Taps Coogan – March 12th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The recently passed $1.9 trillion Covid ‘stimulus’ bill contains a whopping $350 billion in direct state and local bailouts. It also contains transportation and education funding that flows into state budgets, bringing the state and local funding in the bill to about $510 billion.

That comes on top of roughly $310 billion of state and local funding in previous Covid bills, bringing the total ‘Covid’ state and local funding to $820 billion and counting since last March.

Meanwhile, estimates from the Census Bureau suggest that state and local tax revenues amounted to $1.12 trillion for the first nine months of 2020, just $8 billion less than during the same period in 2019. A more recent analysis suggests that local tax revenues may have actually increased by $60 billion in the first three quarters of 2020 as consumer spending held strong and property values rose. All in all, it has been estimated that a modest decline in state and local revenues, offset by state rainy day funds, leaves states with a $6 to $16 billion hole owing specifically to Covid.

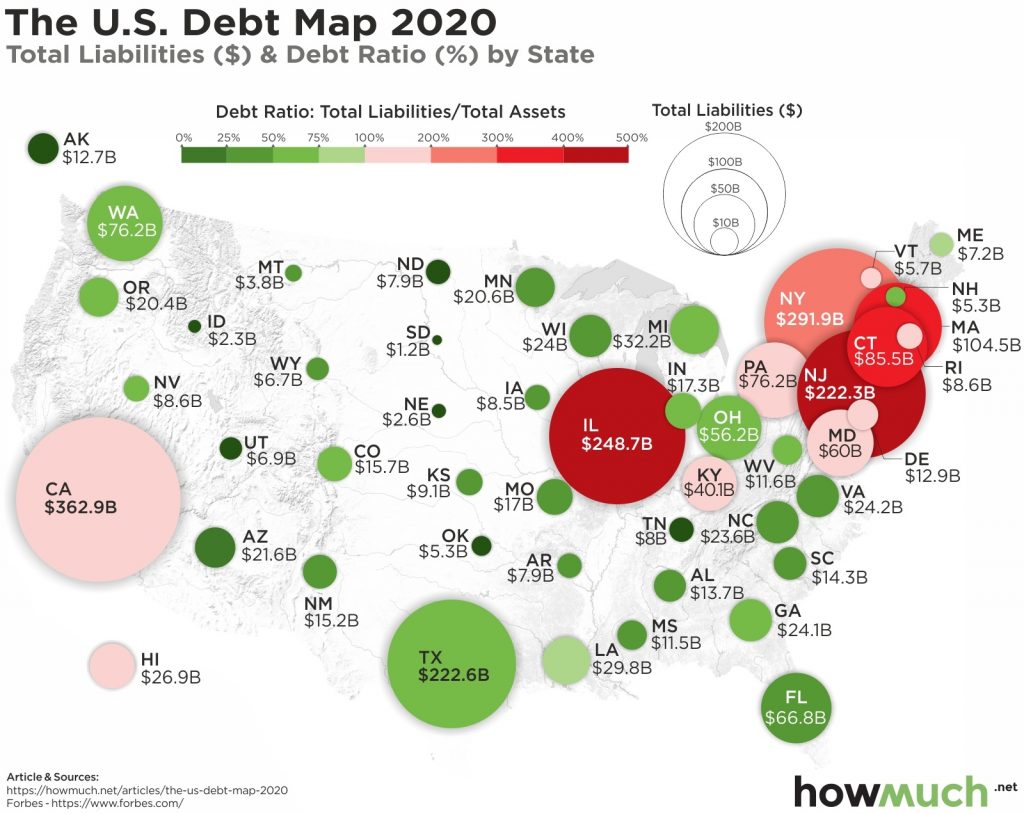

Instead of $16 billion, states are getting $820 billion, three-quarters of an year’s worth of tax revenue. The following map, from Howmuch.net, reveals why. It shows the debt-to-asset ratio of every state.

The political divide in the map above is stark. The current leadership and majority in Congress hails primarily from the states in red above (the minority leadership does too). Those states were on the verge of insolvency before Covid, entirely as a result of long standing policy choices. You may support those policy choices or you may not. Regardless, the rest of the country, people residing in states which made different fiscal choices, are now paying to bail out the debtor states. Those people didn’t receive any of the alleged benefits from the underfunded policies in states like Illinois or New York, but now they are paying for them.

It’s not pocket change either. $820 billion is about $6,400 dollars per household in the US. Just the interest on $820 billion of new debt will cost taxpayers about $12 billion a year with the 10-year treasury interest rate at 1.5%, and the 10-year rate is rising rapidly precisely because the deficit spending is completely out of control.

Another reference point: the national food stamps program, a long time political football that fiscal conservatives spent years trying to pare back, cost about $60 billion a year in 2019, down by $19 billion since 2013. An extra $12 billion of interest payments on this bailout is an enormous amount of money, to say nothing of the $820 billion bailout itself.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.