Taps Coogan – July 7th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

On one hand, this is a historic period for the Treasury market.

The entire Treasury curve is trading at negative real yields. In fact, the entire TIPS Treasury curve is trading at negative nominal yields, implying that the entire Treasury curve, where it is today, should yield less than the average inflation for the next 30 years.

Real 10-Year yields are the most negative they’ve been since 1980 when inflation was double digits. Even junk bonds are now trading at negative real yields.

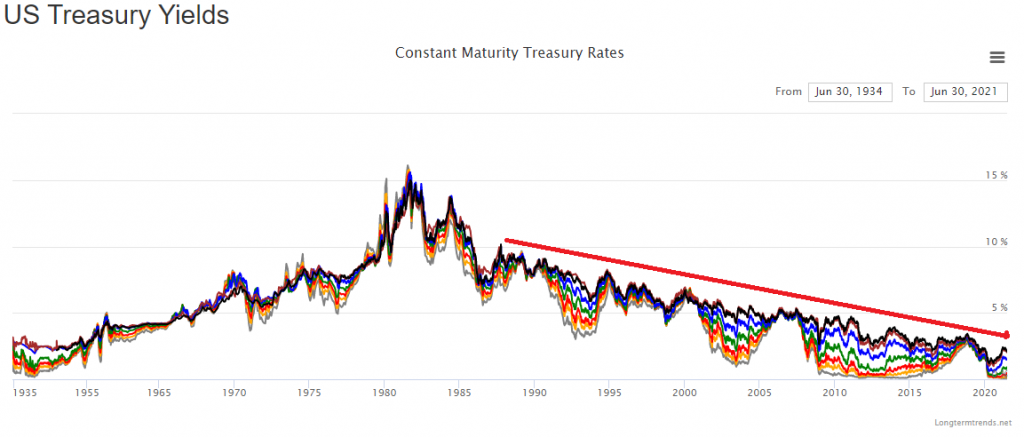

On the other hand, nothing has really changed in the Treasury market, as the following chart from Long Term Trends highlights.

Despite the rise in inflation, despite nearly $10 trillion of federal spending in a year, Covid and the lockdowns, an expansion of the broad money supply by a quarter, the 180-degree pivot on tax and regulatory policy, the fastest rise in commodity prices in a decade, despite all that, Treasury yields are still locked in the same downward pointing trend they’ve been in since the early 1980s.

People say that the Fed only controls the short end of the curve. So far this year, the Fed has bought 80% of all net Treasury issuance. The Fed controls the entire curve when it wants to.

Sure, maybe high inflation will eventually force the Fed change its priorities, but it’s doubtful that an economy this overindebted can make it very far into a tightening cycle, and the Fed will be more than happy to rush back in.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.