Taps Coogan – January 26th, 2024

Enjoy The Sounding Line? Click here to subscribe for free.

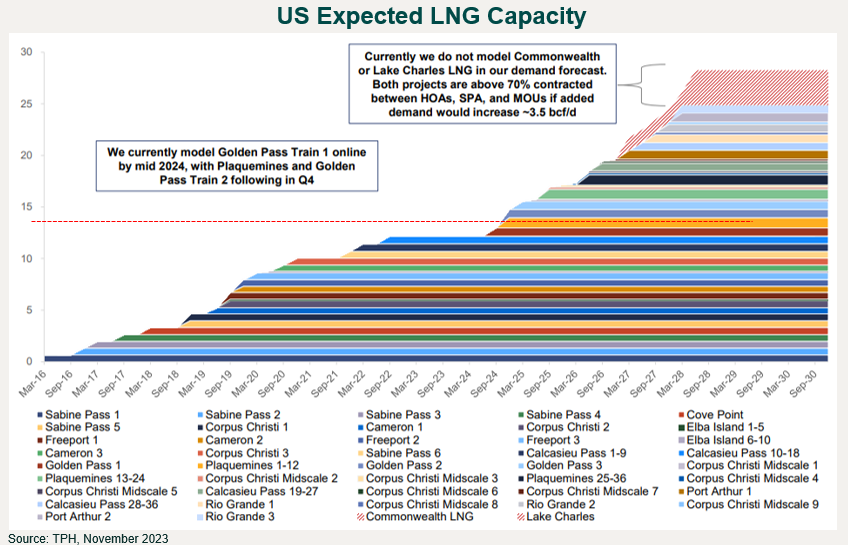

After stagnating since early 2022, US LNG export capacity is poised to return to an aggressive pace of expansion starting at the end of this year. Via Eric Nuttall:

We remain (opportunistically) bullish. pic.twitter.com/nPD0jOoiHK

— Eric Nuttall (@ericnuttall) January 26, 2024

Barring the Lake Charles and Commonwealth projects (in thatched red), the projects shown in the chart above have already secured final investment decisions and, in nearly all cases, begun construction.

As of today, the world’s major gas markets remain localized with big price differences between the exporters like the US or Russia and importers in Europe or Asia. That price differential exists because the ability to arbitrage price differences is limited by a lack of LNG import/export capacity. That ‘problem’ is going to get incrementally fixed via the new capacity as the chart above highlights. (As to why Russian pipeline gas is a false alternative that was rarely significantly cheaper than LNG, read here.)

The net result of the massive expansion in LNG infrastructure coming in the next five years is going to be the flattening of gas markets.

US natural gas currently trades at about $2.50 MMBTu compared to the EU and Asian LNG gas prices of roughly $8.80-$9.50. That leaves enough room for profitable exports after liquification and shipping costs of about $3.00.

While the global average gas price may be far higher or lower in the coming years, all other things being equal, the price differential between exporters like the US and importers like the EU or Asia is likely to converge toward the ~$3 liquification/shipping friction as the market nears a state of spare export capacity. In other words, incrementally, natural gas markets are going to look more like oil markets.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

But Known World Reserves of Natural Gas are Russia 24 %, Iraq and Iran 18% each and U.S. 5% which i mostly from fracking and requires costly shipping. Pending question for EU is can German industry, the locomotive of EU be competetive or will many industries relocate overseas. New deposits in Med also may come on line

Those reserve numbers are famously innaccurate and don’t include shale