Submitted by Taps Coogan on the 22nd of September 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

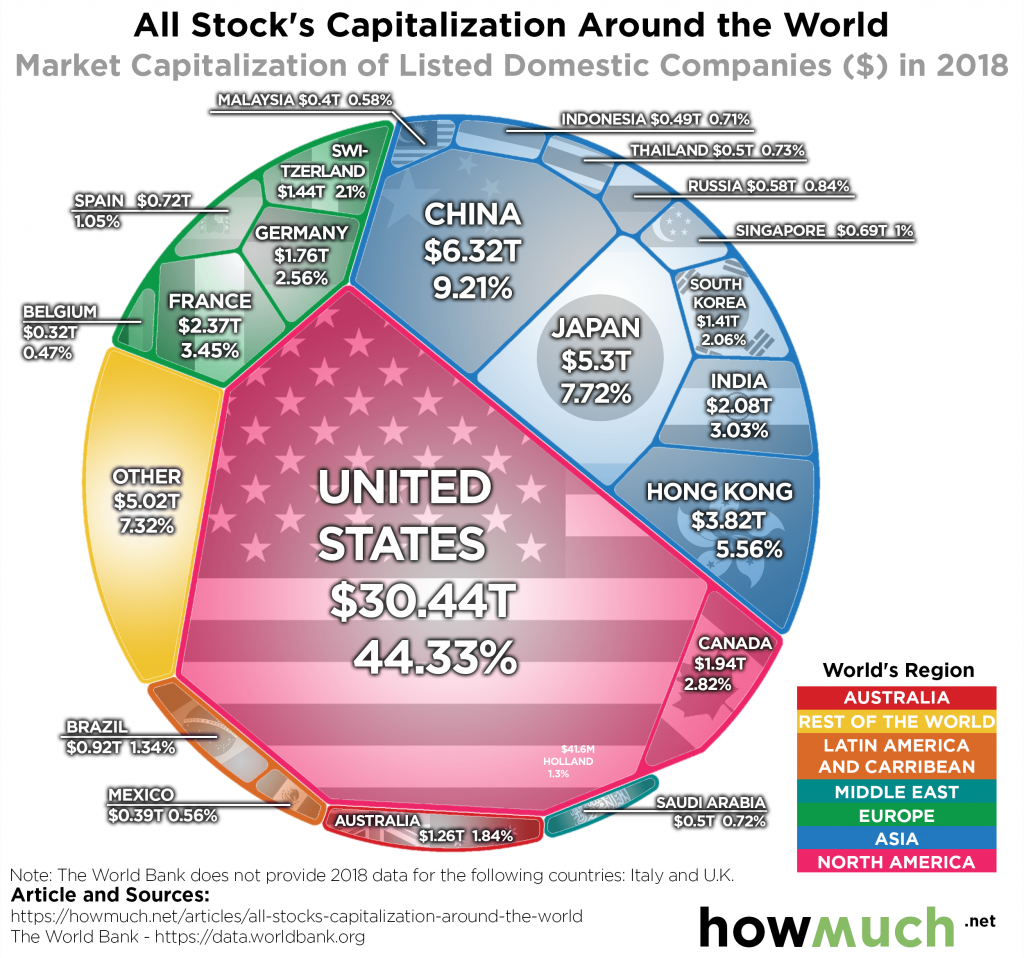

The following info-graphic, from the cost-estimation website HowMuch.net, shows the market capitalization of the biggest stock markets around the world.

Publicly traded companies in the United States have the largest market capitalization in the world ($30.44 trillion), representing 44.33% of the global total. In a relatively distant second, China has a market cap of $6.32 trillion or 9.21% of the total. If one adds Hong Kong’s market cap to China’s, China’s combined market cap jumps to 14.77% of the global total. In third, Japan has a market cap of $5.3 trillion or 7.72% of the global total.

Major European economies France and Germany represent only 3.45% and 2.56% of the global market cap respectively. The UK, which is not listed individually, likely comprises a large chunk of the ‘Other’ category. Its market cap is around $3 trillion, larger than the market cap of France or Germany.

Before celebrating the US’s large market cap, consider this: US market cap now represents roughly 144% of US GDP, the highest level on record except for the peak of the Dot-Com bubble in 2000. It’s part of a growing circularity problem haunting the Fed. US stock and bond values have rocketed higher during this expansion due to accommodative monetary policy from the Fed and despite weak underlying economic fundamentals. Financial asset prices have, in turn, become the key determinants of consumer confidence and consumer spending which has, in turn, become the key determinant of the trajectory of the US economy. The Fed’s policy path has, in turn, become increasingly a function of metrics that are themselves a function of Fed policy. Put differently, the Fed needs stock and bond prices to be high to support an increasingly ‘financialized’ economy, and the economy becomes increasingly ‘financialized’ because the Fed is using financial assets prices to support the economy. Meanwhile, the dynamism of the real economy atrophies in a world of false price signals and artificial rates. All of this because US policy makers have become so mortified at the prospect of a recession that they are willing to do whatever is expedient and imprudent to delay it.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.