Taps Coogan – June 17th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

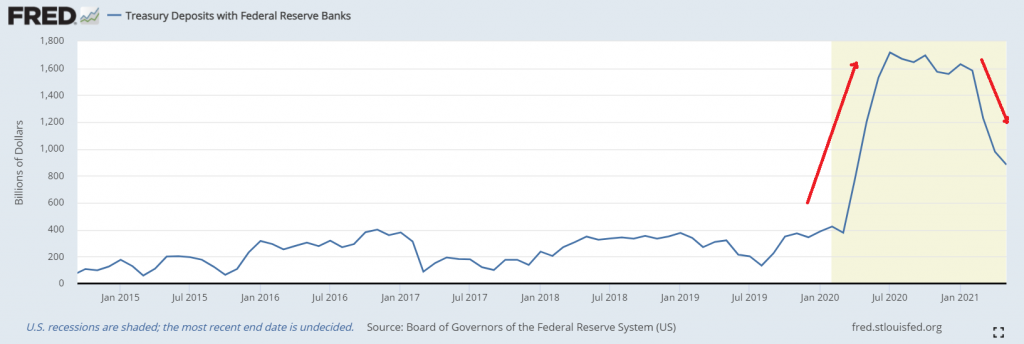

Last year, the US Treasury raised the balance on its checking account at the Fed to a record $1.7 trillion in anticipation of having to support trillions of dollars of spending on various stimulus bills and in order to capitalize on the historically low interest rates at the time. Now, the Treasury is spending down that excess balance.

The Treasury’s ‘checking account’ balance has fallen from about $1.582 trillion in February to $882 billion in May. That represents a whopping $700 billion of spending that would normally have been financed through new debt issuance this year but wasn’t, because the money was already borrowed last year.

As a result, the national debt has ‘only’ increased $555 billion so far this year. Of that $555 billion, the Federal Reserve has monetized $440 billion. That means that the actual market has only had to absorb $145 billion of net new debt so far this year. To put that in perspective, the market had to absorb $1.46 trillion last year.

Many analysts have interpreted the fact that Treasury yields have fallen from around 1.75% in March to just under 1.5% today as evidence that the Treasury market is saying that inflation is peaking.

The treasury market isn’t saying anything of the sort. It’s not saying anything at all. Net treasury issuance over the past month has been negative $35 billion, during which time the Fed bought about $75 billion of treasury debt. Practically speaking, treasury market supply has shrunk by about $110 billion in the last month.

The Fed has bought 80% of net issuance this year and 90% of deficit spending has been financed by either the Fed or the Treasury spending down their account.

Within that context, 1.5% yields on the 10-Year don’t seem all that low.

There is another $400 billion or so of extra money still in the Treasury’s account, so this game isn’t over. Let’s hope that when it is over, inflation won’t still be hovering around 5%.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.