Submitted by Taps Coogan on the 6th of August 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

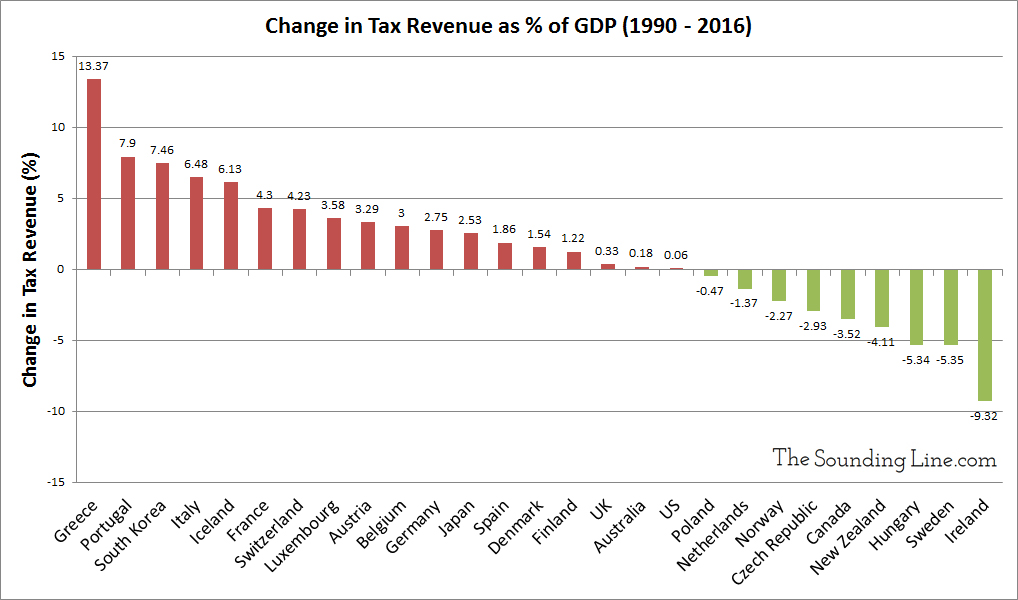

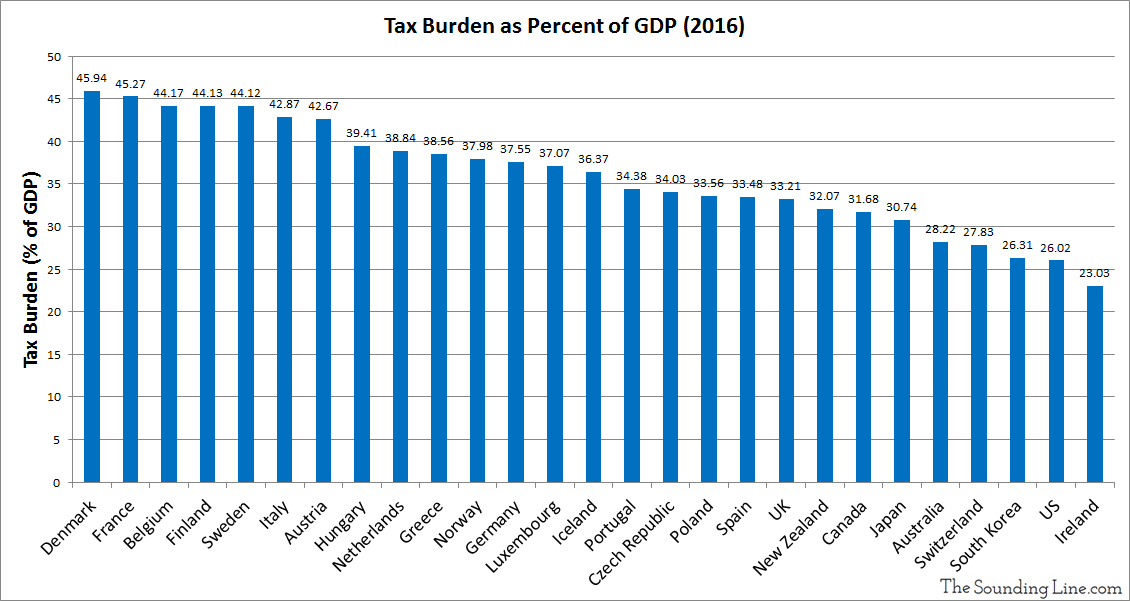

The Organization for Economic Co-operation and Development (OECD) has been tracking the total tax burden (central and local taxes) as a percentage of GDP for 80 countries around the world since 1990. The data reveals that the average OECD country’s tax burden has risen from 31.93% of GDP in 1990 to 34.26% in 2016, the most recent date for which data is available.

As the following charts show, the tendency among developed economies has been toward high and increasing tax burdens, though there are exceptions.

Via Our World in Data:

The US tax burden as a percent of GDP increased by just 0.06% between 1990 and 2016. Since 2016, the Republican tax reform bill has been singed into law and is expected to significantly lower tax revenues starting in 2018. That puts the US among a minority of countries tracked by the OECD that have held overall tax burdens flat, or cut them over the past several decades. In fact, among large developed economies, the US has the lowest tax burden in the world. When including smaller developed economies, the US is second to Ireland which has cut its taxes more than any other country tracked by the OECD. With a GDP growth rate of 7.8%, Ireland has also become the fastest growing economy in the EU, and one of the fastest growing economies in the world, even outpacing China.

Among developing economies, tax burdens are generally lower, though growing at a fast pace.

While overall taxation levels can mask important differences in the way taxes are imposed and upon whom they are imposed, the fact that the US has maintained significantly lower tax levels sustains its status as attractive place for business and investment. The fact that the US has consistently outgrown high tax countries like France, Denmark, Italy, Germany, and Japan over the last several decades is unlikely to be a coincidence. On the other hand, the inability of the US federal government to constrain its massive spending habit has fueled an unsustainable growth in the national debt, a phenomenon which has happened in high and low tax countries alike.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

So, this is why we call FAKE NEWS!

https://www.cnsnews.com/news/article/terence-p-jeffrey/feds-collect-record-individual-income-taxes-through-may-still-run

This ‘analysis’ also seems to conveniently omit all the non-Federal taxes paid in the US.

This is an obvious scam to trick people into thinking taxes are too low.

I probably shouldn’t take the time to respond to such a stupid comment, but here we go… 1.) The post is about tax revenues as a percent of GDP. Has the US government collected record taxes? Yes. Is it a record relative to the size of the economy? No. That is the whole point of the article. The other point is how it compares to other countries. Saying the government collects a certain dollar value of taxes without putting it in some context that can be then compared equally in other countries isn’t very informative (GDP or inflation or per… Read more »