle so please bear with us as we repopulate them. Thanks.

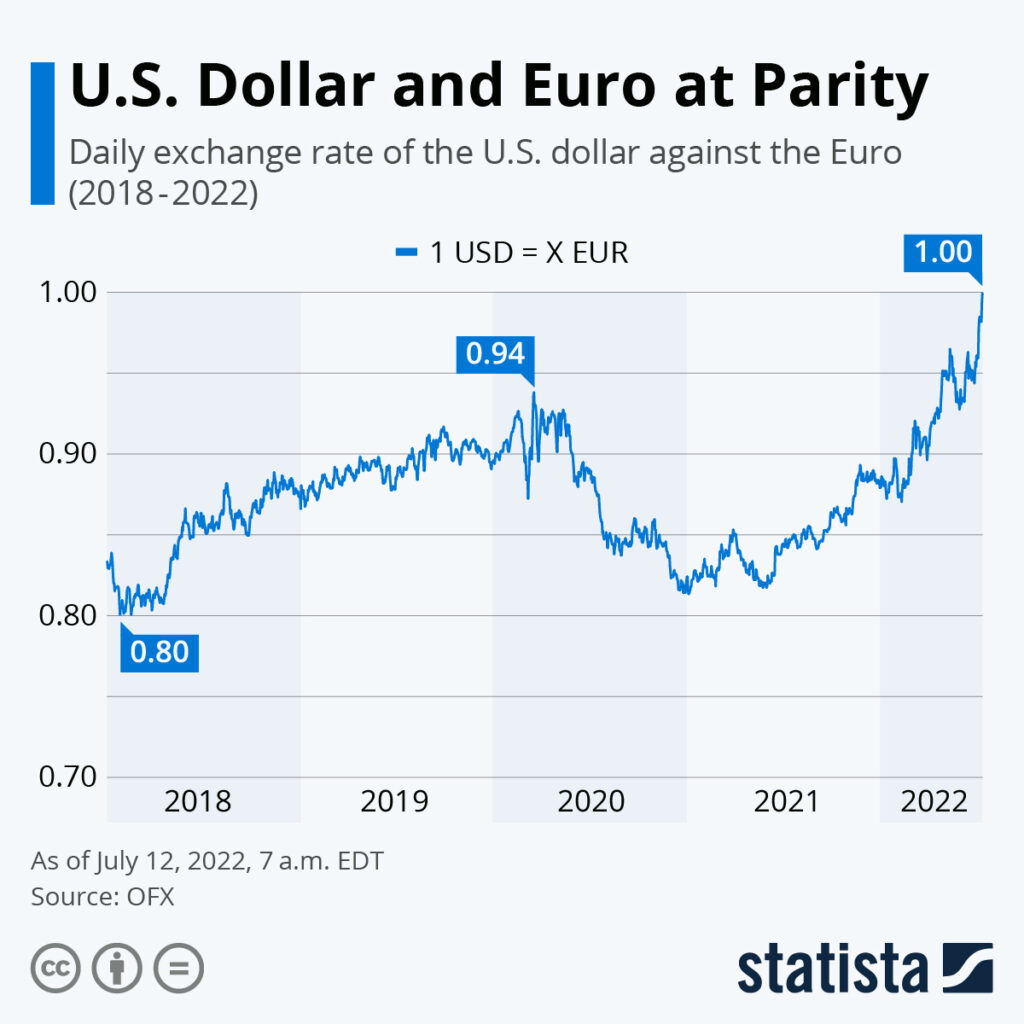

The following chart, from Statista, highlights the historic parity that was reached yesterday between the Euro and the US dollar. It was the first time that the dollar traded to ‘1’ with the Euro since 2002, when the Euro was just rolling out.

With the Federal Reserve finally raising rates fairly expeditiously and doing quantitative tightening while the ECB holds its benchmark rate negative, it’s hardly a surprise that the US dollar has strengthened against the Euro. Add in an energy crisis that has seen prices for natural gas in Europe rise much farther than in the US, the Eurozone’s less friendly business and regulatory environment, its shrinking workforce, its more quickly aging population, its lower birthrate, its lower immigration levels, and its non-participation in the last few generations of tech innovation, and it’s hard to see much of a case for how the Eurozone ends up with the economic vitality needed to meaningfully tighten monetary policy anytime soon.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Cleanest dirty shirt, indeed, though with Manufacturer’s PMI falling thru the floor, retail inventories piled up, consumer skittishness brought on by inflation, an evolving food crisis, and looming energy rationing that will torpedo Europe’s economies, I wouldn’t be in too big of a hurry to hike anymore if I was JP

“I wouldn’t be in too big of a hurry to hike anymore if I was JP” – nor would I

Do not be surprised if the euro drops to eighty cents to the dollar.The Ukraine conflict is taking a toll on the Euro-zone and it could result in finally pushing it over the edge. When you look at the situation, not only are many of the people living in the Euro-zone politically opposed to Brussels exerting more power, on top of that, the banks are up to their eyeballs with bad debts and holding worthless paper. Simply put, the whole system is rotten to the core. The article below details some of the problems the EU now faces.

https://brucewilds.blogspot.com/2022/06/the-european-union-is-again-close-to.html