Taps Coogan – April 2nd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

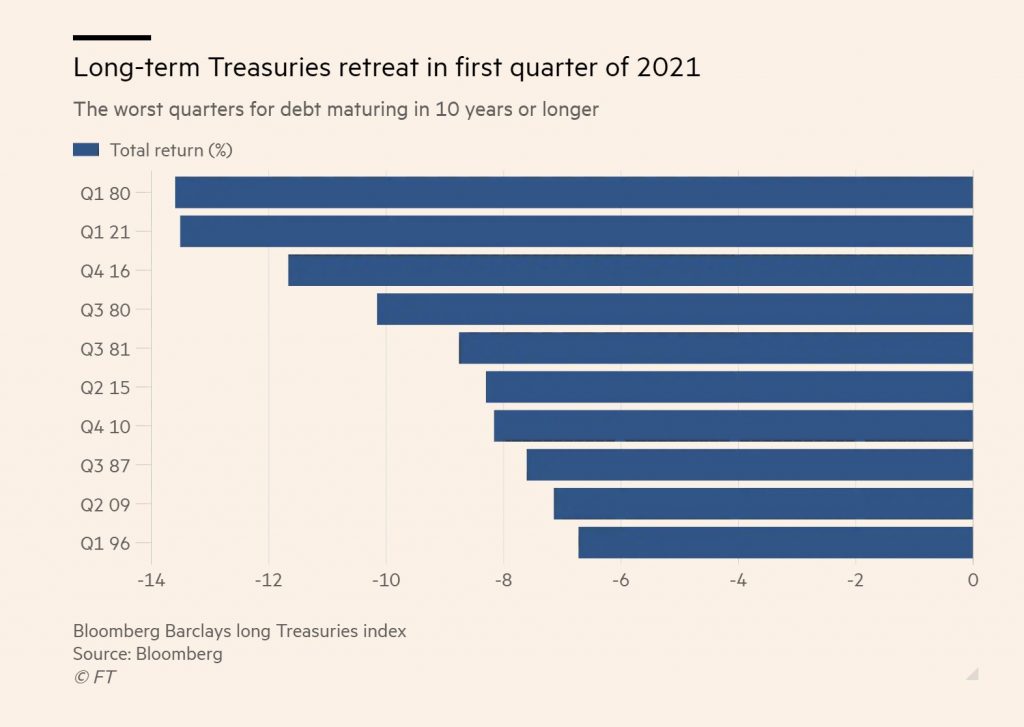

The following chart, from the Financial Times via ACEMAXX ANALYTICS, shows that the total return of long dated Treasuries (10 years and over) fell by the most since 1980, the last year before Paul Volcker crushed the inflation of that era and kicked off the 40 year bond bull market that may be ending right here and now.

With 10-year yields as low as they were this past winter (less than 1%), it took less than a 1% rise in the 10-year to produce this outsized loss. While the rise in rates may have run its course in the short term (or maybe not), at the current 10-year breakeven inflation rate, the 10-year would have to rise another 0.6% just to get long dated treasury holders to a breakeven real yield.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

How do I get in contact with Taps Coogan? (contact(at)thesoundingline.com did not work). I would like to include one of his charts in my new book on the housing industry. THANKS so much.

Sam Rashkin

replace the (at) with @. it’s written that way to avoid spam bots