Submitted by Taps Coogan on the 11th of September 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

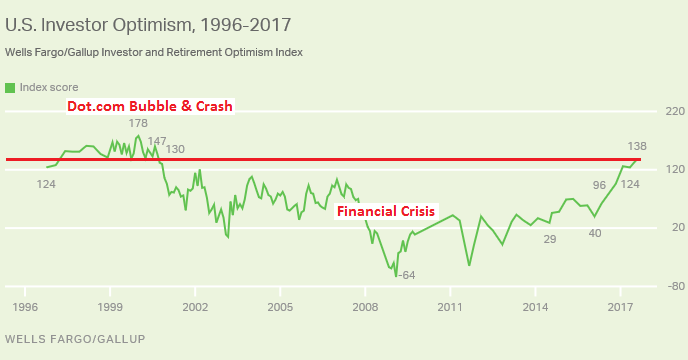

It has taken nearly two decades, but according to a Wells Frago and Gallup survey, retail investor confidence has finally returned to highs last seen during the peak of the Dot-com bubble in 2000.

As Wolf Street reports, for U.S. investors with at least $10,000 invested in stocks, bonds, or mutual funds, the following holds true:

- “68% of these investors said they’re optimistic about the stock market’s performance next year.

- This matches the prior records set in December 1999 and January 2000. Peak optimism occurred two and three months before one of the most epic crashes commenced in March 2000.

- 25% of the investors said they’re “very optimistic,” an all-time record, besting the prior record of 24% set in the first quarter of this year. This is up from 11% a year ago!”

Furthermore:

- “61% said now is a good time to buy stocks, up from 53% two years ago. Of them, 47% cited as the main reason that the market will continue to rise.

- 17% see downward volatility in the stock market as a buying opportunity.

- But there were still a few worrywarts left: Only 37% do not think that now is a good time to buy stocks. Just over half of them, so only 19% of all respondents, after an eight-year stock market boom, cited a market correction as a reason for their reluctance to buy, buy, buy.”

Based on these various factors, Gallup has increased its confidence index to 138, just shy of its brief all time high of 178 during the Dot-com bubble. For retired investors, the index is even higher at 158.

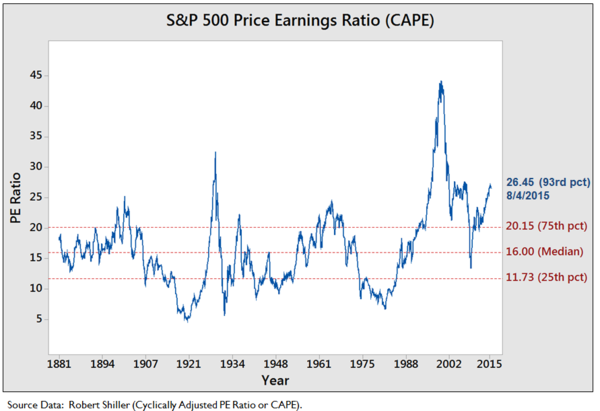

The Dot-com bubble was arguably the largest stock market bubble in US history (superseded perhaps only by 1929). Evidence of the enormity of the Dot-com bubble can been seen in the chart of investor optimism above as well as in the fact the Schiller P/E ratio reached its all time high during the dot-com bubble.

That investor confidence is as high now as it was during the Dot-com bubble, should be taken as a very negative indicator for financial markets. Retail investors as a group are notorious for being horrible market timers. The best evidence of this is the fact that their confidence is highest when markets are at their peak, like in 1999-2000, precisely when a good investor should be losing his or her confidence in obviously inflated stock prices. As Wolf Street notes:

That investor confidence is as high now as it was during the Dot-com bubble, should be taken as a very negative indicator for financial markets. Retail investors as a group are notorious for being horrible market timers. The best evidence of this is the fact that their confidence is highest when markets are at their peak, like in 1999-2000, precisely when a good investor should be losing his or her confidence in obviously inflated stock prices. As Wolf Street notes:

“This is what everyone has been waiting for: Retail investors becoming super-optimistic about stocks. In 1999 and early 2000, high enthusiasm for stocks was a powerful sign that the stock market bubble was on its last legs. Of course, no one can say how much higher their enthusiasm will surge this time around. During the dot.com bubble, the index hit 178 for a moment before the market came unglued, at a horrendous expense to those very same investors. But the current level of the index has already left the optimism before the Financial Crisis in the dust.”

Add this to the growing list of indicators we have discussed here at The Sounding Line that say the same thing: the market is grossly overvalued (here, here, here, here). However, as we say about all these indicators, just because an indicator has reached unsustainable levels, does not mean it has reached peak unsustainable levels. It does mean that the fuse is lit and the utmost caution is now warranted.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.