Submitted by Taps Coogan on the 26th of October 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

A great deal has been written over many years about a coming ‘demise’ of the US Dollar and its abandonment as the world’s preferred reserve currency. In the last few days, CNBC, Zerohedge, and a host of other news outlets have published articles discussing how China’s anticipated decision to issue Yuan based oil future contracts backed by gold will be a ‘powerful move’ to ‘dethrone’ the US dollar. Zerohedge notes: “besides serving as a hedging tool for Chinese companies, the contract will aid a broader Chinese government agenda of increasing the use of the yuan in trade settlement… and thus the acceleration of de-dollarization and the rise of the Petro-Yuan.”

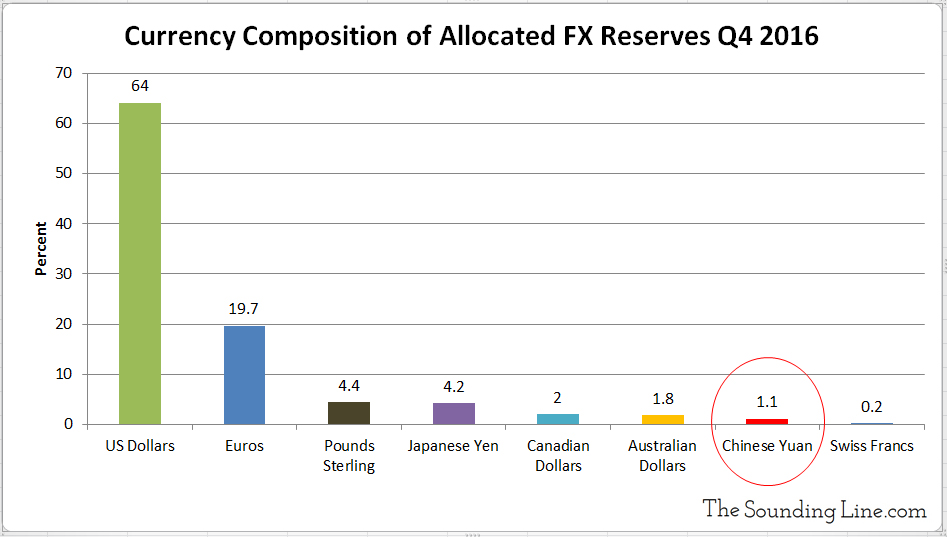

While China has experienced astounding economic growth for several decades, the idea that the Chinese yuan is close to usurping the US dollar as the leading global reserve currency stretches credulity. The following chart shows the composition of allocated foreign currency reserves held around the world as of the end of 2016. Readers are encouraged to note that the Chinese yuan is less popular as a reserve currency than the Australian dollar, the Canadian dollar, the Japanese yen, the UK’s pound sterling, and the euro.

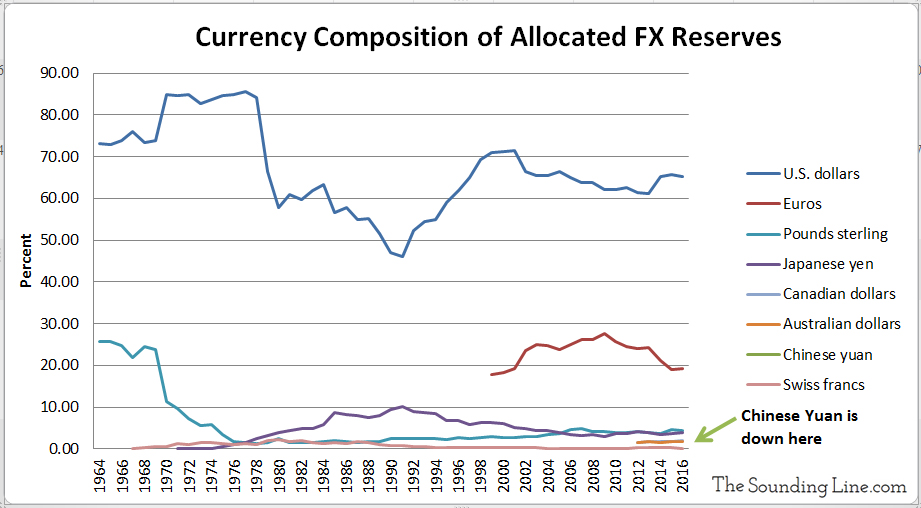

The following chart shows the percentage of allocated foreign reserves held in US dollars since 1964. While lower than its peak utilization of 85.5% in 1977, the US dollar is nearly 20% more popular today than it was in 1991. The Chinese yuan’s share of reserves (1.1%) is so small that it is essentially impossible to see in the chart.

If reserve currency preference were primarily based on a country’s importance to the global trade of goods, or the trade of oil, or based on the size of its economy, the currencies of China, India, and Brazil would be among the most popular. Despite the proliferation of many ‘petrodollar’ theories, and their derivatives, this is not the case.

To understand why, consider this: All of the oil exported in the world in 2016 was worth about $678 billion. Despite all that is written about the ‘Petrodollar’ system, oil represents less than 5% of the total global goods trade, which is estimated at over $16 trillion a year. The global goods trade is in turn a tiny fraction of the shares of US stocks transacted in a given year (roughly $60 trillion). The US shares traded in a year are in turn a tiny fraction of the US treasury bonds traded in a year (roughly $125 trillion) and total US bond market transactions in a given year (roughly $190 trillion). All of this is a tiny fraction of the total currency transactions, which are some $1.825 quadrillion (that’s $1,825 trillion)!

While crude oil is a vital resource that many countries import, it’s size relative to the total goods trade and to financial markets has been greatly misconstrued.

Reserve currency preference involves much much more than the pricing of oil or other trade goods. Countries decide which currency to hold in reserve based on: the easy, fair, and liquid convertibility of the currency, access to the deepest debt and financial markets denominated in that currency, free and unimpinged capital flows, the issuing country’s legal framework, and the currency’s stability. It is more likely that the 200 plus independent countries involved in exporting, importing, and/or refining oil products prefer to use US dollars as a medium of exchange because the US dollar is preeminent in the much larger financial markets from which oil payments are drawn than the reverse.

Nations are not going to denominate the majority of their reserves in Chinese yuan so long as the Chinese maintain a ‘closed capital account,‘ arbitrarily restricting the conversion of the yuan into other currencies, the flow of capital in and out of China, and pegging the value of the yuan to the US dollar. So long as the financial markets in which reserves are actually used are overwhelmingly denominated in US dollars, the US dollar is likely to remain the world’s preferred reserve currency.

Nothing lasts forever and that includes the US dollar’s reserve status. However, stories of the imminent ascendancy of the Chinese yuan, which lack perspective on the yuan’s actual utilization as a reserve currency and the dynamics that drive international financial markets, reveal more about an author’s biases than their grasp of the subject. The transition to the Chinese yuan is neither certain, imminent, nor likely to happen as a result of oil contract pricing. Before assuming that the Chinese yuan will usurp the US dollar, let’s see if it can usurp the Australian dollar first.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It is written into the Russian Constitution that the Russians can only buy US Treasuries with the dollars the Russians get from their oil sales. Please think. For how long has Putin PROMISED that he was going to nationalize the Rothschild-owned and controlled Russian central bank and de-dollarize the Russian economy? For the better part of a decade, hasn’t he? We have to admit by now that Putin has been lying as he could have nationalized the Russian central bank with a presidential executive order within 24 hours. Check the DATE on this article: http://new.euro-med.dk/20141215-putins-confident-putin-to-nationalize-rothschilds-central-bank-and-purge-collaborators-with-west-war-till-one-side-collapses-inevitable.php Even the sworn enemy of… Read more »