Taps Coogan – June 18th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe

Every month the Federal Reserve publishes the US industrial capacity utilization rate based on the results of a Census Bureau survey of manufacturers across the country. The aim of the survey is to estimate what percentage of the nation’s total industrial production capacity is being utilized at any given moment.

The data set is noteworthy for three reasons. First and most directly, it provides a window into the ebbs and flows of demand and production within the US economy. It generally mirrors economic growth trends in the economy, occasionally with a significant lead. Second, it ties into the potential for inflationary pressures. Capacity utilization peaked during the late 1960s and 1970s when producers were reaching the practical limits of their existing production capacity (which is always less than 100%) and had to invest in new plants and equipment to grow production. Third, and directly tied into number two, the data set is a good barometer for the probability of significant private sector capital investment, a key determinant of economic productivity and real long term growth.

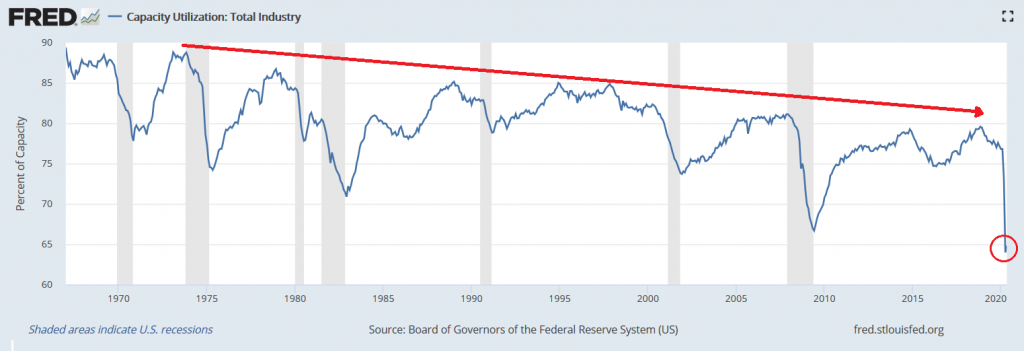

Unfortunately, this metric has been trending lower over the last few decades. The decline has occurred due to a litany of reasons ranging from slower growth, out-sourcing, more efficient management of existing manufacturing lines, low demand for US manufactured exports, monetary policy that has kept noncompetitive producers in business, etc… It peaked at 89% in the 1970s, 85% in the 1980s and 1990s, and 81% in the 2000s. Since the Global Financial Crisis, it has never managed to get back above 80%.

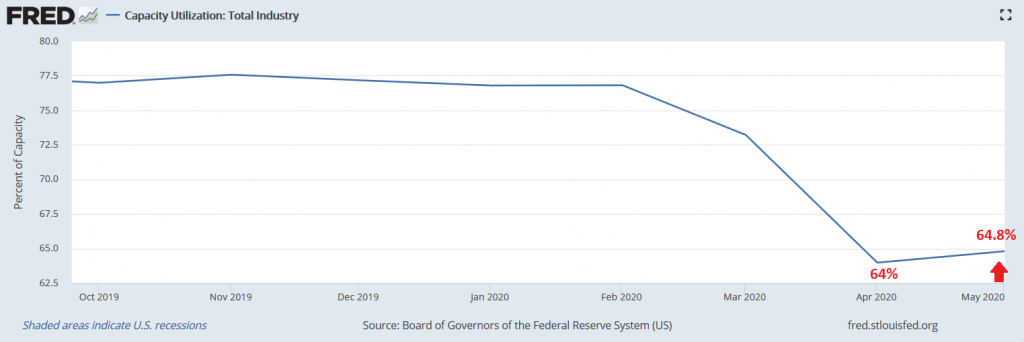

Then came Covid and the lockdowns, which pushed the metric to a previously unimaginable all-time low of 64% in April 2020. The good news, if one can call it that, is that it has inched up to 64.8% in May 2020, signifying that the Covid low is probably in the books.

Presumably, capacity utilization will get most of the way back to its pre-covid levels over the next several months. However, the real challenge is that in order for the US economy to start to move the needle on long term productivity growth and in order to outgrow the economy’s massive debt burden, massive private sector capital investment is going to be needed. That investment will not come until existing capacity is being fully utilized. For that, capacity utilization needs to do more than just recover to its pre-covid levels. It needs to get back above 80%. That is going to be a herculean task for a historically over indebted private sector full of ‘zombie’ companies kept alive by the Fed. Nonetheless, that’s the task at hand.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.