Taps Coogan – January 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

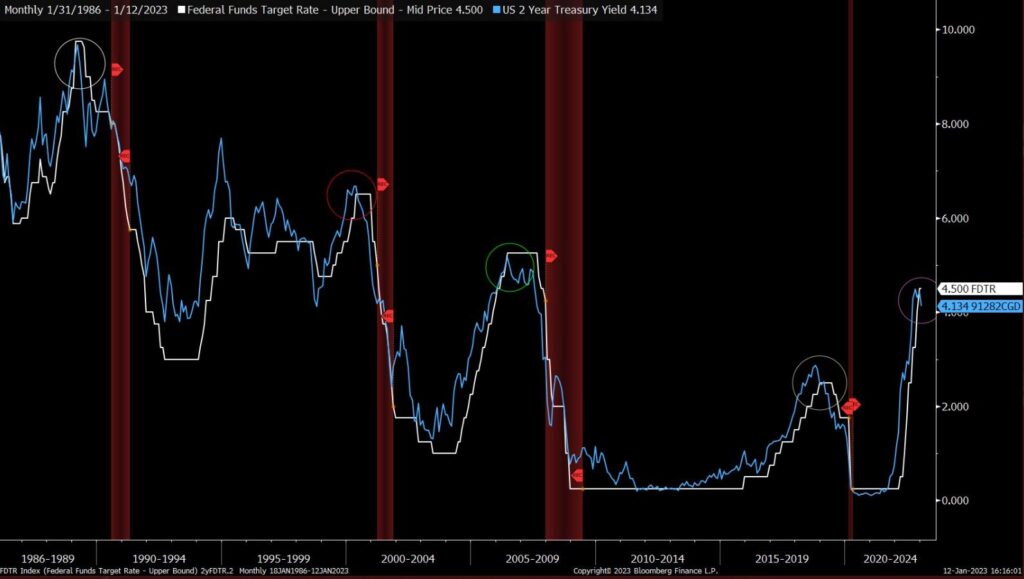

The yield on the 2-year treasury has dropped below the upper bound of the Fed Funds rate for the first time during this tightening cycle, a signal that has traditionally signaled the end of a tightening cycle. Via Gina Martin Adams:

It’s hardly news to markets that the Fed is approaching a pause, but this provides further evidence that such a pause is imminent. Perhaps more importantly, this point in the monetary policy cycle – the ‘pause,’ is typically the preamble to the actual recession. That lines up well with market expectations that the bear market pauses for a while before a proper recession kicks in later this year. Rarely do widely held market expectations around recessions (or a lack thereof) pan out perfectly, so we’ll see.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.