Submitted by Taps Coogan on the 29th of February 2016 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

In ‘The Anatomy of a Stock Market Bubble’ (link here), we noted that despite U.S. stock indices nearing all-time highs, investment in fixed gross capital (i.e. the assets used in the production of goods and services) remains far below pre-recession levels.

It doesn’t take an economic prodigy to realize that the circular logic of more stock-buybacks and M&A leading to higher share prices and profits which in turn leads to more stock-buy-backs and M&A, all at the expense of investment in the things that make actual goods and services, isn’t sustainable.

It follows directly that once share prices and/or profitability stop increasing, the engine of this self-inflating scheme will work in reverse. Therefore it’s prudent to ask:

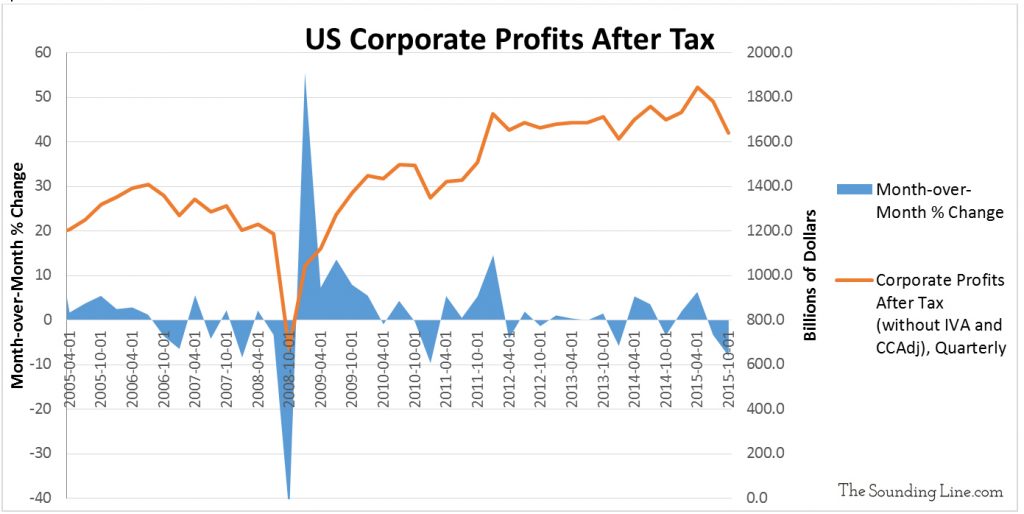

Are corporate profits still increasing?

The Federal Reserve tracks quarterly corporate profits after taxes and the results show that fourth quarter 2015 profits declined by the most since Q1 2011 and was the second largest decline since the 2008 recession. With a number of recent disappointments in earnings being released (see Apple, Netflix, Microsoft, Goldman Sachs, energy sector…), it is reasonable to expect that Q1 2016 earnings will exacerbate this downturn. We will revisit this subject once the Q1 data finishes coming in.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.