Submitted by Taps Coogan on the 3rd of March 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

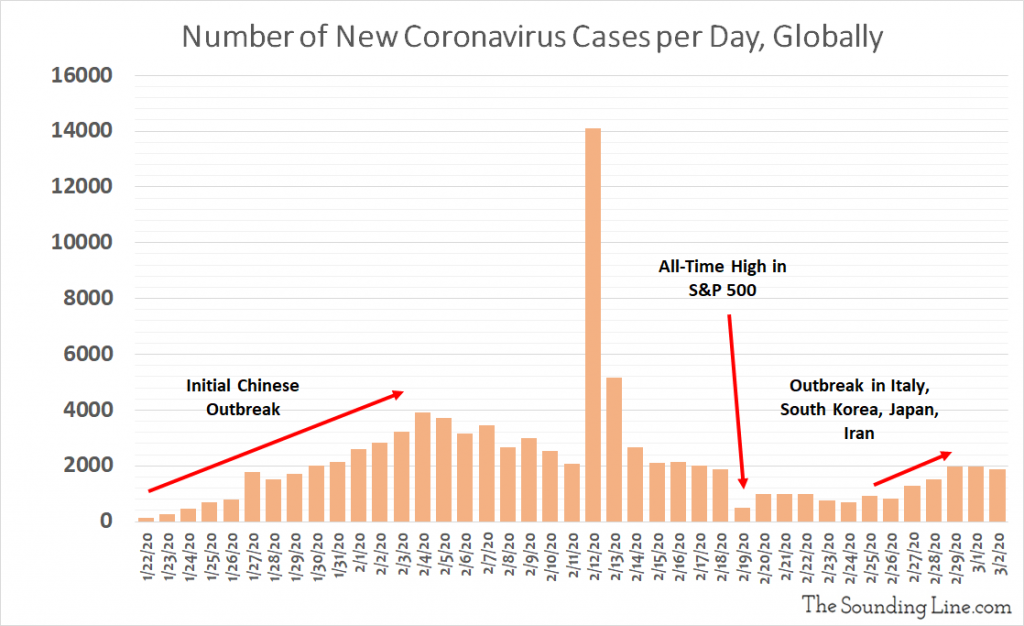

The following chart shows the number of new Coronavirus cases reported around the world each day since January 22nd.

To the extent that officially reported statistics are reliable, the average number of new cases reported each day since January 22nd has been 2,195. That number has not trended meaningfully higher since the initial Chinese outbreak peaked in mid February. Despite the second wave of outbreaks in Italy, South Korea, Japan, and Iran, the number of new cases as been falling slightly for the last couple of days and was 1,859 as of March 2nd, below the average since the outbreak started.

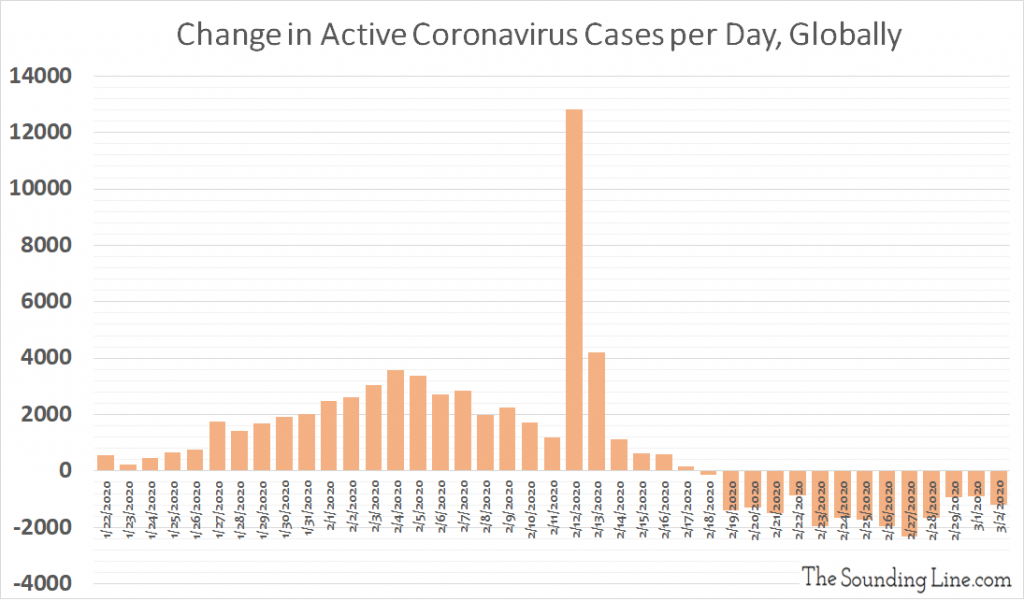

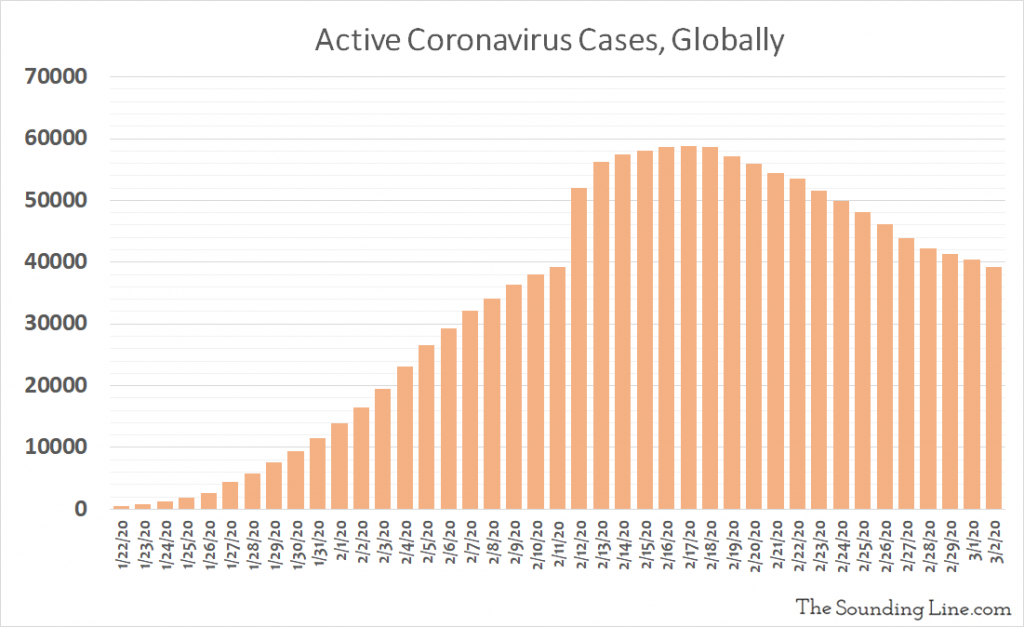

To the extent that officially reported statistics are reliable, the number of people recovering from, or dying of, the Coronavirus has been outpacing the number of new cases since February 19th. February 19th was coincidentally also the day that the S&P 500 hit its last all-time high. Put differently, despite the new outbreaks in Europe and Asia, the number of people on planet Earth with the Coronavirus has been falling for the last two weeks. More people have now recovered from the Coronavirus than currently have it.

The very serious risk that the Coronavirus poses to the world is not that it continues to spread at its current pace. It would take over a decade at the current pace to infect the entire human population. The very serious risk that the Coronavirus poses is that the pace of infection accelerates dramatically. Even though the new case count is fairly stable for now, that risk remains very real. Not only are the official statics likely to be understating the true number of infections, until the disease is completely eradicated, the risk remains that the outbreak will re-accelerates.

However, the worst case scenarios have not manifested yet. Just as it is conceivable that the outbreak gets worse, it is conceivable that it will get better.

What does it mean for financial markets if the Coronavirus risk moderates? Consider that monetary, fiscal, and liquidity conditions were among the frothiest ever witnessed before the outbreak started. Consider that most major economies have announced or proposed some form of economic stimulus to combat the economic impacts of the Coronavirus, whether that be more interest rate cuts, fiscal spending, debt forgiveness, or other measures. However frothy liquidity conditions were before the outbreak, they will be frothier if it passes.

One can debate how much effect those policies will have on the real economy. However, financial markets have shown time and time again that as long as monetary and liquidity conditions are extremely accomodative, the real economy is completely irrelevant. Unless the Coronavirus outbreak worsens dramatically, it seems unlikely to change that dynamic.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.