Submitted by Taps Coogan on the 25th of April 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

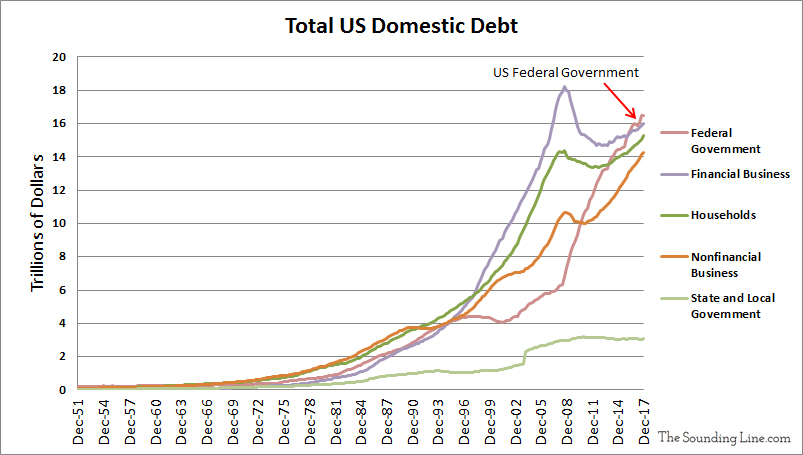

Since the 2008 financial crisis, the US federal government’s debt has nearly tripled. The federal government has overtaken the household sector, the business sector, and the financial sector, to become the largest borrower in the country and world, even when excluding over $5 trillion of intragovernmental debt that the federal government owes to itself.

With the benchmark US 10-year treasury breaking above the critical 3% level for the first time in years, the 35 year bond bull market may be ending. With the federal government already spending 14% of its revenues servicing the national debt, with budget deficits expected to balloon further in the next few years, and with the Federal Reserve reducing its bond purchases, the federal government is not well positioned to cope with the possibility of rising interest rates.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

IT IS A GOOD BLOG!