Taps Coogan – January 4th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

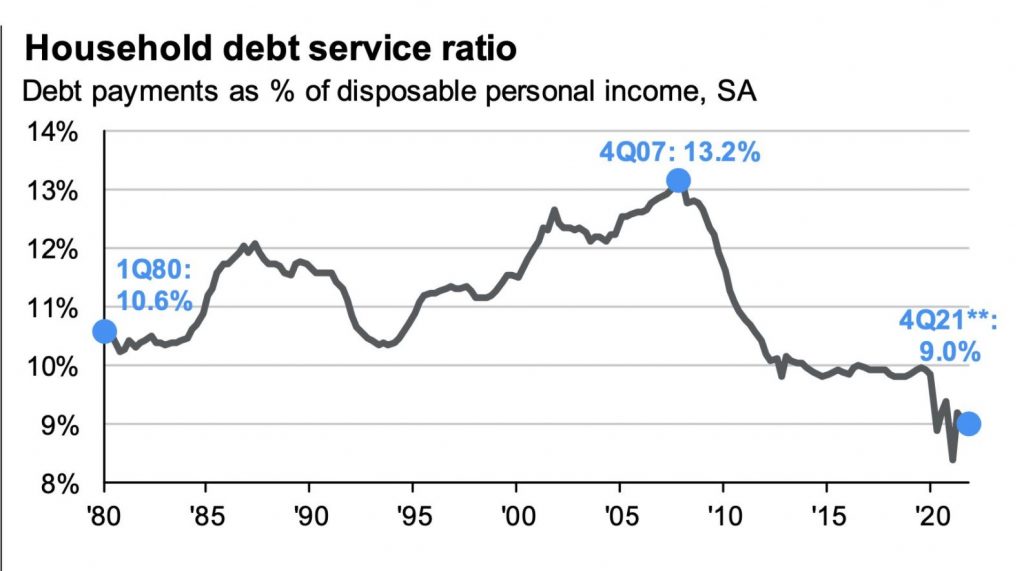

Despite a jump spike in consumer borrowing in 2021, the actual cost of consumer debt servicing relative to disposable income has plunged and remains near record lows in the fourth quarter of 2021, as the following chart from ACEMAXX ANALYTICS highlights.

This phenomenon highlights the Catch-22 of interventionalist monetary policy. Ever since the Global Financial Crisis, every market scare has lead to larger deployments of monetary stimulus. Those ever larger doses of monetary stimulus have led to ever lower interest rates and debt servicing costs. Those lower debt costs have enabled ever more borrowing, which in turn has led to ever rising debt levels. Rising debt levels have increased interest rate sensitivity in the economy, necessitating ever larger monetary interventions, enabling ever more debt, and so on and so forth. 13 years of increasing debt levels and household debt servicing costs are nowhere near a breaking point, quite the opposite.

How does this feedback loop end? The idea used to be that inflation would pressure the Fed into stopping the accommodation cycle. While that may come to pass, it certainly hasn’t yet. Inflation is nearly 7% and the Fed will be doing $60 billion of QE this month.

Indeed, the Fed is roughly 28 quarter-point interest rate hikes away from positive real-overnight rates. Sure, inflation may moderate a bit in 2022, but given a choice between persistent inflation overshoots and deleveraging, this Fed will choose persistent inflation, as this year has highlighted.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

okay, so this is bullshit. recalculate with income bracket adjustments. This is exactly how the “women earn 75 cents for every dollar a man earns” bullshit gets spread as fact. I have an 830 Fico but one late payment (by 12 hours I might add) made my business line % rate end up at 19.24%, yes I am calling tomorrow to see if I can get that lowered……..BUT to what? 12% while Wells Fargo pays .25%? I am so tired of everything. Even 9% is criminal IMHO. Consumer reports (multi year subscription) makes this “study” out as to be bullshit… Read more »

Why is it bullshit? It’s talking about debt payments in that chart not interest. Even so, I could believe interest component is high because the value of the debt can be many times higher than household income.

There is no doubt interest servicing costs have come down for households and businesses.

Debt payments and net interest are the same thing in this parlance. Consider this a chart of interest payments if you prefer. Yes, definitely this is lumping everything together. That’s why it’s one line on one chart. Looking at things broken down can be interesting. But so is looking at the big picture. It’s not saying that household debt interest costs are 9%. It’s saying that 9% of disposable household income is being spent on interest. The vast majority of household debt is tied up in mortgages and mortgage rates have come down to just about their lowest level in… Read more »

I suspect the disposable income calculation is about as trustworthy as CPI or Unemployment.