Submitted by Taps Coogan on the 29th of March 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The US national debt currently stands at $21 trillion dollars and is rising rapidly. With federal budget deficits likely to exceed $1 trillion a year for the foreseeable future, the question of who will continue to lend such staggering sums of money to the US government is more important than ever.

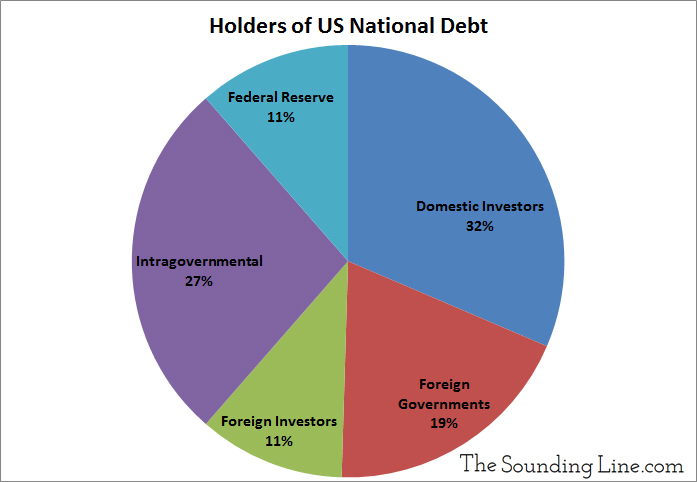

Of the $21 trillion in existing US government debt, roughly $6.6 trillion is held by domestic investors and institutions. $6.3 trillion is held by foreign countries ($4 trillion held by foreign governments and $2.3 trillion by foreign investors). $5.7 trillion is held by the US government itself in pension, retirement, and other intragovernmental funds. $2.4 trillion is held by the Federal Reserve. The following chart shows the percentage each group holds.

As can be seen in the chart above, roughly 30% of the US national debt is held overseas by a combination of foreign governments and private investors. The following chart, from Statista, reveals which countries comprise the majority of these foreign holdings.

You will find more infographics at Statista

You will find more infographics at Statista

By far, the two largest foreign lenders to the US are China and Japan. Despite increasing trade war rhetoric, China modestly increased its holdings of US treasuries between 2017 and 2018. Japan modestly decreased its holdings over the same period. Overall, foreign investors increased their US treasury holdings between January 2017 and January 2018 from $5.9 trillion to just under $6.3 trillion.

Perhaps surprisingly to some readers, Ireland is technically the third largest holder of US treasuries. Unlike in China and Japan, where sovereign wealth funds, pension funds, and the government own the bulk of the treasury holdings, in Ireland the bulk of the treasury holdings are owned by US companies. These companies use oversees profits to buy treasuries and stash them at Irish banks in order to avoid repatriating money to the US and incurring US taxes.

There has been widespread speculation that China could retaliate against increasing US tariffs by selling its US treasury holdings and flooding the treasury market with more supply than it can handle. In reality, while China is the largest foreign holder of treasuries, it only controls about 5.5% of the total treasury market ($1.17 trillion or 18.7% of total overseas holdings). In isolation, a large decrease in China’s treasury holdings could be absorbed by the rest of the market. The Federal Reserve’s treasuries holdings are twice as big as China’s and, as a last resort, it could expand its balance sheet and absorb the totality of China’s holdings. It’s also worth remembering that China would be adversely affected by a sell-off in the treasury market. The Chinese government is, after all, the largest foreign holder of treasuries. If a Chinese liquidation somehow succeeded in driving up rates, China would take stiff losses on the treasuries they were selling.

Nonetheless, several trends unfolding at the same time could pose challenges for the treasury market. The combination of rapidly increasing budget deficits, decreasing purchases by the Federal Reserve, and increased foreign selling could create trillions of dollars in excess supply and a meaningful increase in interest rates. That would be costly for the US government and put pressure on bond markets world-wide.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Oversees. Sheesh!

Fixed it. Thanks !